Please use a PC Browser to access Register-Tadawul

Does PriceSmart's Guatemala Expansion Signal a New Phase of Regional Growth Ambitions for PSMT?

PriceSmart, Inc. PSMT | 128.77 | -0.84% |

- In August 2025, PriceSmart, Inc. opened its seventh warehouse club in Guatemala, situated on a four-acre property in Quetzaltenango, expanding its network to 56 clubs worldwide.

- This marks a continued commitment to growth in Central America, highlighting PriceSmart's efforts to reach new local markets beyond the nation's capital.

- We'll explore how this latest club opening reflects PriceSmart's regional growth focus and shapes its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

PriceSmart Investment Narrative Recap

To be a PriceSmart shareholder, you need to believe in the company’s ability to expand profitably across Central America and the Caribbean, using club rollout as a growth driver. The new club in Quetzaltenango underlines PriceSmart’s pursuit of untapped cities, but this particular opening does not materially alter the near-term outlook, as the most important catalyst remains steady membership and private label penetration, while currency and liquidity headwinds in select markets remain the key risk.

Among recent company news, the appointment of David Price as CEO from September 2025 could be the most relevant, as executive leadership changes may shape execution of expansion strategies. While new club openings can enhance the long-term addressable market, consistent leadership will be crucial for navigating margin pressures tied to FX and operational challenges.

On the flip side, investors should keep a close eye on ongoing foreign currency limitations and repatriation risks, especially in…

PriceSmart's outlook forecasts $6.9 billion in revenue and $209.1 million in earnings by 2028. This assumes an annual revenue growth rate of 10.1% and a $66.5 million increase in earnings from the current $142.6 million level.

Uncover how PriceSmart's forecasts yield a $111.67 fair value, a 3% downside to its current price.

Exploring Other Perspectives

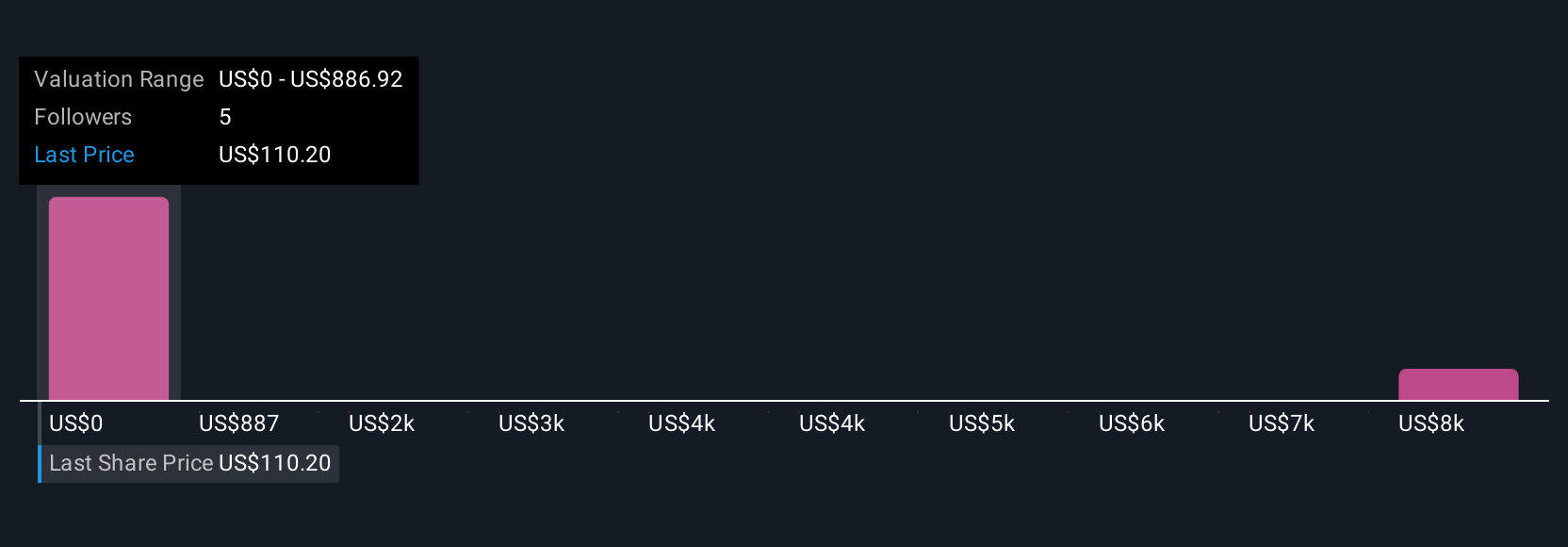

Five retail investors in the Simply Wall St Community set PriceSmart’s fair value between US$886.92 and US$8,869.22, reflecting radically different expectations about its profit outlook. Persistent foreign currency risks across key markets continue to pose unpredictable challenges that every investor should consider when weighing these diverse viewpoints.

Explore 5 other fair value estimates on PriceSmart - why the stock might be a potential multi-bagger!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.