Please use a PC Browser to access Register-Tadawul

Does Medtronic’s (MDT) AI Ambitions Signal a Transformative Shift or Just Incremental Innovation?

Medtronic Plc MDT | 99.87 | +0.12% |

- Medtronic plc recently presented at the 7th Annual Ai4 2025 conference in Las Vegas, featuring Global Chief Information Security Officer Stephanie Franklin-Thomas on August 12, 2025.

- This participation highlights the company's focus on advanced technologies like artificial intelligence and robotics as part of its ongoing business transformation.

- We'll look at how Medtronic’s AI-focused initiatives, spotlighted at the recent conference, could influence its investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Medtronic Investment Narrative Recap

Medtronic’s long-term investment story centers on its ability to drive growth through innovation in areas like AI, robotics, and new product launches. The recent Ai4 2025 conference participation showcases Medtronic’s push toward advanced technologies but does not materially change the primary short-term catalyst, which remains the potential ramp in its Cardiac Ablation Solutions and rollout of new surgical platforms. The main risk continues to be margin pressures from rising costs and an unfavorable tariff environment, which could pressure earnings in the near term.

Among the company’s recent announcements, the expansion of the URO clinical study for robotic-assisted urologic surgery stands out. This progress ties directly to Medtronic’s efforts in robotics and AI, positioning it to benefit from an anticipated growth phase if hospital adoption and global expansion continue as planned. This progress is particularly relevant with macro headwinds and cost inflation still looming over short-term profitability, and as investors await the upcoming earnings report...

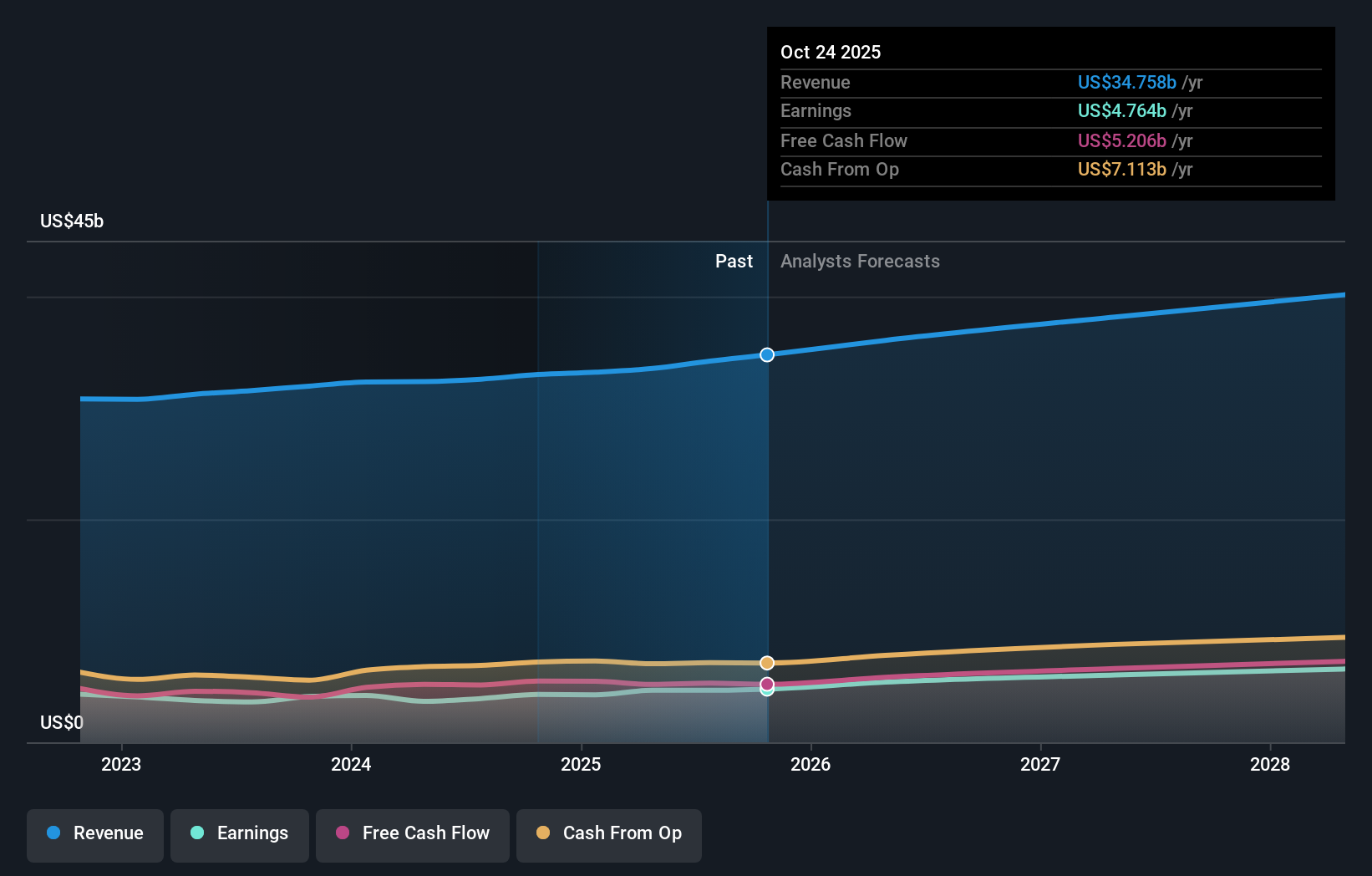

Medtronic's outlook anticipates $38.9 billion in revenue and $6.2 billion in earnings by 2028. This is based on a 5.1% annual revenue growth rate and a $1.5 billion increase in earnings from $4.7 billion today.

Uncover how Medtronic's forecasts yield a $96.90 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community have shared fair values for Medtronic, with estimates ranging from US$82.66 to US$96.90. While opinions span a wide band, upcoming pressures on margins caused by cost and tariff factors may weigh on sentiment. See how your view stacks up among this mix of outlooks.

Explore 7 other fair value estimates on Medtronic - why the stock might be worth as much as $96.90!

Build Your Own Medtronic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medtronic research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Medtronic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medtronic's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.