Please use a PC Browser to access Register-Tadawul

Does ON Semiconductor’s AI Power Tech Acquisition Signal a New Growth Trajectory for ON?

ON Semiconductor Corporation ON | 54.96 | -1.80% |

- In late September 2025, ON Semiconductor announced it had acquired the rights to Vcore power technologies and related intellectual property from Aura Semiconductor, aiming to bolster its power management solutions for AI data centers. This move is part of ON Semiconductor’s broader series of acquisitions and partnerships targeting next-generation silicon carbide technologies for electric vehicles and advanced energy storage.

- The company’s recent focus on enhancing its portfolio for AI and EV applications underscores its ambition to strengthen its position in high-growth sectors and respond to evolving industry needs, even as market conditions remain uncertain.

- We’ll examine how ON Semiconductor’s investment in AI-focused power solutions could shift its growth narrative and expectations.

Find companies with promising cash flow potential yet trading below their fair value.

ON Semiconductor Investment Narrative Recap

To own ON Semiconductor today, an investor needs conviction in the company's shift toward high-value growth markets like AI data centers and electric vehicles, despite near-term earnings pressure and a challenging automotive market. The acquisition of Vcore power technologies from Aura Semiconductor enhances ON's AI-focused power management offerings, but it does not materially change the most important short-term catalyst, securing demand recovery in the automotive and industrial segments. The greatest risk continues to be persistent underutilization of manufacturing capacity, which could weigh on margins if demand does not pick up soon.

Among ON Semiconductor’s recent announcements, its July partnership with NVIDIA to support 800 Volt Direct Current architectures for AI data centers stands out, directly complementing the Vcore power technology acquisition. These initiatives increase ON’s relevance in next-generation infrastructure but require clear evidence of sustained customer adoption before offsetting headwinds from weaker automotive and industrial demand.

However, investors should be aware that margin recovery could take longer than expected if utilization rates remain stubbornly low and demand in key markets stays...

ON Semiconductor's outlook projects $7.5 billion in revenue and $1.9 billion in earnings by 2028. This scenario involves 5.4% annual revenue growth and a $1.43 billion increase in earnings from the current $465.8 million.

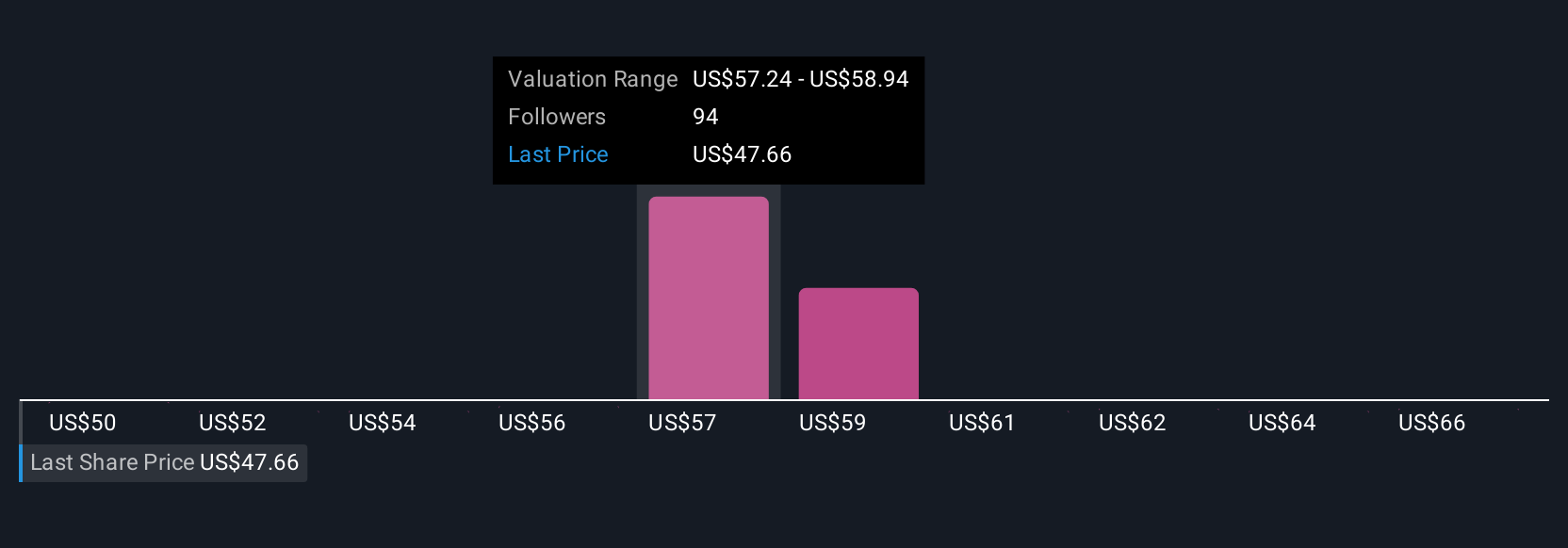

Uncover how ON Semiconductor's forecasts yield a $57.53 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 14 fair value estimates ranging from US$49.59 to US$70 per share. Amid these diverse views, several participants are eyeing the slow pace of automotive demand recovery as a key factor for ON’s future growth expectations.

Explore 14 other fair value estimates on ON Semiconductor - why the stock might be worth as much as 44% more than the current price!

Build Your Own ON Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ON Semiconductor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ON Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ON Semiconductor's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.