Please use a PC Browser to access Register-Tadawul

Does Warrior Met Coal's (HCC) Credit Expansion Reflect a New Commitment to Long-Term Production Growth?

Warrior Met Coal, Inc. HCC | 83.55 | +0.05% |

- In September 2025, Warrior Met Coal announced it had amended and extended its Second Amended and Restated Asset-Based Revolving Credit Facility, increasing the total commitment by US$27 million to US$143 million and pushing the maturity to August 28, 2030.

- This move boosts the company's financial flexibility, aiming to support the Blue Creek development project as it progresses toward full production and higher capacity.

- We’ll explore how this enhanced credit facility could strengthen Warrior Met Coal’s planned production growth and shift its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Warrior Met Coal Investment Narrative Recap

To be a shareholder of Warrior Met Coal today, you need to believe in the company's ability to deliver higher volumes and margin improvement from the Blue Creek project, while managing volatile coal prices and shifting Asian demand. The recent expansion and extension of its credit facility directly supports Blue Creek’s ramp to full production, which is the key short-term catalyst; however, this move also heightens exposure to operational and placement risks if market conditions remain weak.

The most relevant recent announcement is Warrior Met Coal's increase in production and sales guidance for 2025, which aligns with Blue Creek's anticipated longwall startup. While the expanded credit facility bolsters financial flexibility for this major growth initiative, investor focus remains fixed on whether expanded output can translate into margin recovery amid challenging price fundamentals.

By contrast, investors should also be aware that growing dependence on Asian demand introduces new risks that...

Warrior Met Coal's outlook anticipates $2.0 billion in revenue and $636.5 million in earnings by 2028. This is based on analysts' expectations of 18.8% annual revenue growth and a $596 million increase in earnings from the current $40.3 million.

Uncover how Warrior Met Coal's forecasts yield a $65.67 fair value, a 4% upside to its current price.

Exploring Other Perspectives

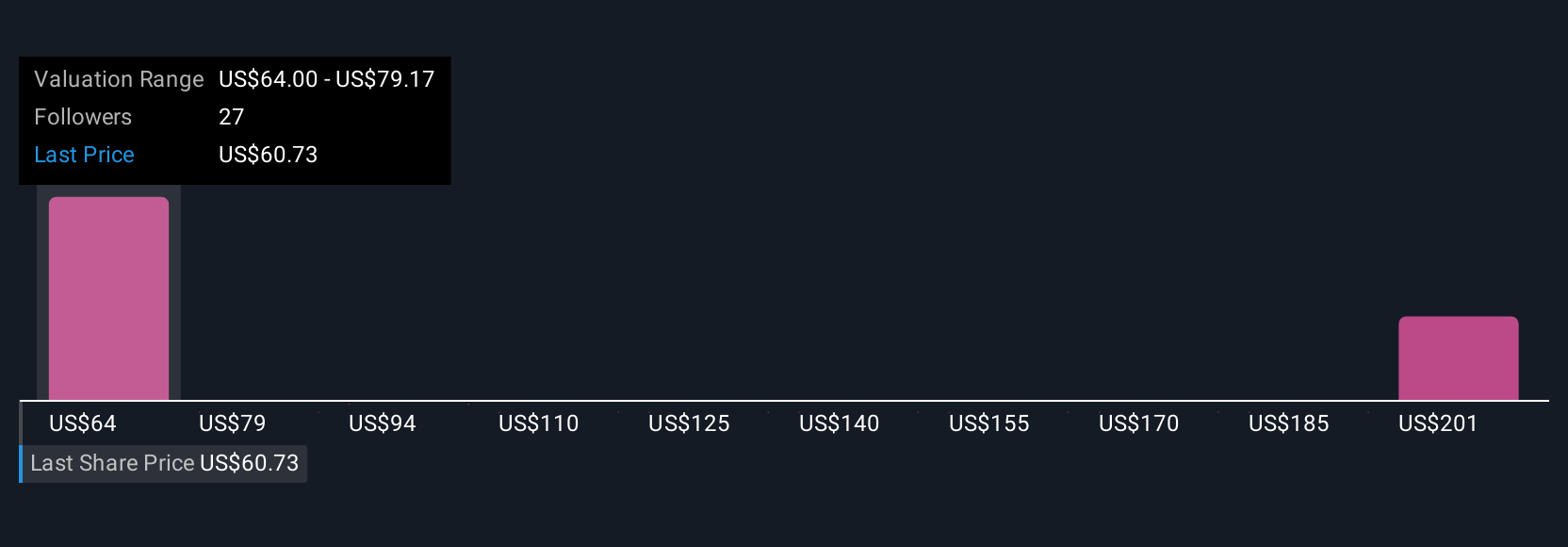

Private investors within the Simply Wall St Community assigned fair values ranging from US$65.67 to US$210.44 across 5 personal estimates. While optimism around Blue Creek’s capacity increase is strong, persistent pressure on coal pricing could challenge these assumptions and shape your own view of Warrior Met Coal’s outlook.

Explore 5 other fair value estimates on Warrior Met Coal - why the stock might be worth just $65.67!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.