Please use a PC Browser to access Register-Tadawul

Does Wall Street’s Unified ‘Buy’ on Builders FirstSource (BLDR) Clarify or Cloud Its Margin Story?

Builders FirstSource, Inc. BLDR | 124.66 | +12.01% |

- In recent days, Builders FirstSource received renewed attention from Wall Street as 19 covering analysts maintained a consensus ‘Buy’ rating on the company.

- This broad analyst agreement underscores how professional sentiment can itself become a factor in investor behavior, even without new operational developments from the business.

- We’ll now examine how this broad analyst support could influence Builders FirstSource’s existing investment narrative around digital investment, consolidation, and margins.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Builders FirstSource Investment Narrative Recap

To own Builders FirstSource, you have to believe in its ability to compound value from digital tools, value added products and consolidation, despite a choppy housing and commodity backdrop. The recent wave of Buy ratings and price targets does not materially change the near term picture, where the key catalyst remains execution on higher margin, tech enabled offerings, and a major risk is that housing and renovation activity stays soft for longer than the business can comfortably absorb.

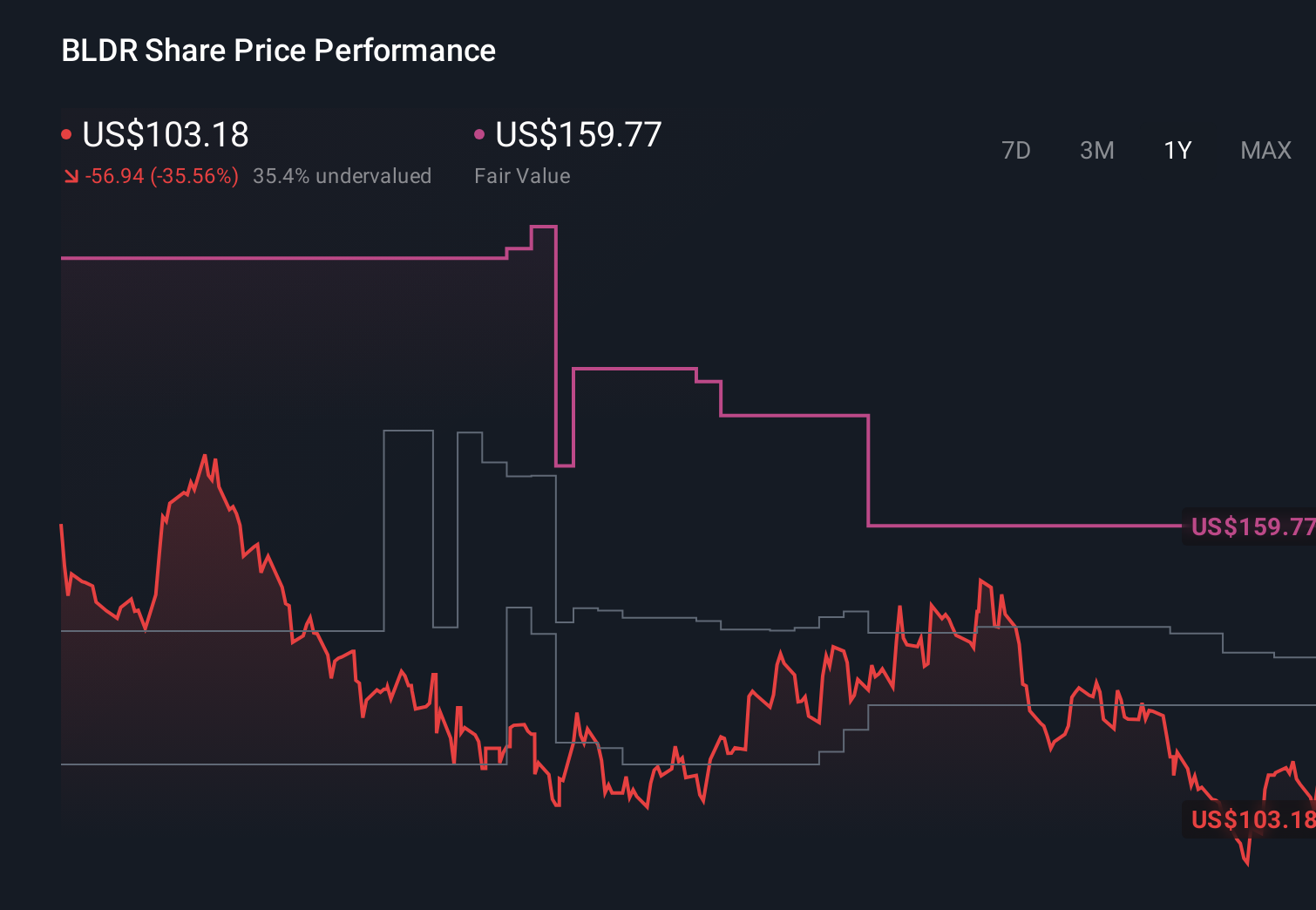

The most relevant recent development here is the reaffirmed analyst support, with 19 firms maintaining a consensus Buy and an average target of about US$141. This aligns directly with the existing narrative that capital allocation, including ongoing buybacks and a focus on margins, will matter more to the story than short lived sentiment shifts in the share price.

Yet investors should still be aware that a prolonged period of weak single family housing starts could...

Builders FirstSource’s narrative projects $16.4 billion revenue and $684.5 million earnings by 2028. This implies a 0.9% yearly revenue decline and an earnings decrease of $71.9 million from $756.4 million today.

Uncover how Builders FirstSource's forecasts yield a $132.52 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community valuations for Builders FirstSource cluster between about US$111 and US$133 per share, showing how far individual views can stretch. Set that against the risk that housing activity remains muted and you can see why many investors choose to compare several different viewpoints before deciding how Builders FirstSource might fit into their portfolio.

Explore 2 other fair value estimates on Builders FirstSource - why the stock might be worth just $111.26!

Build Your Own Builders FirstSource Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Builders FirstSource research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Builders FirstSource research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Builders FirstSource's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.