Please use a PC Browser to access Register-Tadawul

Does Renaissance's Exit Signal Deeper Competitive Challenges for PagerDuty (PD) in Software Growth?

PagerDuty PD | 6.89 | -0.86% |

- In the past week, Renaissance Investment Management disclosed in its Q2 2025 Small Cap Growth Strategy letter that it exited its position in PagerDuty, Inc. due to prolonged challenges in revenue growth and mounting market competition. The investor highlighted a preference for AI-focused companies over PagerDuty, reflecting industry shifts and performance concerns.

- This move by a prominent institutional investor underscores the impact that execution challenges and shifting growth prospects can have on institutional confidence within the software sector.

- We'll now explore how Renaissance's concerns about execution and competition may reshape PagerDuty's investment outlook going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PagerDuty Investment Narrative Recap

To own PagerDuty stock, an investor must believe in its ability to capture ongoing digital transformation trends, benefit from increasing operational complexity, and drive value through new AI and automation offerings despite heightened competition. Renaissance Investment Management's recent exit, attributed to revenue growth concerns and competitive pressures, does increase near-term uncertainty but does not materially alter the major short-term catalyst: sustained enterprise demand for real-time incident response. The biggest risk remains intensified competition, which could further challenge margin and ARR expansion.

Among recent announcements, PagerDuty's appointment of Todd McNabb as Chief Revenue Officer stands out as most relevant to these concerns. Bringing over 25 years of experience in scaling technology companies, McNabb’s arrival is timely as PagerDuty seeks to improve sales execution and restore revenue momentum, which is central to addressing the competitive pressures spotlighted by Renaissance’s move.

However, investors should be aware that while new leadership aims to reboot sales execution, the risk of customer downgrades and market share loss remains...

PagerDuty's outlook anticipates $572.1 million in revenue and $74.9 million in earnings by 2028. This implies a 6.3% annual revenue growth rate and a $111.8 million earnings increase from current earnings of -$36.9 million.

Uncover how PagerDuty's forecasts yield a $19.14 fair value, a 18% upside to its current price.

Exploring Other Perspectives

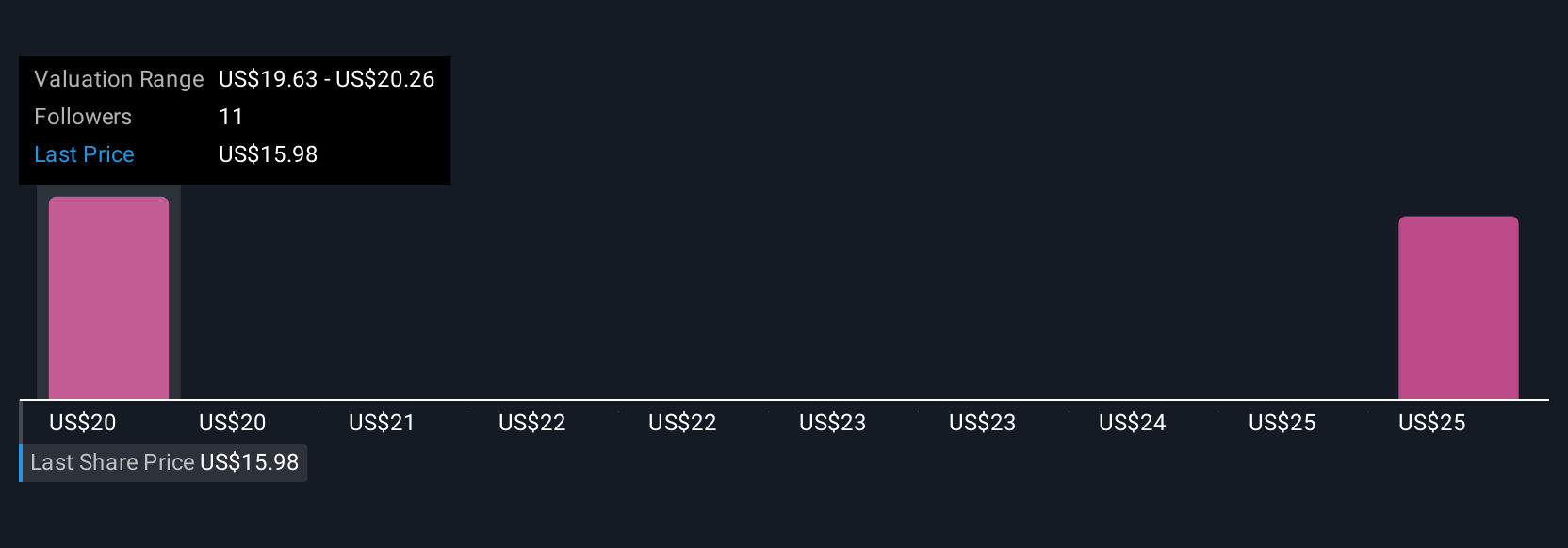

Fair value estimates from the Simply Wall St Community range from US$19.14 to US$26.69, based on three independent views. With competition emerging as a key risk, differences in expectations could shape wide swings in sentiment among holders, see how others in the community are sizing up these growth challenges.

Explore 3 other fair value estimates on PagerDuty - why the stock might be worth just $19.14!

Build Your Own PagerDuty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PagerDuty research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PagerDuty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PagerDuty's overall financial health at a glance.

No Opportunity In PagerDuty?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.