Please use a PC Browser to access Register-Tadawul

Does Integra LifeSciences Share Rebound Signal a New Growth Phase in 2025?

Integra LifeSciences Holdings Corporation IART | 13.42 | -4.48% |

If you're reading this and wondering what your next move should be with Integra LifeSciences Holdings, you’re definitely not alone. The stock seems to be on everyone’s radar after a roller-coaster year, and understandably so. After sliding more than 34% year-to-date and dropping a hefty 69.3% over the past five years, shares recently caught a surprising gust of momentum, up 13.0% in the last week alone. That kind of rebound always gets investors talking quickly about whether a lasting turnaround is underway or if it’s just a blip.

It’s not just price charts making the case for a second look at Integra, either. There’s a strong argument to be made around its valuation score, an impressive 5 out of 6 on our undervaluation check. That kind of score means the company passes most of the key markers we look for in stocks that may be mispriced or simply overlooked by the broader market. Add in ongoing industry chatter about shifts in healthcare technology and medical devices, and there’s clearly more at play here than just numbers on a screen.

So where does Integra LifeSciences actually stand when you put it under the valuation microscope? Let’s dig into how different approaches stack up for Integra. Stick around, because there’s a smarter, more nuanced way to weigh a company’s real worth that we’ll unpack at the end.

Approach 1: Integra LifeSciences Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. For Integra LifeSciences Holdings, this approach uses both analyst estimates and extended projections to form a long-term outlook.

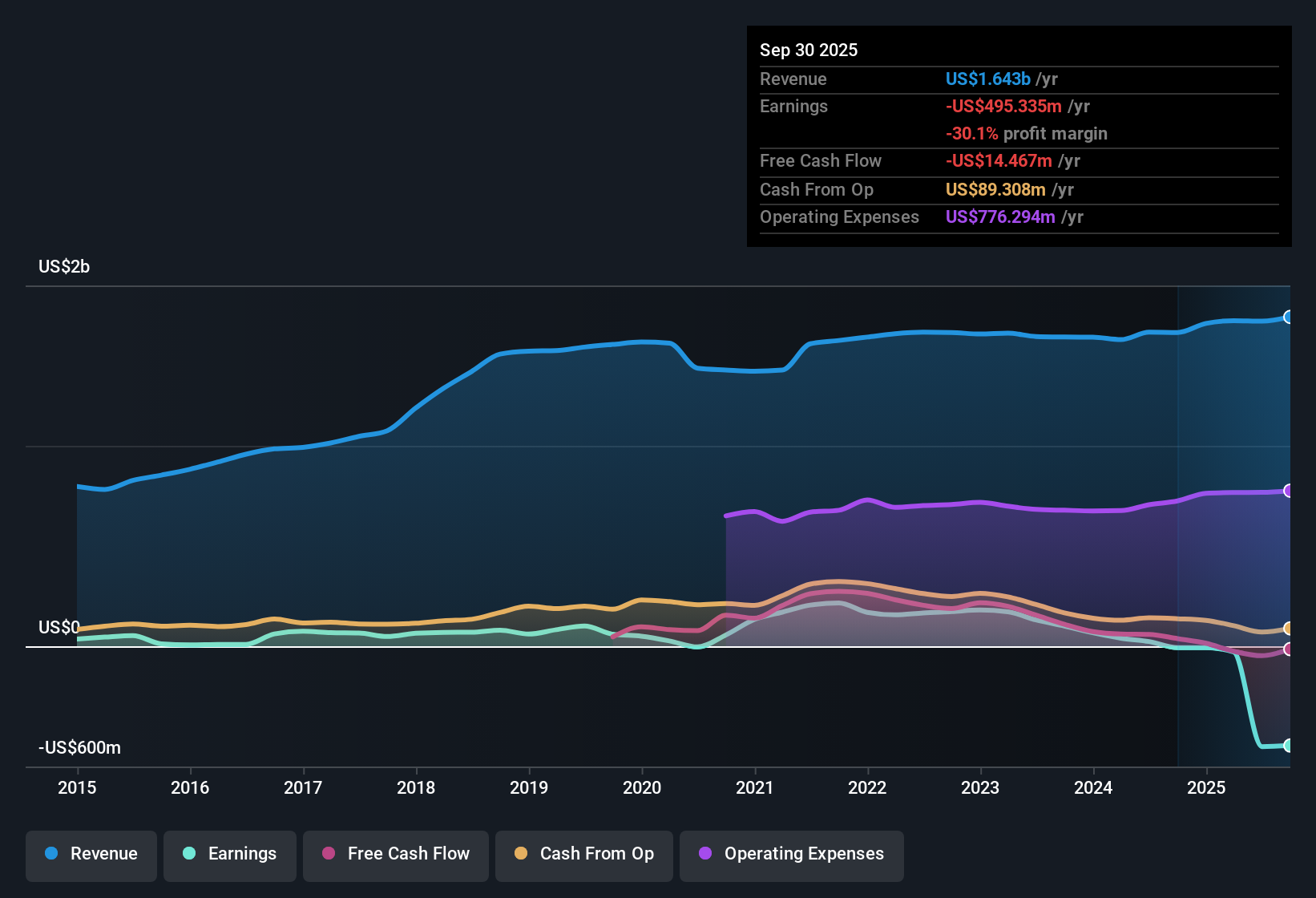

Currently, Integra's last twelve months of free cash flow stand at -$18 million. Analysts anticipate a significant turnaround, with projected free cash flow rising to $197 million by 2027. Longer-range projections from Simply Wall St estimate further growth, reaching over $855 million in 2035. These expected increases suggest the company could be entering a period of rapid expansion after recent challenges.

