Please use a PC Browser to access Register-Tadawul

Does Fed Rate Cut Hints Reinforce the Bull Case for Nelnet (NNI)?

Nelnet, Inc. Class A NNI | 130.42 | -0.56% |

- Shares of education finance company Nelnet rose significantly in the past week after Federal Reserve Chair Jerome Powell signaled potential interest rate cuts.

- As an education lender, Nelnet's business can be directly affected by changes in interest rates, which influence both its loan portfolio profitability and investor sentiment.

- With the possibility of lower interest rates on the horizon, we'll explore what this means for the company's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Nelnet's Investment Narrative?

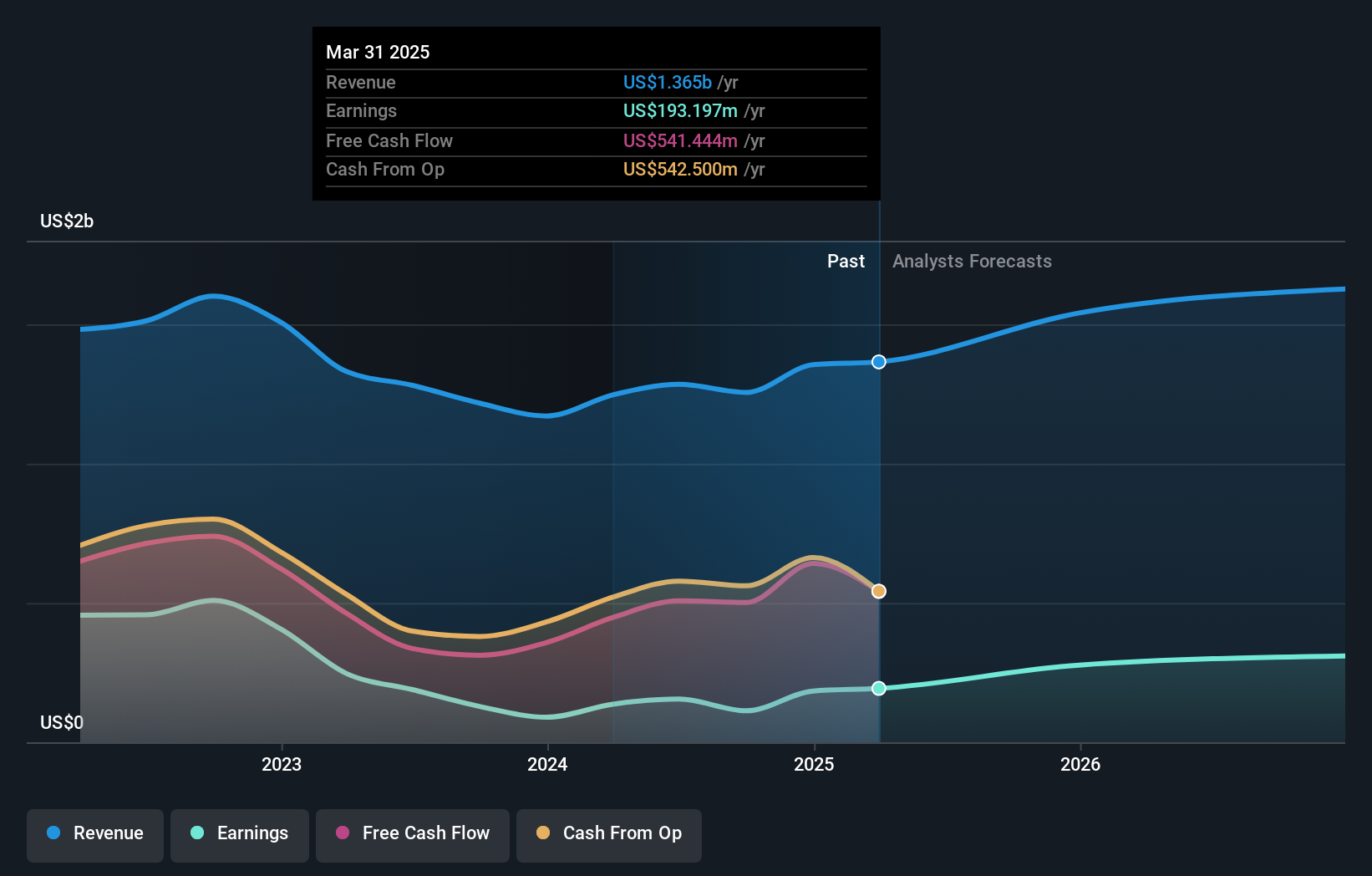

To be comfortable as a Nelnet shareholder, you need to believe in the company's ability to generate consistent earnings from its core education finance activities and to find growth through new business ventures like Propelr, its AI-driven learning platform. The surge in Nelnet's shares after Jerome Powell's signal on potential rate cuts highlights just how sensitive its stock can be to monetary policy shifts, with lower rates often viewed as boosting loan demand and earnings prospects. While the recent jump suggests investors are optimistic, from a fundamental viewpoint, the news is unlikely to meaningfully change key short term catalysts unless rate cuts actually materialize and start benefiting Nelnet's margins. Main risks, such as low return on equity, slower revenue growth, and high relative valuation, may remain just as important even with the positive rate outlook. But as always, the perception of risk can shift if investor sentiment keeps driving up the share price.

But the possibility of slower revenue growth is something investors should pay close attention to. Nelnet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Nelnet - why the stock might be worth as much as $130.00!

Build Your Own Nelnet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nelnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nelnet's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.