Please use a PC Browser to access Register-Tadawul

Does Partnering With Nyobolt Signal a New Era for Symbotic’s (SYM) Warehouse Automation Strategy?

Symbotic Inc. - Class A Common Stock SYM | 61.43 | -3.44% |

- In recent days, Symbotic announced a collaboration with Nyobolt to enhance the performance and durability of its SymBot autonomous mobile robots, while ongoing demand for the company’s warehouse automation tools continues to be reinforced by artificial intelligence adoption and a strong US$22.4 billion backlog.

- Symbotic’s commercial agreements, particularly its partnership with Walmart, and advances in automation technology have positioned it to further streamline logistics operations across the retail sector.

- We'll look at how the Nyobolt partnership and growing automation demand could shape Symbotic's investment outlook going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Symbotic Investment Narrative Recap

To be a Symbotic shareholder, you have to believe in the long-term need for automating logistics, trusting both the scale of its US$22.4 billion backlog and the competitive edge of its technology. The recently announced Nyobolt partnership elevates SymBot robot capabilities but does not alter the most important short-term catalyst, the rollout pace of the next-generation storage structure, nor reduce the earnings visibility risks tied to customer project timing and concentration. If there’s a material impact, it would be over a longer horizon.

Among all recent news, the Nyobolt battery technology partnership is highly relevant as it directly supports Symbotic's push to deliver robots with improved performance and durability, which is crucial for satisfying automation demand. This aligns well with the company's focus on efficiency gains and more robust, scalable solutions for high-volume customers, a necessary ingredient if Symbotic is to accelerate its installations and capitalize on its large project pipeline.

Yet, despite these advancements, investors should not overlook the potential for lumpier revenues if next-gen storage deployments or customer projects are delayed...

Symbotic's outlook anticipates $4.1 billion in revenue and $348.5 million in earnings by 2028. This scenario is based on a 23.0% annual revenue growth rate and an increase in earnings of $359 million from the current -$10.5 million.

Uncover how Symbotic's forecasts yield a $50.12 fair value, a 27% downside to its current price.

Exploring Other Perspectives

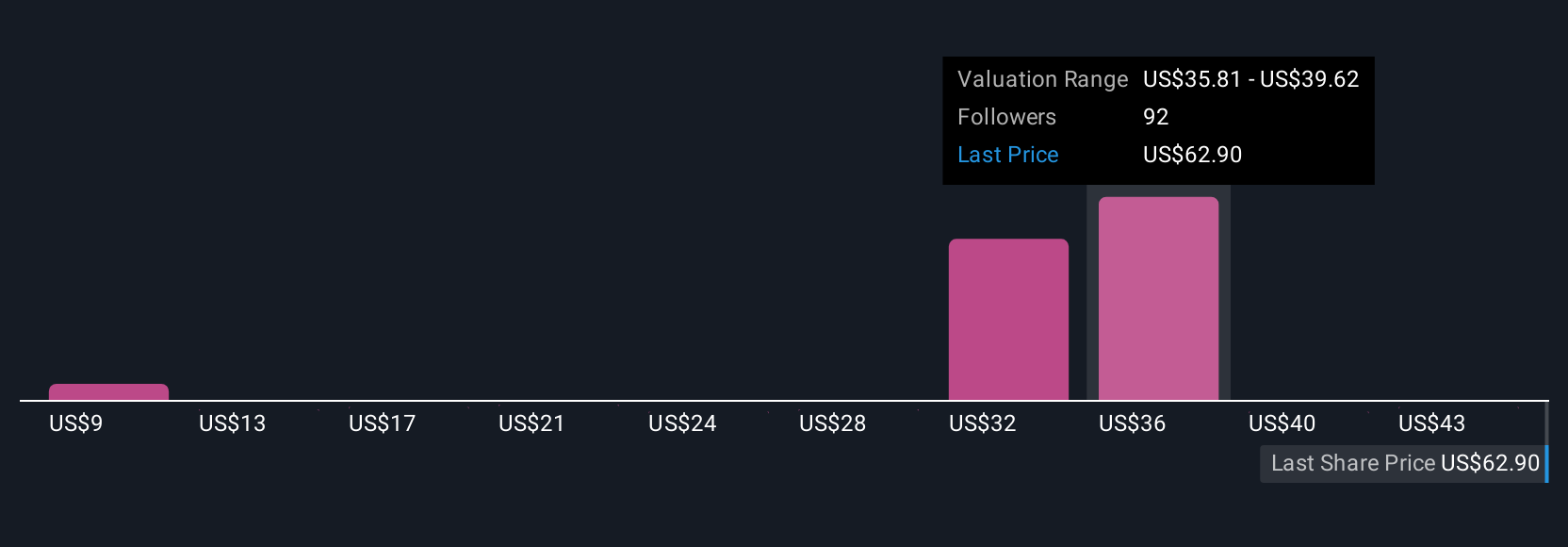

Simply Wall St Community members have set fair value estimates for Symbotic between US$8.97 and US$60, collecting 26 separate opinions. With rollout timing and demand for the new storage structure still in focus, you can see how investors weigh both growth catalysts and project risks when forming their views.

Explore 26 other fair value estimates on Symbotic - why the stock might be worth as much as $60.00!

Build Your Own Symbotic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Symbotic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Symbotic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Symbotic's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.