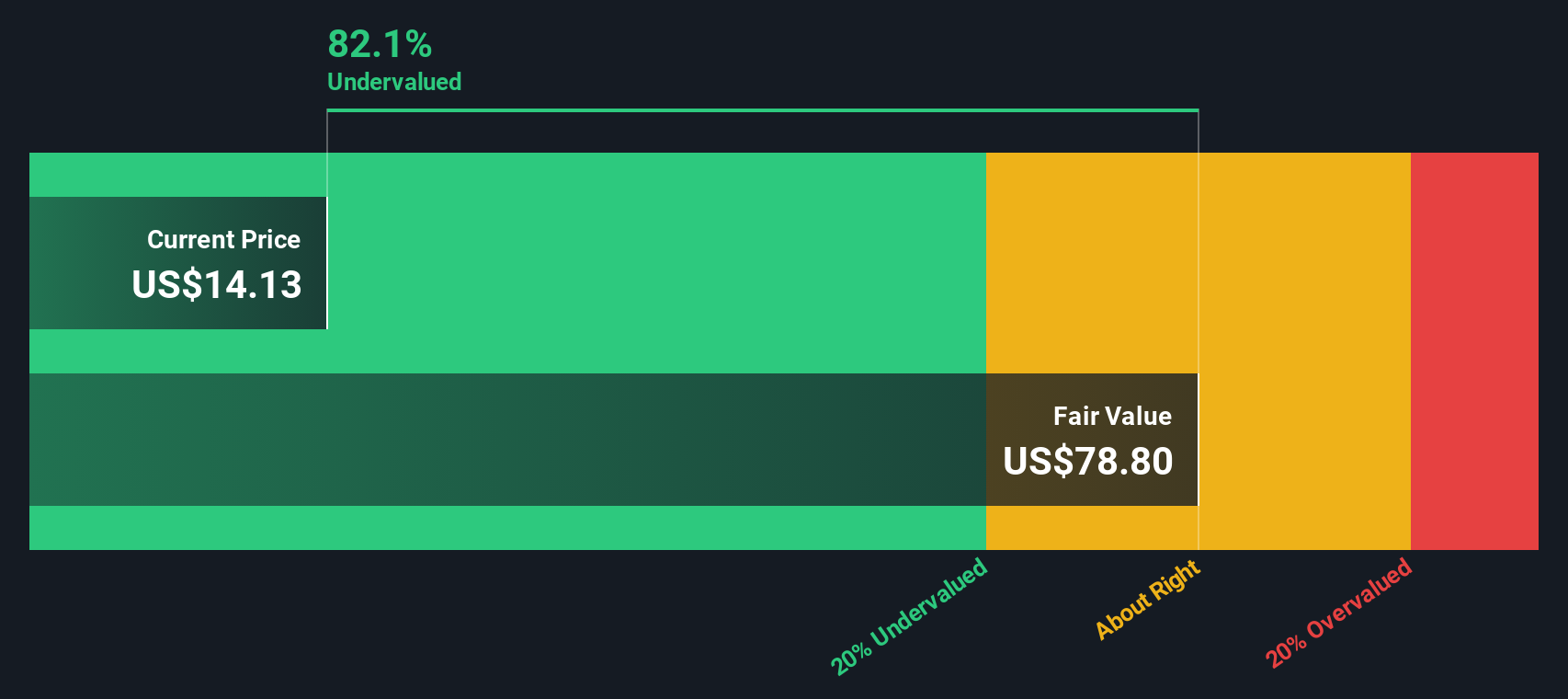

All cash flows in this analysis are denominated in US dollars. The DCF model calculates an intrinsic value of $80.42 per share. With the stock trading at an implied 81.2% discount to this estimate, the valuation suggests that shares are deeply undervalued relative to their underlying cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Integra LifeSciences Holdings is undervalued by 81.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Integra LifeSciences Holdings Price vs Sales (P/S)

