Please use a PC Browser to access Register-Tadawul

Does McDonald’s (MCD) Dividend Growth Reveal More About Its Capital Allocation Priorities?

McDonald's Corporation MCD | 314.50 | -1.33% |

- On July 23, 2025, McDonald's Board of Directors declared a quarterly cash dividend of US$1.77 per share, payable September 16, 2025 to shareholders of record on September 2, 2025.

- This consistent dividend increase extends McDonald’s unbroken streak of annual dividend growth since the mid-1970s, highlighting its focus on shareholder returns alongside digital platform and delivery service expansions.

- We’ll examine how McDonald’s continued dividend growth and product innovation enhance its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

McDonald's Investment Narrative Recap

To own McDonald’s stock, you need to believe in its ability to drive steady returns through a resilient brand, expansion of digital platforms, and consistent shareholder payouts. The latest quarterly dividend affirmation reinforces management’s focus on rewarding investors, but the most important short-term catalyst remains whether digital ordering and menu innovation can offset challenging consumer trends in key markets. For now, the dividend news has little material impact on the biggest risk, which is ongoing declines in revenue from lower guest counts among low and middle-income consumers. Among recent announcements, the limited test of new beverages in Wisconsin stands out as particularly relevant. Expanding specialty drink offerings directly supports McDonald’s efforts to grow in specialist product verticals and attract higher-margin sales, offering a potential catalyst if successful programs are rolled out chain-wide. This aligns with ongoing attempts to counteract traffic declines by improving value and novelty for customers. By contrast, investors should be aware of emerging pressures on profitability from increased reliance on promotions and value menus if inflation remains elevated and consumer sentiment stays soft...

McDonald's narrative projects $30.0 billion revenue and $10.2 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $2.0 billion earnings increase from $8.2 billion today.

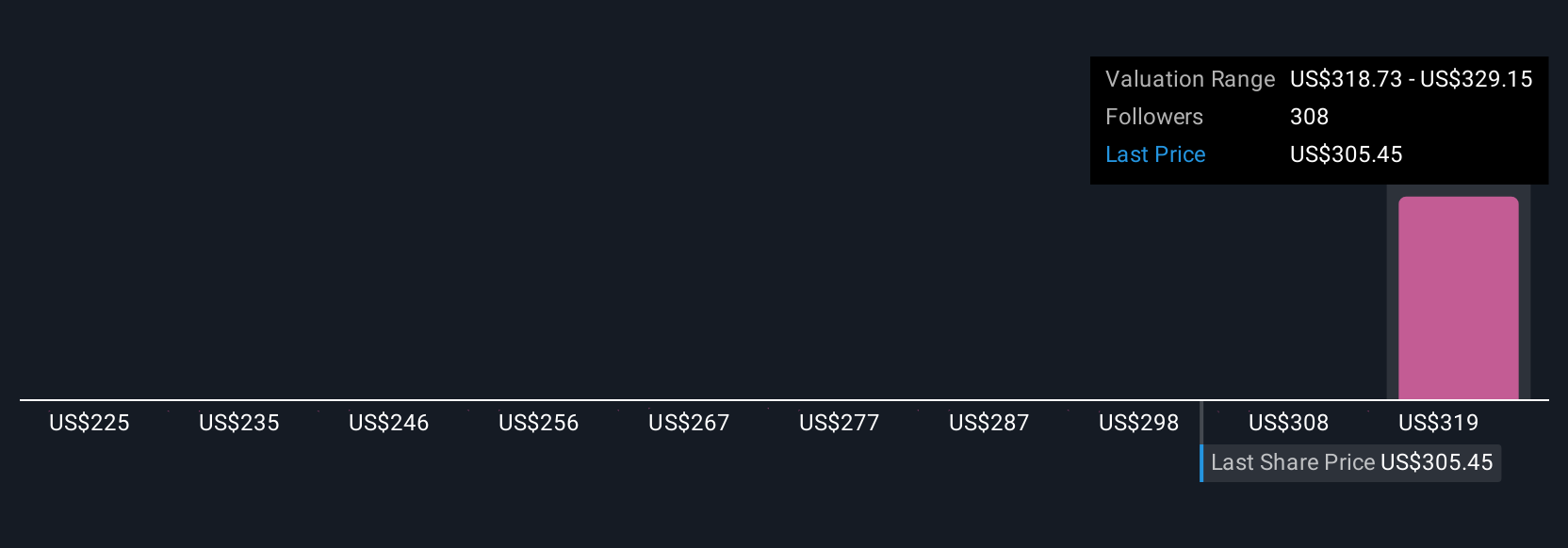

Uncover how McDonald's forecasts yield a $328.79 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community currently see McDonald’s fair value between US$225 and US$344.99 per share. Amid this wide range, many are watching how specialty product innovation might influence McDonald’s ability to grow sales in challenging markets, make sure to consider the full spectrum of opinions.

Explore 16 other fair value estimates on McDonald's - why the stock might be worth 26% less than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.