Please use a PC Browser to access Register-Tadawul

Does Sally Beauty’s (SBH) New Analyst Upgrade Signal Shifting Value Perceptions in Specialty Retail?

Sally Beauty Holdings, Inc. SBH | 14.90 | -0.07% |

- Recently, Sally Beauty Holdings received an analyst upgrade and an 'A' grade for Value, with metrics such as P/E and P/S ratios suggesting the stock may be undervalued, according to Zacks.

- This highlights growing confidence in the company’s earnings outlook and its position as an attractive value choice within the specialty retail sector.

- We will now examine how these positive analyst ratings and value signals could influence Sally Beauty’s broader investment narrative.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sally Beauty Holdings Investment Narrative Recap

To be a shareholder of Sally Beauty Holdings today, you need confidence in the company’s ability to deliver value to budget-conscious beauty shoppers while navigating the pressures of intense specialty retail competition. The recent analyst upgrade and value rating strengthen the short-term catalyst of renewed investor attention, yet the main risk remains sustained softness in certain product categories; this news event does not materially alter that risk or shift near-term growth drivers for the business.

Among recent company moves, the expansion of exclusive nail product offerings and collaborations with trending brands like Nailboo and KISS stand out as directly supporting Sally Beauty’s focus on driving higher-margin sales, a key catalyst for maintaining profitability as value-focused customer behavior continues to shape the sector.

On the other hand, while some see momentum, investors should be aware of lingering concerns around physical store closures and...

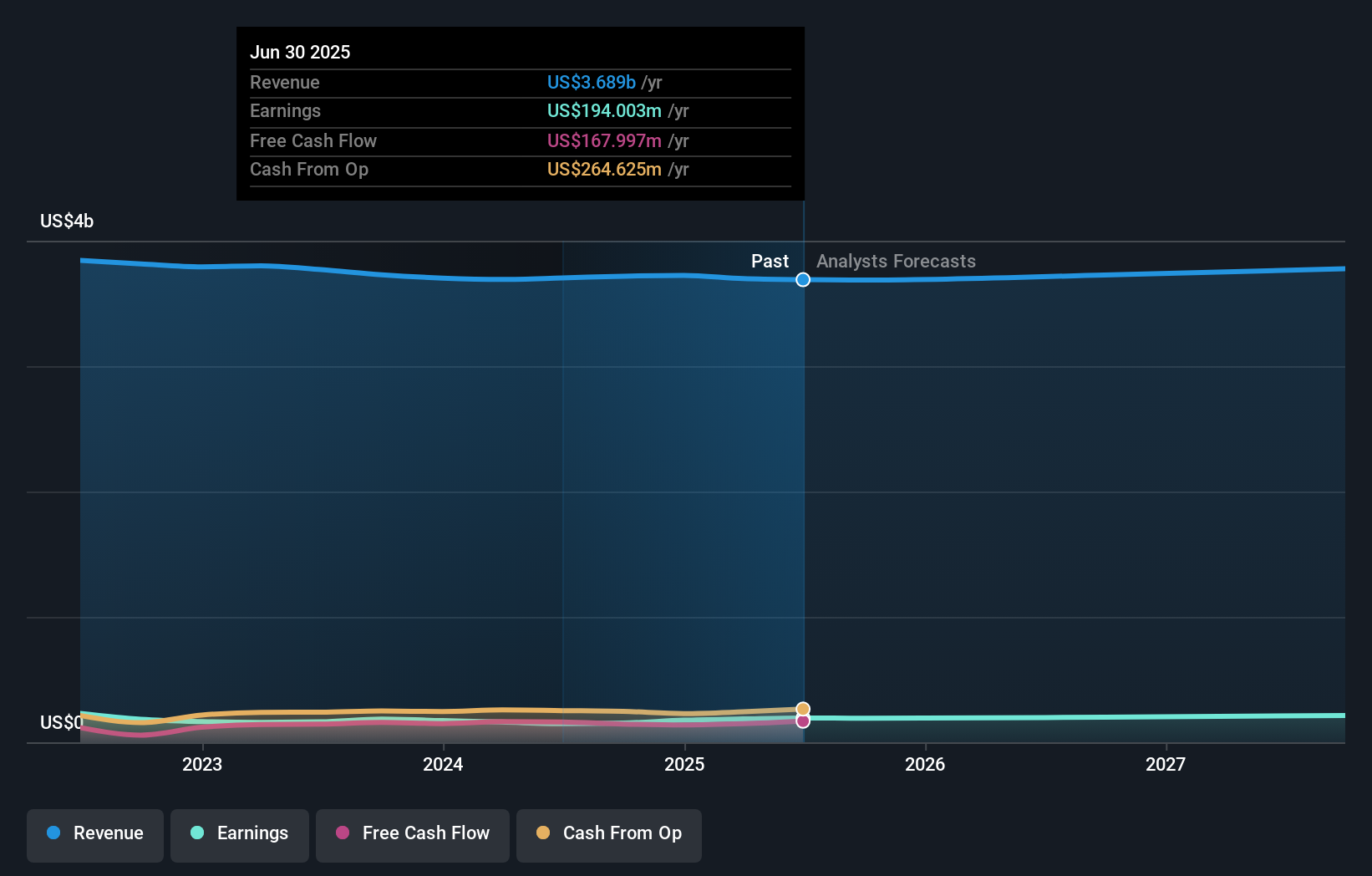

Sally Beauty Holdings' outlook anticipates $3.8 billion in revenue and $211.5 million in earnings by 2028. This is based on a projected 1.3% annual revenue growth and a $17.5 million increase in earnings from the current $194.0 million.

Uncover how Sally Beauty Holdings' forecasts yield a $12.70 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community for Sally Beauty range from US$12.70 up to US$23.53. Opinions remain divided, especially as the largest risk continues to be ongoing sales softness among value-focused customers, challenging consistent revenue growth.

Explore 3 other fair value estimates on Sally Beauty Holdings - why the stock might be worth as much as 70% more than the current price!

Build Your Own Sally Beauty Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sally Beauty Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sally Beauty Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sally Beauty Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.