Please use a PC Browser to access Register-Tadawul

Does USA Compression Partners (USAC) Price Reflect Its Strong Multi‑Year Unit Returns?

USA Compression Partners LP USAC | 25.20 25.20 | +1.12% 0.00% Post |

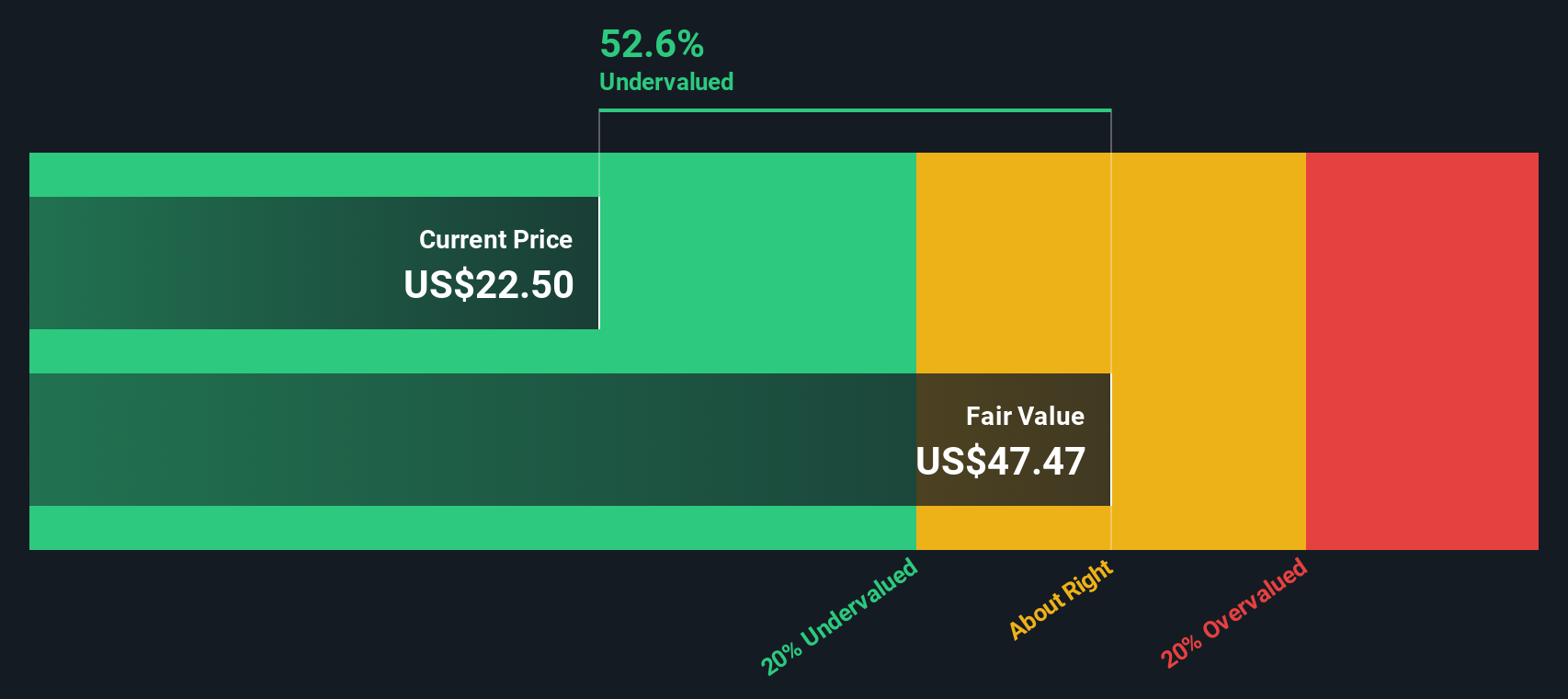

- Wondering if USA Compression Partners at around US$25.73 is offering fair value or if the price already reflects the story? This article walks through what the current market level might be implying.

- The units have returned 4.3% over the past week, 9.4% over the past month and 9.8% over the last year, with longer term returns of 63.2% over 3 years and 167.2% over 5 years. These figures may catch the eye of investors thinking about growth potential and changing risk perceptions.

- Recent coverage has focused on USA Compression Partners as an income oriented energy infrastructure name, with attention on how its contract driven model and role in natural gas compression fit into broader energy trends. Commentators have also highlighted how its focus on fee based services can shape investor expectations around stability, which in turn helps frame how the market reacts to price moves.

- Right now our valuation framework gives USA Compression Partners a score of 1 out of 6 on potential undervaluation checks. Next we will walk through the standard valuation approaches investors often use and then finish with a different way of thinking about value that can tie these methods together.

USA Compression Partners scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Compression Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business could be worth today by projecting its future cash flows and then discounting those back to a single present value figure.

For USA Compression Partners, the starting point is last twelve month Free Cash Flow of about $183.5 million. Using a 2 Stage Free Cash Flow to Equity model, cash flows are projected each year out to 2035. Analyst inputs go out to 2027, with later years extrapolated. For example, Simply Wall St’s projections show Free Cash Flow of $160.5 million in 2026 and $115 million in 2027, stepping down to about $89.1 million by 2035, all in dollar terms and then discounted back to today.