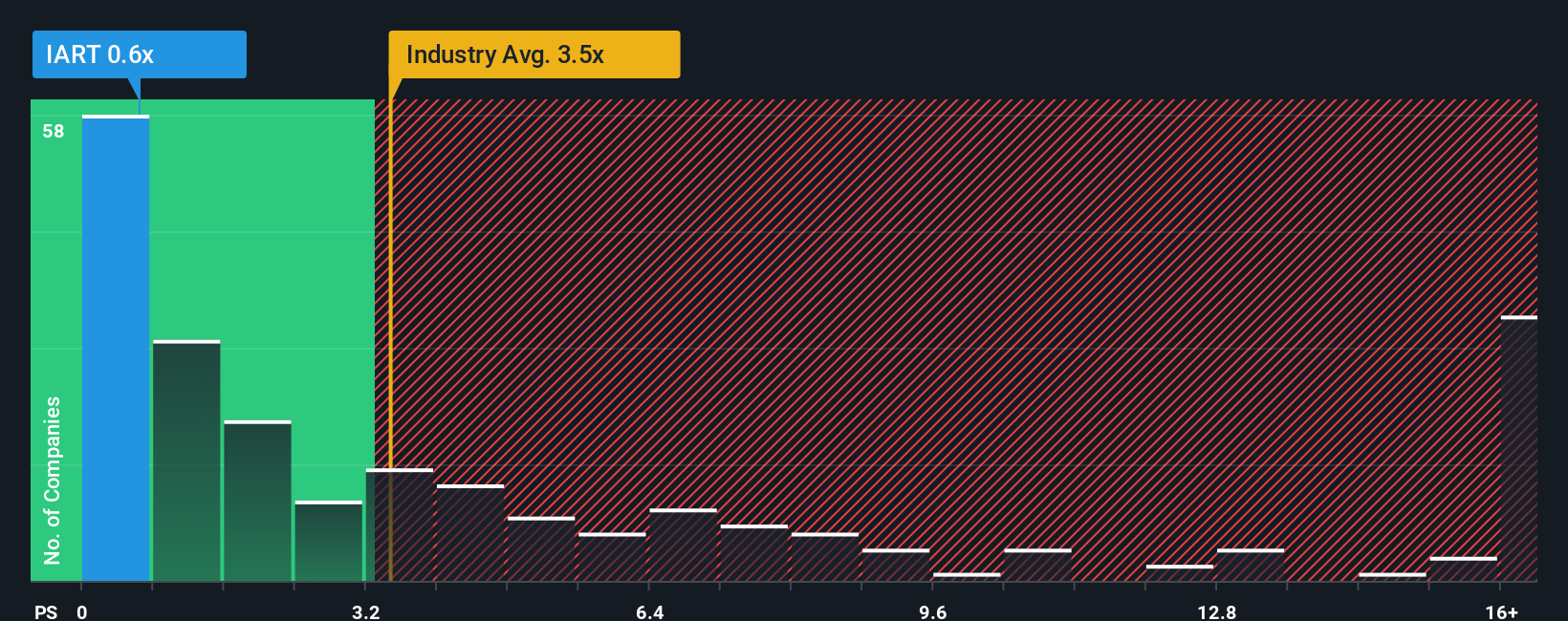

For companies in the medical equipment industry, the Price-to-Sales (P/S) ratio is often a more telling gauge of value than earnings-based multiples, particularly when profitability is lumpy or still normalizing. Revenue tends to be comparatively stable, making the P/S ratio a practical tool for understanding how the market values each dollar of Integra’s sales.

But what is a “normal” P/S multiple? The answer is not one-size-fits-all. It depends heavily on outlook and risk. Companies with higher growth potential, robust margins, or unique competitive advantages typically warrant higher multiples. Slower-growing or riskier firms often command less.

Currently, Integra LifeSciences trades at a P/S ratio of 0.72x, which is well below both the industry average of 2.87x and the peer average of 25.22x. On the surface, this suggests that the market is heavily discounting each dollar of Integra’s revenue compared to its rivals. However, simply comparing to peers or industry does not factor in growth, risk levels, or company-specific nuances.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated to be 1.55x for Integra, is designed to account for aspects such as the company’s earnings growth, risk profile, profit margins, market cap, and its specific industry dynamics. By using this tailored benchmark instead of just industry or peer averages, investors get a more contextual, apples-to-apples sense of value.

Since Integra’s current P/S multiple of 0.72x is significantly below its Fair Ratio of 1.55x, the stock appears to be undervalued against its fundamentals at this point.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Integra LifeSciences Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company: your view of its future, what will drive its success or struggles, and how numbers like fair value, revenue, and margins fit into that big picture.

Narratives work by linking the company’s unique story to a clear financial forecast, and then connecting that forecast to an estimated fair value, making your investment thesis transparent from start to finish. This approach is not only accessible to investors of any level but is also available directly on Simply Wall St’s Community page, used by millions globally.

With Narratives, you can see if it might be time to buy or sell by instantly comparing the fair value from your story to the current share price. Since these insights are updated dynamically with every new piece of news, earnings report, or company update, you are always equipped with the latest perspective.

For Integra LifeSciences Holdings, for example, some investors see a fair value as high as $30.00 driven by new product launches and demographic tailwinds, while others set it as low as $10.00 if operational headwinds persist. Your Narrative makes all the difference in your decision.

Do you think there's more to the story for Integra LifeSciences Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.