Please use a PC Browser to access Register-Tadawul

Does Sprinklr’s (CXM) Leadership Change and Buyback Reveal a Shift in Its Margin Ambitions?

Sprinklr, Inc. Class A CXM | 5.82 | -3.00% |

- Sprinklr recently reported its second quarter results, showing year-over-year growth in revenue to US$212.04 million and net income of US$12.62 million, and announced the upcoming departure of CFO Manish Sarin later this month.

- Along with a leadership shakeup and new earnings guidance, the company completed a significant share buyback, repurchasing over 17.6 million shares for US$150.05 million.

- We'll examine how the CFO transition and recent earnings results may influence Sprinklr's longer-term earnings and margin outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sprinklr Investment Narrative Recap

To be a Sprinklr shareholder, you have to believe that the company can keep expanding its AI-powered customer experience platform among large global enterprises, despite recent churn and margin pressures. The departure of CFO Manish Sarin and new guidance are unlikely to seriously alter the near-term outlook, customer retention and margin stability remain the most important catalysts and risks right now. One of the most relevant announcements is the completed US$150.05 million share buyback, representing over 6.8% of Sprinklr’s shares outstanding. This action comes at a time when operational efficiency and margin expansion ambitions are front and center for shareholders seeking evidence of sustainable profit growth. Yet, on the flip side, investors should be aware that heavy reliance on a concentrated base of enterprise customers makes Sprinklr especially vulnerable if just a few large clients scale back...

Sprinklr is projected to reach $1.0 billion in revenue and $36.8 million in earnings by 2028. This outlook assumes an 8.0% annual revenue growth rate, with earnings declining by $83.4 million from current earnings of $120.2 million.

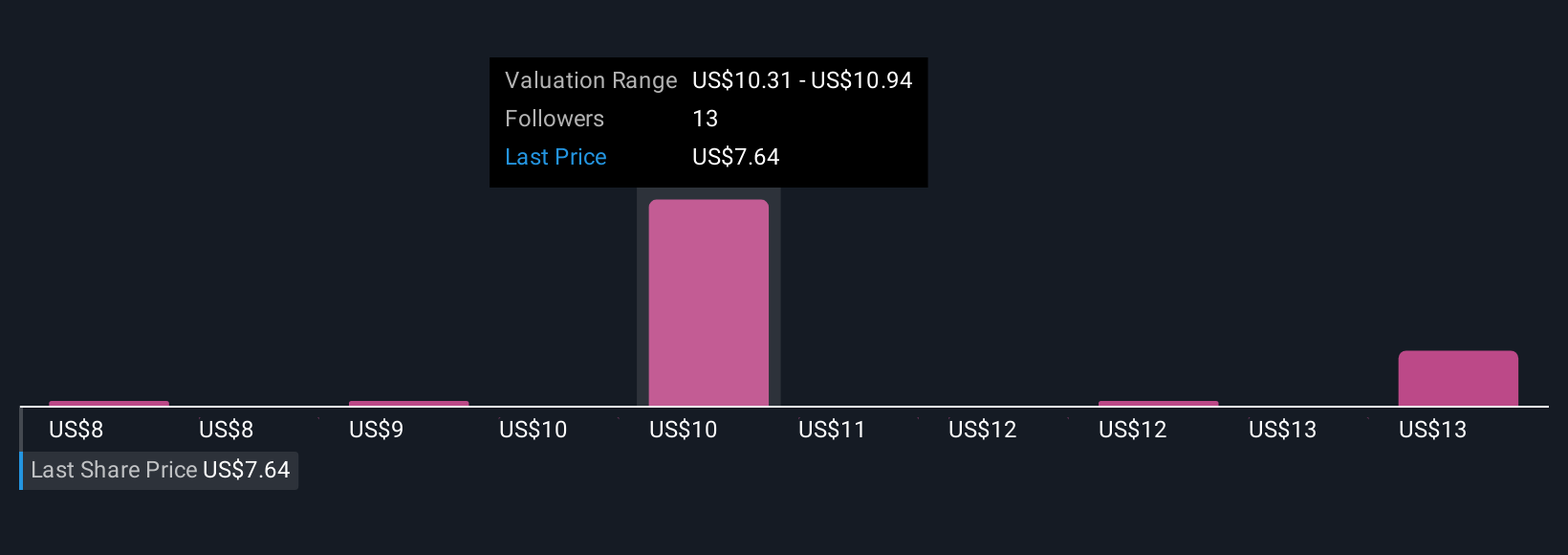

Uncover how Sprinklr's forecasts yield a $10.44 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have placed Sprinklr’s fair value estimates between US$7.79 and US$14.11 across five separate analyses. While opinions differ widely, keep in mind, persistent customer churn and down-sell risk remain top concerns for the company’s future performance.

Explore 5 other fair value estimates on Sprinklr - why the stock might be worth just $7.79!

Build Your Own Sprinklr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sprinklr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprinklr's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.