Adding these discounted cash flows together gives an estimated intrinsic value of about $12.01 per unit for NYSE:USAC. Against a recent market price around $25.73, the DCF output suggests the units trade at a 114.3% premium to this model’s fair value, which points to USA Compression Partners looking expensive based on these cash flow assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Compression Partners may be overvalued by 114.3%. Discover 868 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: USA Compression Partners Price vs Earnings

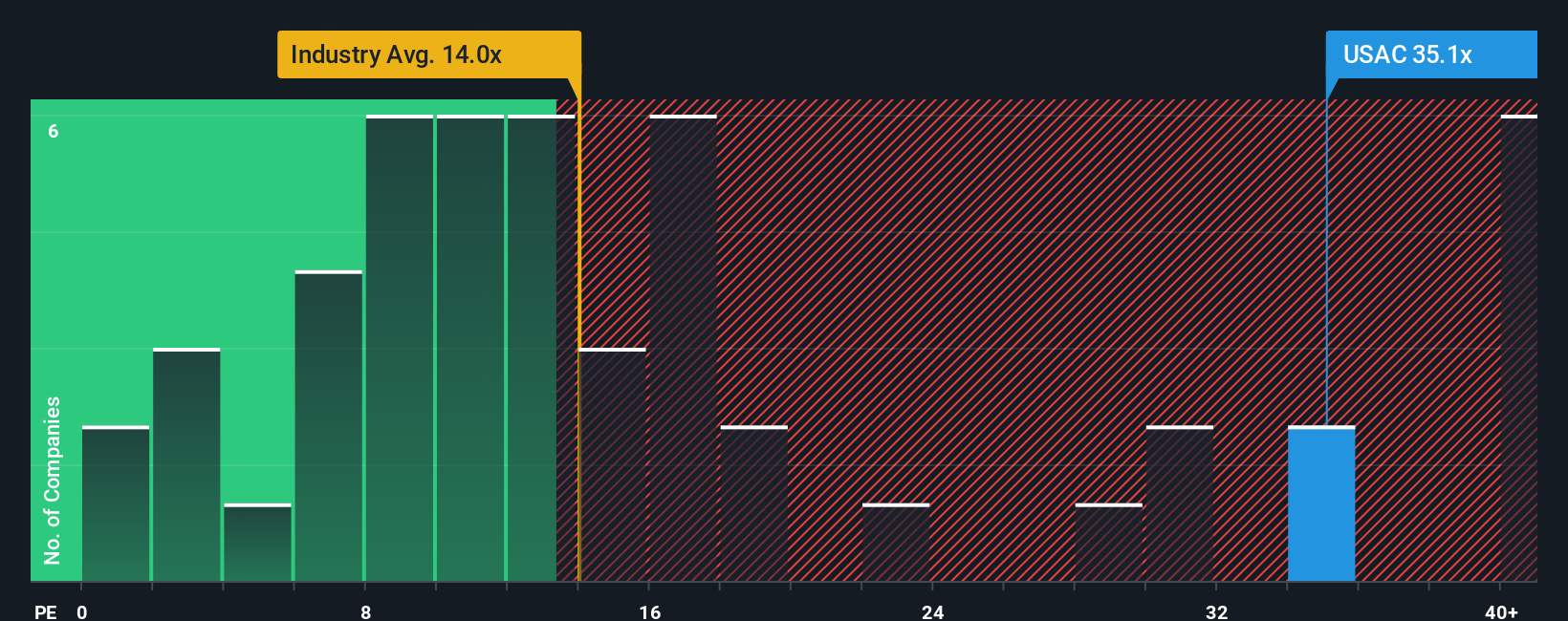

For a profitable business like USA Compression Partners, the P/E ratio is a common way to judge how much you are paying for each dollar of earnings. A higher P/E usually reflects higher market expectations for growth or a perception of lower risk, while a lower P/E often signals more modest growth assumptions or higher perceived risk.

USA Compression Partners currently trades on a P/E of about 32.8x. That sits above the Energy Services industry average P/E of roughly 21.1x, yet slightly below the peer group average of around 36.5x. Simply Wall St also calculates a proprietary “Fair Ratio” for NYSE:USAC of 22.2x, which is the P/E level it might trade on given its earnings growth profile, industry, profit margins, market cap and risk characteristics.

This Fair Ratio can be more informative than a simple comparison to peers or the sector, because it adjusts for factors such as growth, risks and profitability rather than assuming all companies deserve the same multiple. With USA Compression Partners trading at 32.8x versus a Fair Ratio of 22.2x, the units appear expensive under this P/E based framework.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Compression Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simply your own story about USA Compression Partners. A Narrative links what you believe about its contracts, natural gas role and risks to a set of revenue, earnings and margin forecasts, a fair value, and then a clear view on whether that fair value looks attractive versus today’s price. All of this is available within an easy tool on Simply Wall St’s Community page that updates as new news or earnings arrive. Narratives can differ widely from other investors, such as one user seeing US$30 as reasonable while another sees US$23 as more appropriate, based on how each weighs factors like natural gas demand, contract length, customer concentration and costs.

Do you think there's more to the story for USA Compression Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.