Please use a PC Browser to access Register-Tadawul

Does Lotus Technology's (LOT) Intra-Group Loan Reflect a New Approach to Financial Flexibility?

Lotus Technology Inc. ADR LOT | 1.40 | +0.36% |

- Lotus Technology Inc. recently finalized a loan agreement with Lotus Cars Limited for up to £80,000,000 at an 8% annual interest rate, with repayment due by the end of 2025.

- This internal financing arrangement highlights the company's ongoing capital allocation decisions and may have implications for its financial flexibility and risk profile.

- We'll discuss how this substantial intra-group loan shapes Lotus Technology's ongoing balance sheet management and its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Lotus Technology Investment Narrative Recap

To be a Lotus Technology shareholder, you need conviction in the company's global EV expansion and operational improvement potential, weighed against persistent financial losses and substantial leverage. The recent £80,000,000 intra-group loan at 8% interest does not appear to materially shift the most important near-term catalyst, international market expansion, nor does it significantly alter the main risk, which remains the company's ability to stabilize its balance sheet in light of leverage and ongoing losses. This news instead highlights Lotus Technology's active management of liquidity as it seeks stability and growth.

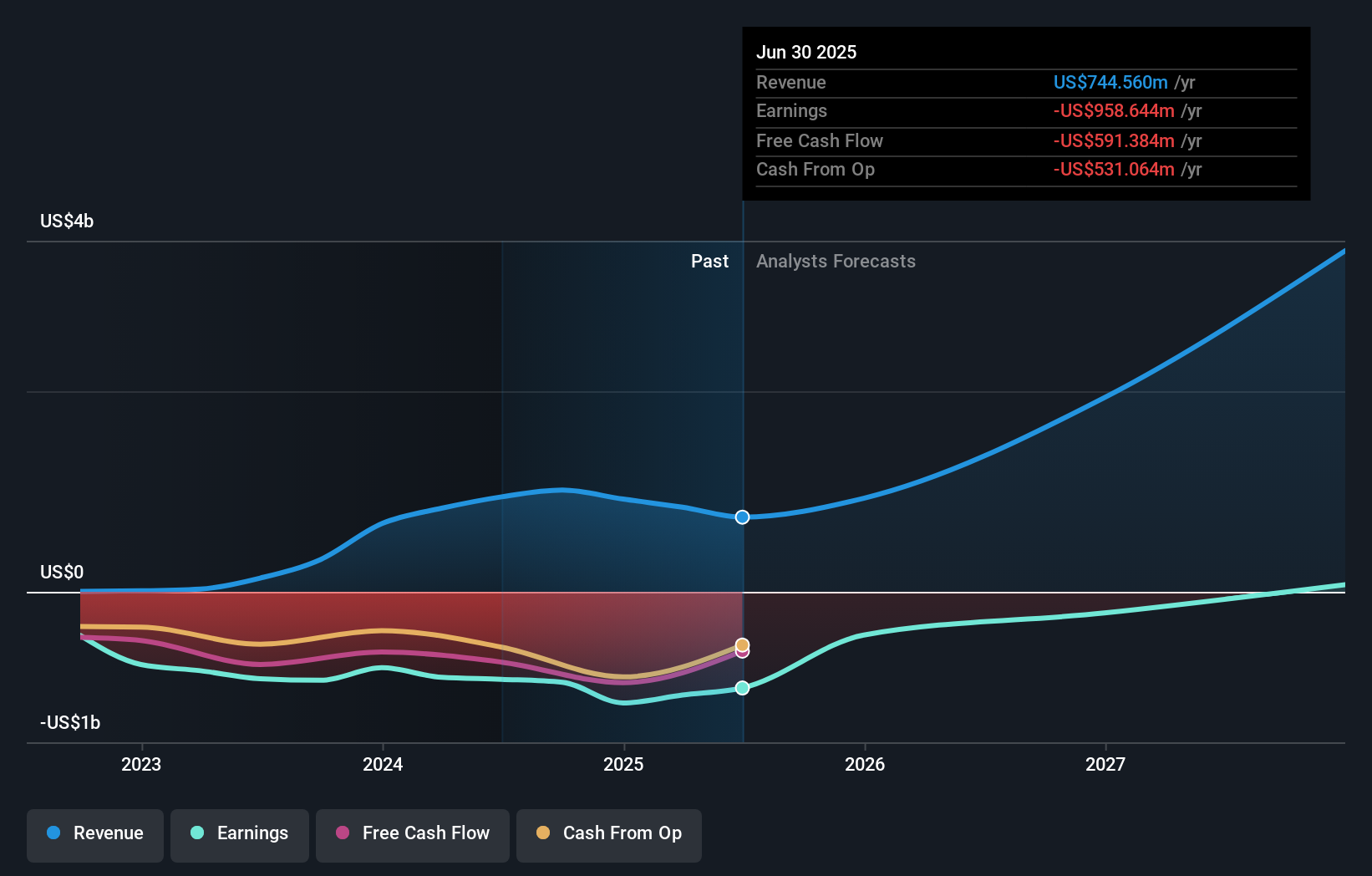

Among recent announcements, Lotus Technology's June 2025 convertible note transaction, raising an additional US$119.26 million, stands out in relevance. It complements the internal loan as part of an ongoing effort to boost liquidity and meet cash needs, a focus made all the more critical with international expansion ambitions and challenging financial metrics. Yet with leverage concerns and ongoing operating losses, near-term balance sheet stabilization remains a major hurdle for any catalyst to unlock value.

In contrast, investors should also be aware that with significant debt maturing within the next year, the timing and terms of future financing could...

Lotus Technology's narrative projects $3.7 billion revenue and $201.1 million earnings by 2028. This requires 63.7% yearly revenue growth and a $1.2 billion increase in earnings from the current -$1.0 billion.

Uncover how Lotus Technology's forecasts yield a $3.00 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided a single US$3.00 fair value estimate for Lotus Technology, reflecting a concentrated perspective. This compares with ongoing concerns over high leverage and persistent losses, highlighting why broader viewpoints on value and risk may be crucial for your research.

Explore another fair value estimate on Lotus Technology - why the stock might be worth just $3.00!

Build Your Own Lotus Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lotus Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lotus Technology's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.