Please use a PC Browser to access Register-Tadawul

Does TransMedics CEO’s Recent $2M Share Purchase Reinforce the Bull Case for TMDX?

TransMedics Group TMDX | 126.79 | -0.65% |

- In recent weeks, TransMedics Group announced that its CEO purchased approximately US$2 million in company shares, following the company's release of robust second quarter results and an upward revision of full-year 2025 revenue guidance to a range of US$585 million to US$605 million.

- This wave of insider buying, paired with the company's continued earnings growth and market expansion plans, has drawn increased investor attention and highlighted confidence in TransMedics' outlook.

- We'll explore how the CEO's substantial share purchase reinforces confidence in TransMedics' future and impacts the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TransMedics Group Investment Narrative Recap

To be a shareholder in TransMedics Group, you need conviction in the future of organ transplant technology and the company's ability to deliver sustained medical and commercial advances. The recent FDA approval for the new ENHANCE Heart trial is a pivotal short term catalyst, but does not directly reduce the key risk that unfavorable clinical outcomes or superior competitor technology could undermine TransMedics' growth story. The CEO's recent substantial share purchase underscores management confidence, but the overall risk profile tied to clinical and market leadership remains largely unchanged.

Among recent news, the FDA's green light for the Next-Generation OCS ENHANCE Heart trial stands out. If successful, this could expand the available patient pool and bolster TransMedics’ position at the forefront of transplant innovation, supporting long-term growth drivers and further validating the belief underpinning the company’s investment case.

In contrast, investors should be aware that regulatory scrutiny and evolving clinical trial data still have the potential to...

TransMedics Group's narrative projects $913.8 million in revenue and $151.1 million in earnings by 2028. This requires 19.8% yearly revenue growth and a $79.4 million earnings increase from $71.7 million currently.

Uncover how TransMedics Group's forecasts yield a $142.29 fair value, a 9% upside to its current price.

Exploring Other Perspectives

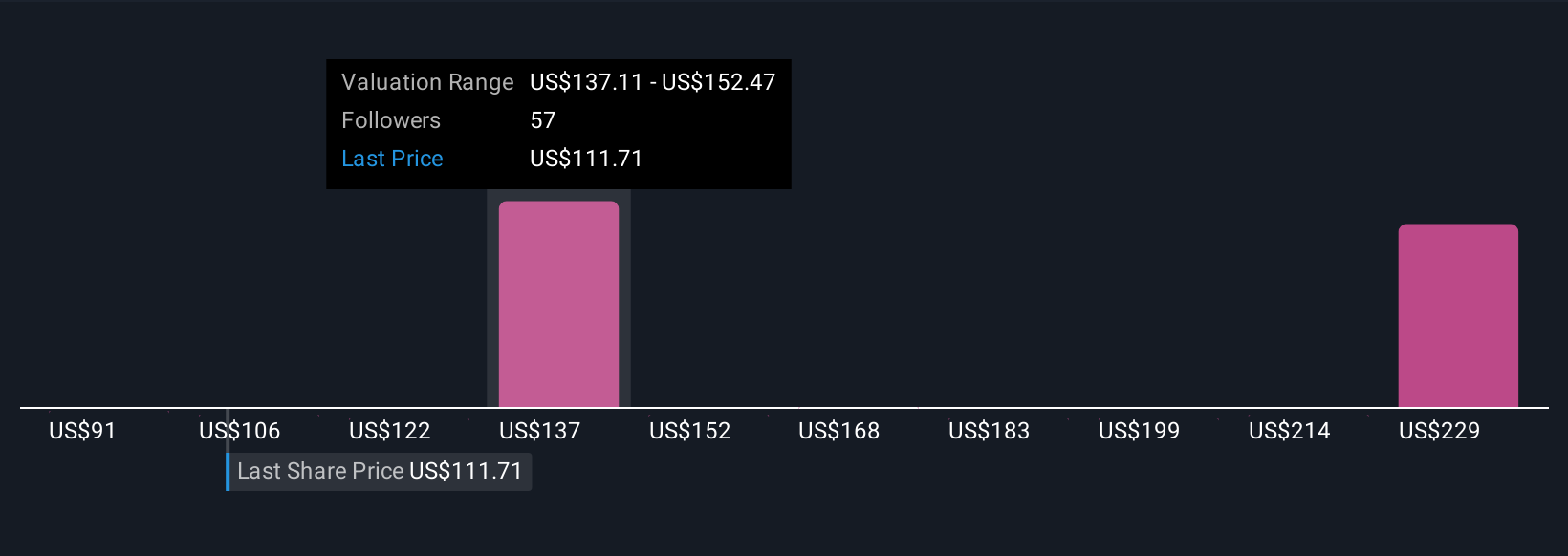

Nine members of the Simply Wall St Community provide fair value estimates for TMDX ranging from US$65.24 to US$310.00. This diversity of views sits against the backdrop of clinical innovation still being the company's most important near-term potential driver, which could materially shift perceptions of value.

Explore 9 other fair value estimates on TransMedics Group - why the stock might be worth less than half the current price!

Build Your Own TransMedics Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransMedics Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TransMedics Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransMedics Group's overall financial health at a glance.

No Opportunity In TransMedics Group?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.