Please use a PC Browser to access Register-Tadawul

Does First Citizens BancShares' (FCNC.A) New Bond Offering Reveal a Shift in Capital Allocation Priorities?

- Earlier this month, First Citizens BancShares completed a US$600 million fixed-income offering, issuing 5.600% callable senior subordinated unsecured notes due September 2035 at 100% of principal with a 0.35% discount.

- This move provides additional capital which could enhance the company’s financial flexibility and signal management’s focus on liquidity and future growth initiatives.

- We'll explore how this sizeable bond issuance could impact First Citizens BancShares’ approach to capital allocation and its ongoing investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

First Citizens BancShares Investment Narrative Recap

Owning First Citizens BancShares typically appeals to those who value resilient balance sheets and disciplined capital management, especially as the bank grows its commercial and specialized lending footprint. The recent US$600 million bond offering strengthens liquidity, but does not materially change near-term catalysts or the key risk: pressure on net interest income from a lower rate environment persists despite added capital flexibility.

One of the most relevant recent announcements is the buyback update, with over US$3.1 billion of shares repurchased under the current program. This aligns with the company’s efforts to bolster shareholder returns, but the effectiveness could be challenged if earnings remain under pressure from compressed net interest margins.

By contrast, investors should be aware that the asset-sensitive balance sheet’s exposure to possible rate cuts could...

First Citizens BancShares' outlook anticipates $9.7 billion in revenue and $2.2 billion in earnings by 2028. This is based on a 2.6% annual revenue growth rate and a decrease in earnings of $0.1 billion from the current $2.3 billion.

Uncover how First Citizens BancShares' forecasts yield a $2311 fair value, a 19% upside to its current price.

Exploring Other Perspectives

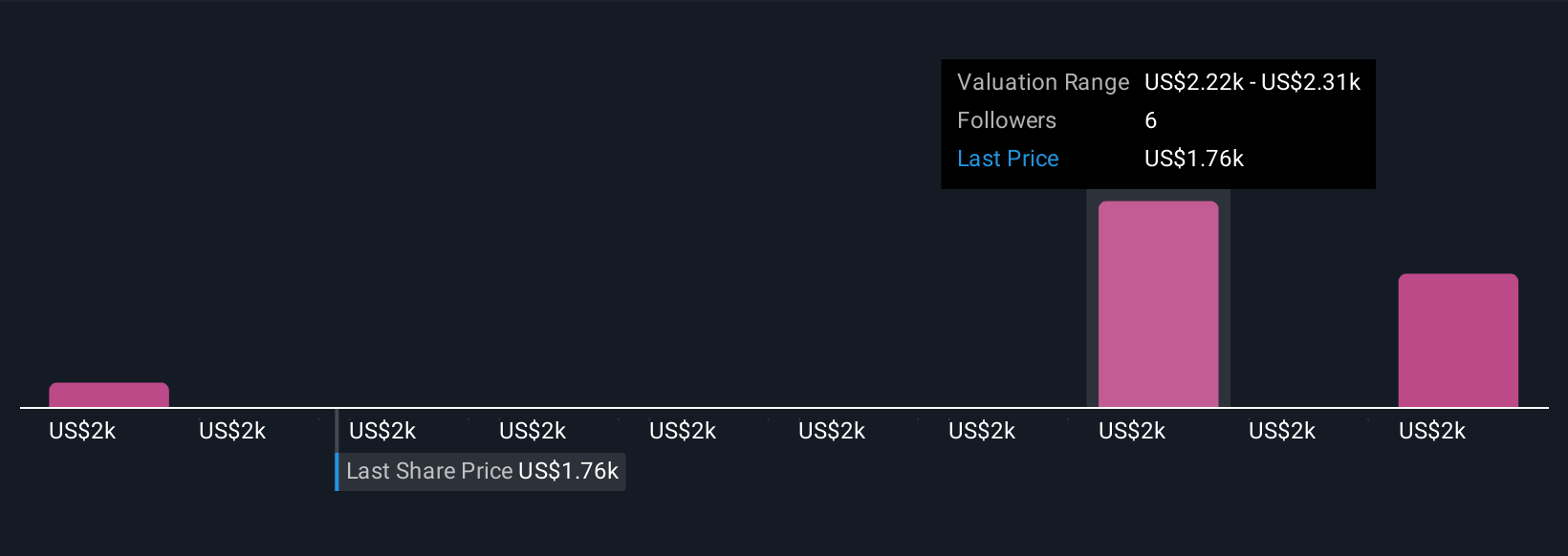

Simply Wall St Community members estimate fair value from US$1,568 to US$2,603 across three perspectives, highlighting wide differences in outlooks. With earnings guidance trending lower, this spread underlines how investor expectations for future returns can diverge considerably.

Explore 3 other fair value estimates on First Citizens BancShares - why the stock might be worth 19% less than the current price!

Build Your Own First Citizens BancShares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Citizens BancShares research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Citizens BancShares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Citizens BancShares' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.