Please use a PC Browser to access Register-Tadawul

Does Hedgeye’s Bearish Store Call Reframe Boot Barn’s (BOOT) Long-Term Expansion Narrative?

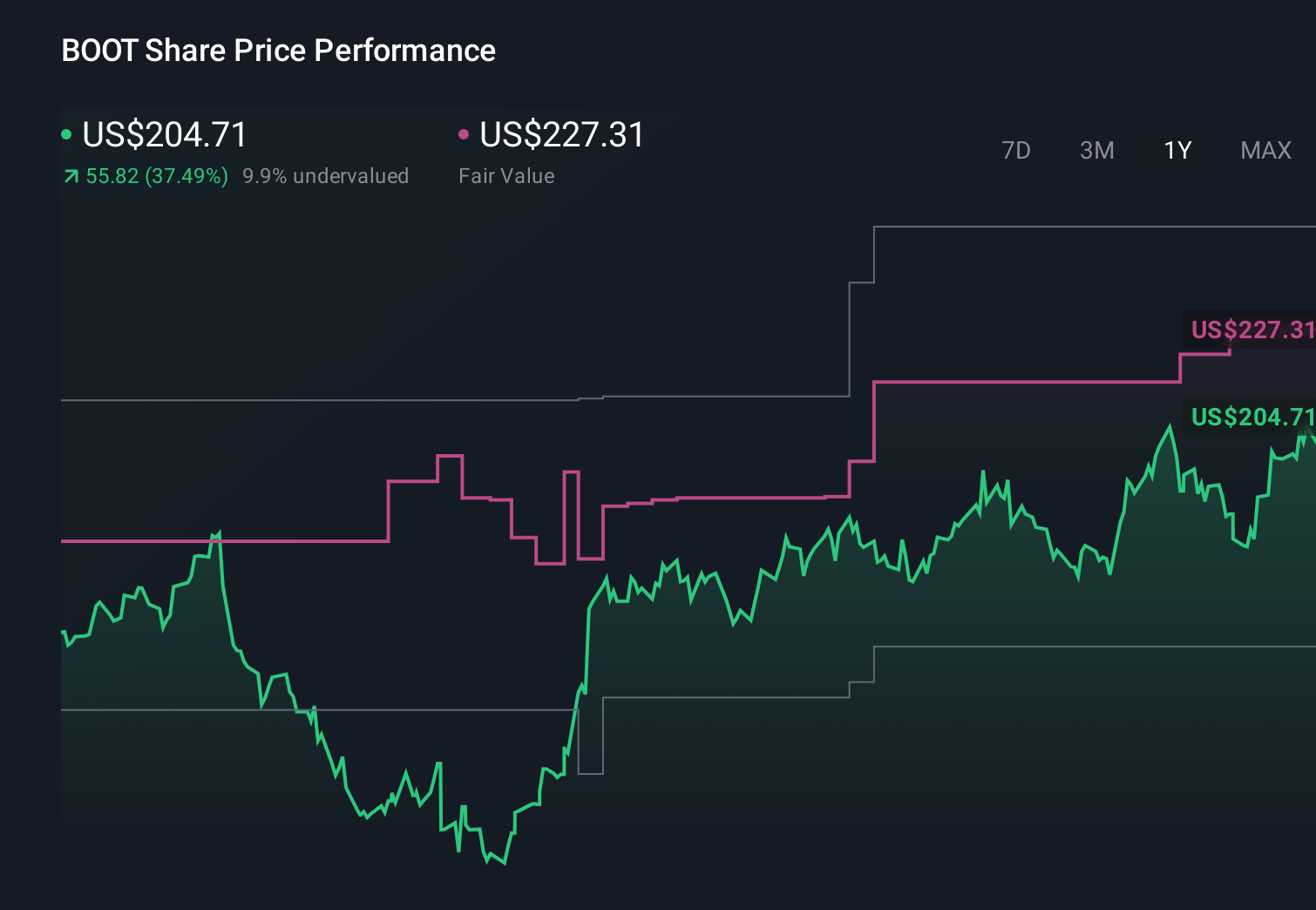

Boot Barn Holdings, Inc. BOOT | 199.76 | +1.46% |

- Boot Barn Holdings, Inc. recently announced it will release its third-quarter fiscal 2026 results for the period ended December 27, 2025, after market close on February 4, 2026, followed by a management conference call for investors and analysts.

- A new bearish short call from Hedgeye, questioning Boot Barn’s long-term store expansion potential from roughly 515 locations, has raised fresh debate over the company’s growth outlook.

- Next, we’ll examine how Hedgeye’s skepticism about Boot Barn’s store expansion ambitions could influence the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Boot Barn Holdings' Investment Narrative?

To own Boot Barn today, you really have to believe the company can keep compounding its Western and workwear niche without overreaching on store growth or margins. The story has been built around steady revenue and earnings expansion, solid profitability and a management team that has generally hit or raised guidance, as seen in the preliminary Q3 2026 update. The new Hedgeye short call directly challenges one of the core pillars of that thesis: the idea that Boot Barn can grow meaningfully beyond its roughly 515 stores. Given the stock’s recent pullback and already full-looking multiples versus peers, that skepticism could make investors far more sensitive to what management says about long-term unit expansion and capital allocation on the upcoming February 4 earnings call. If store growth expectations reset, near term catalysts may shift from aggressive expansion to execution at the existing footprint and consistent earnings delivery.

However, there is one concentration risk here that long term shareholders should not ignore. Boot Barn Holdings' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 5 other fair value estimates on Boot Barn Holdings - why the stock might be worth less than half the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boot Barn Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boot Barn Holdings' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.