Please use a PC Browser to access Register-Tadawul

Dole (DOLE): Assessing Valuation After $157.9 Million Follow-On Equity Offering

Dole plc DOLE | 15.34 | -1.41% |

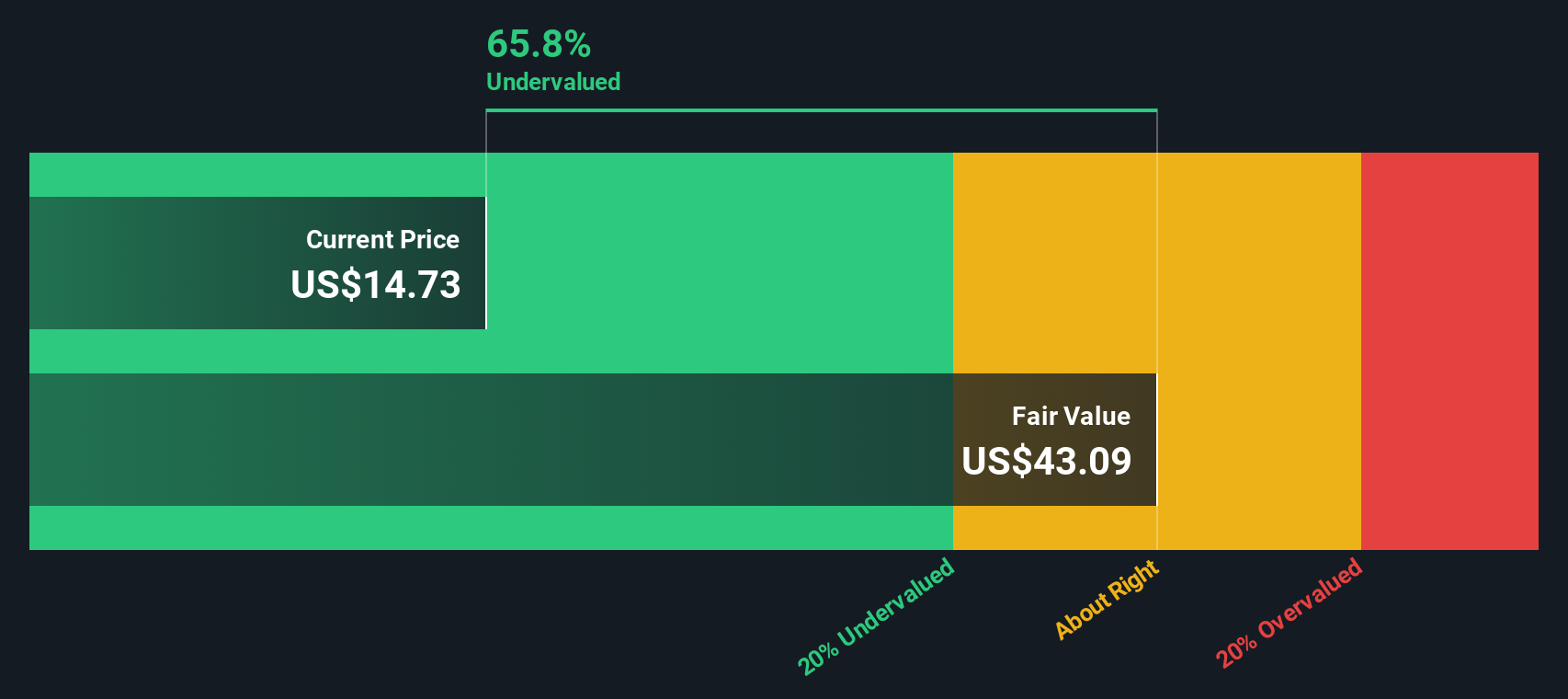

Most Popular Narrative: 23.4% Undervalued

According to the most popular narrative, Dole is currently trading at a significant discount compared to its analyst-derived fair value. This suggests the stock has meaningful upside potential if forecasts hold true.

Strong global demand and a strategic presence in key markets support revenue growth and margin expansion through premium positioning and diversified fresh produce offerings. Financial restructuring and operational investments improve flexibility and efficiency, enabling focus on higher-margin products and long-term market share gains as regulatory and ESG shifts occur.

Curious about what is fueling this undervaluation call? The narrative hints at a powerful blend of international expansion, strategic pivots, and efficiency moves driving Dole’s future. What aggressive projections make up the backbone of this valuation? Read on to see what is really behind the bold price target and whether the market is missing something significant.

Result: Fair Value of $17.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, extreme weather and the company's heavy reliance on major fruit crops could challenge the upbeat outlook and put pressure on Dole's future earnings stability.

Find out about the key risks to this Dole narrative.Another View: Our DCF Model Perspective

While analyst price targets point to meaningful upside, our SWS DCF model also signals Dole is trading below its estimated fair value. But do these different methods truly support the same story, or could the future surprise?

Build Your Own Dole Narrative

If you see things differently or want deeper insight, you can dig into the data and shape your own view in just a few minutes. Do it your way

A great starting point for your Dole research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let opportunity pass you by. All around the market, clever investors are uncovering fresh opportunities. Make sure you are one of them by checking out these proven idea generators:

- Target steady income and strong foundations by reviewing dividend stocks with solid yields using dividend stocks with yields > 3% to keep your portfolio resilient.

- Pounce on hidden bargains in undervalued companies by leveraging undervalued stocks based on cash flows, where the next breakout winner could be just a click away.

- Catch the next tech wave by scanning for innovative healthcare AI businesses with healthcare AI stocks, bringing breakthroughs to both medicine and your investment strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.