Please use a PC Browser to access Register-Tadawul

Does Industrial Momentum and Recent Acquisitions Shift the Outlook for Graco (GGG)?

Graco Inc. GGG | 83.64 | +0.08% |

- In recent months, Graco Inc. has experienced strong momentum in its Industrial and Expansion Markets segments, fueled by robust demand for powder finishing, lubrication products, and activity in the semiconductor sector, along with product and market share gains from its acquisitions of Color Service S.r.l., Corob S.p.A., and PCT System.

- An important insight is that, while the Contractor segment remains challenged by high housing costs and subdued North American construction, Graco's expanded offerings and shareholder returns through dividend increases and share repurchases continue to support interest in the company.

- Now, we'll explore how Graco's recent Industrial and Expansion Markets momentum could shift its overall investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Graco Investment Narrative Recap

To be a Graco shareholder, I believe in the company's ability to capitalize on specialized manufacturing demand, expand through acquisitions, and maintain resilient cash returns even as construction-linked segments face headwinds. The latest surge in Industrial and Expansion Markets supports the most important short-term catalyst, diversification beyond housing, but the impact on the biggest risk, a potential squeeze on gross margins from cost inflation and lower factory volumes, does not appear materially shifted for now.

One recent announcement that stands out is the reaffirmation of Graco's low single-digit sales growth guidance for 2025, underscoring a measured outlook despite strong acquisition-driven momentum. This continuing guidance connects directly to the core catalyst of broadening end markets and innovating through new product launches, keeping the focus on navigating variable demand across its business lines.

Yet, in contrast to these growth drivers, investors should be aware of the margin pressures that can arise when...

Graco's outlook anticipates $2.7 billion in revenue and $641.7 million in earnings by 2028. This implies a 7.9% annual revenue growth rate and a $159.1 million earnings increase from the current $482.6 million.

Uncover how Graco's forecasts yield a $92.44 fair value, a 9% upside to its current price.

Exploring Other Perspectives

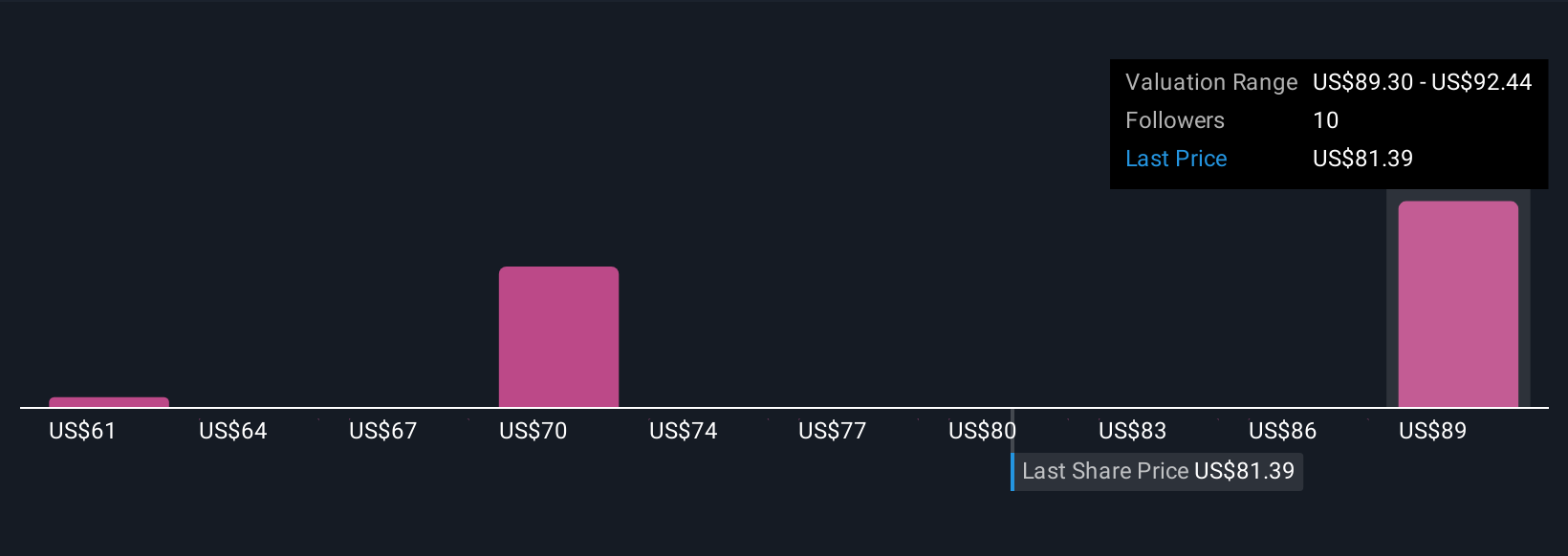

Simply Wall St Community members have shared four independent fair value estimates for Graco ranging from US$61 to US$92.44. With sentiment spanning this wide, keep in mind that margin compression and input costs continue to shape prospects as you compare these diverse outlooks.

Explore 4 other fair value estimates on Graco - why the stock might be worth 28% less than the current price!

Build Your Own Graco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Graco research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Graco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Graco's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.