Please use a PC Browser to access Register-Tadawul

Does Porch Group’s Expanded Property Data Shift the Long-Term Outlook for PRCH’s Data Strategy?

Porch Group PRCH | 9.92 | -5.25% |

- Earlier this week, Porch Group announced the expansion of its Home Factors property intelligence platform, adding new data features including electrical panel location, roof life stage segmentation, and updated plumbing material indicators for enhanced insurance underwriting precision.

- This broadened dataset moves Home Factors closer to its goal of delivering over 100 property attributes for approximately 90% of U.S. homes, offering insurance carriers deeper visibility into home infrastructure and potential risk factors.

- We'll examine how the addition of nuanced property data to Home Factors could alter Porch Group’s investment narrative and data segment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Porch Group Investment Narrative Recap

To be a shareholder in Porch Group, you need confidence that its property and insurance data innovations can drive sustained revenue growth, improve margin quality, and attract carrier adoption. The Home Factors expansion brings more granular data, potentially supporting short-term adoption and strengthening the case for the data segment as a growth catalyst, but does not materially alter the main near-term risk, which remains execution on the transition to fee-based insurance services and ensuring stable recurring revenue.

Among recent announcements, the July launch of new Home Factors attributes focused on water intrusion risk stands out as highly relevant. This mirrors the October enhancements by demonstrating Porch's ongoing ability to layer differentiated data products on its platform, which could influence carrier uptake and data monetization, the very elements now seen as crucial short-term catalysts for segment and margin growth.

In contrast, investors should also consider the ongoing risks tied to execution on insurance model changes and revenue predictability, since...

Porch Group's narrative projects $482.4 million in revenue and $63.9 million in earnings by 2028. This requires 4.1% yearly revenue growth and a $75 million increase in earnings from -$11.1 million currently.

Uncover how Porch Group's forecasts yield a $19.75 fair value, a 31% upside to its current price.

Exploring Other Perspectives

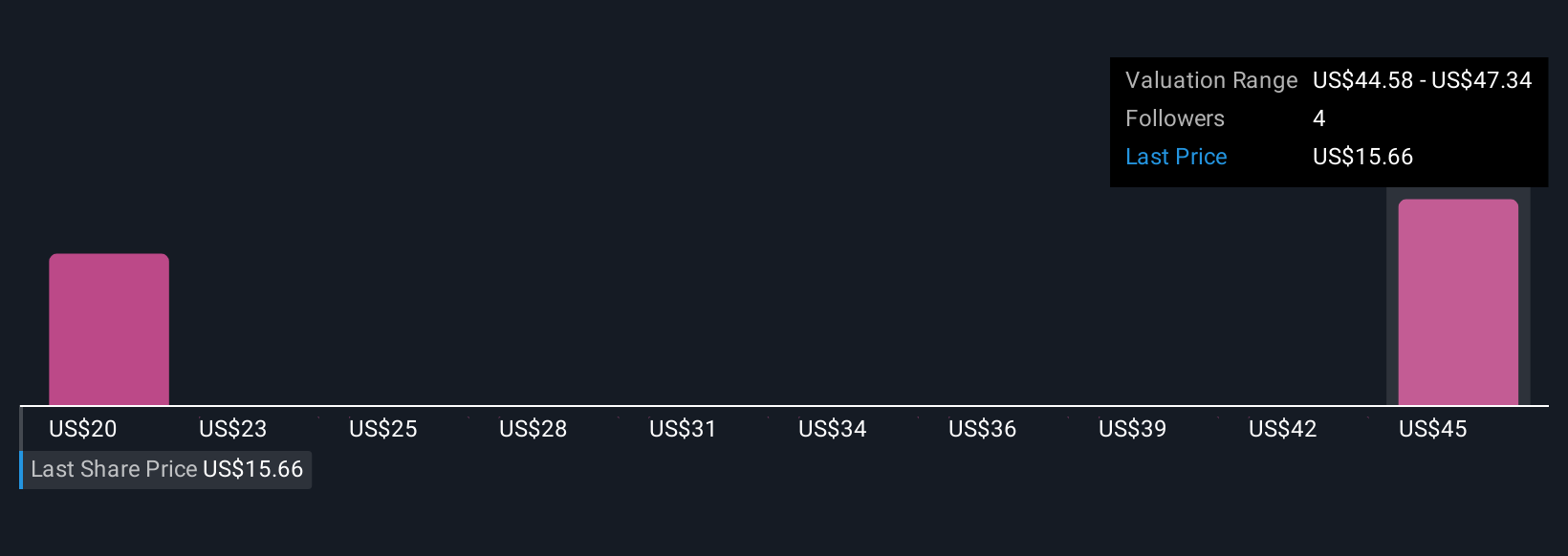

Two fair value estimates from the Simply Wall St Community show a broad US$19.75 to US$47.17 range. While many see upside in data expansion, some remind that short-term earnings can hinge on successful carrier adoption, so it pays to consider several viewpoints.

Explore 2 other fair value estimates on Porch Group - why the stock might be worth over 3x more than the current price!

Build Your Own Porch Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Porch Group research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Porch Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Porch Group's overall financial health at a glance.

No Opportunity In Porch Group?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.