Please use a PC Browser to access Register-Tadawul

DoorDash (DASH): Evaluating the Valuation After Strategic Push With Sally Beauty Pop-Up in New York

DoorDash DASH | 227.49 | +1.32% |

DoorDash and Sally Beauty Team Up for New York Pop-Up, Raising Investor Eyebrows

DoorDash (DASH) has just launched a splashy new partnership with Sally Beauty, kicking off a three-day “Beauty on the Go” pop-up event in New York City. This collaboration offers attendees exclusive swag bags packed with fan-favorite products and integrates on-demand delivery directly into the in-person experience. The move signals DoorDash’s push to connect with new consumer segments and deepen its footprint in retail delivery, all while boosting brand visibility in a crowded urban market.

This announcement comes as DoorDash stock recovers from a tough August, when Amazon’s grocery push rattled the space and sparked a spike in investor caution. Over the past year, however, momentum has shifted. DoorDash shares are up 84% in twelve months and over 53% year-to-date, outpacing much of the sector and suggesting renewed confidence in the company’s growth story. The Sally Beauty partnership, while just one of several recent strategic efforts, contributes to a broader trend: DoorDash is increasing its focus on partnerships as competition from Amazon, Instacart, and Uber intensifies.

With the stock now near potential buy points, the question for investors is clear—does DoorDash offer untapped potential, or is all anticipated growth already reflected in today’s valuation?

Most Popular Narrative: 10.8% Undervalued

According to the most closely followed narrative, DoorDash is currently valued at a discount relative to its projected future performance. The prevailing view suggests the company’s long-term prospects, supported by analyst expectations, imply more upside than the current share price reflects.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This diversification could accelerate topline revenue while supporting net margin expansion.

What drives this price target? A handful of blockbuster growth forecasts, rising profit margins, and ambitious financial projections fuel the positive outlook from analysts. The story depends on whether DoorDash can deliver a future profit scenario more often associated with major tech companies than with retail delivery. Which unpredictable factors could influence this valuation? The answers, along with the controversial numbers that make up this calculation, are explained in the full narrative.

Result: Fair Value of $294.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising labor costs and heightened competition from major players could challenge DoorDash’s ability to sustain its growth and margin improvements in the future.

Find out about the key risks to this DoorDash narrative.Another View: What Are the Multiples Saying?

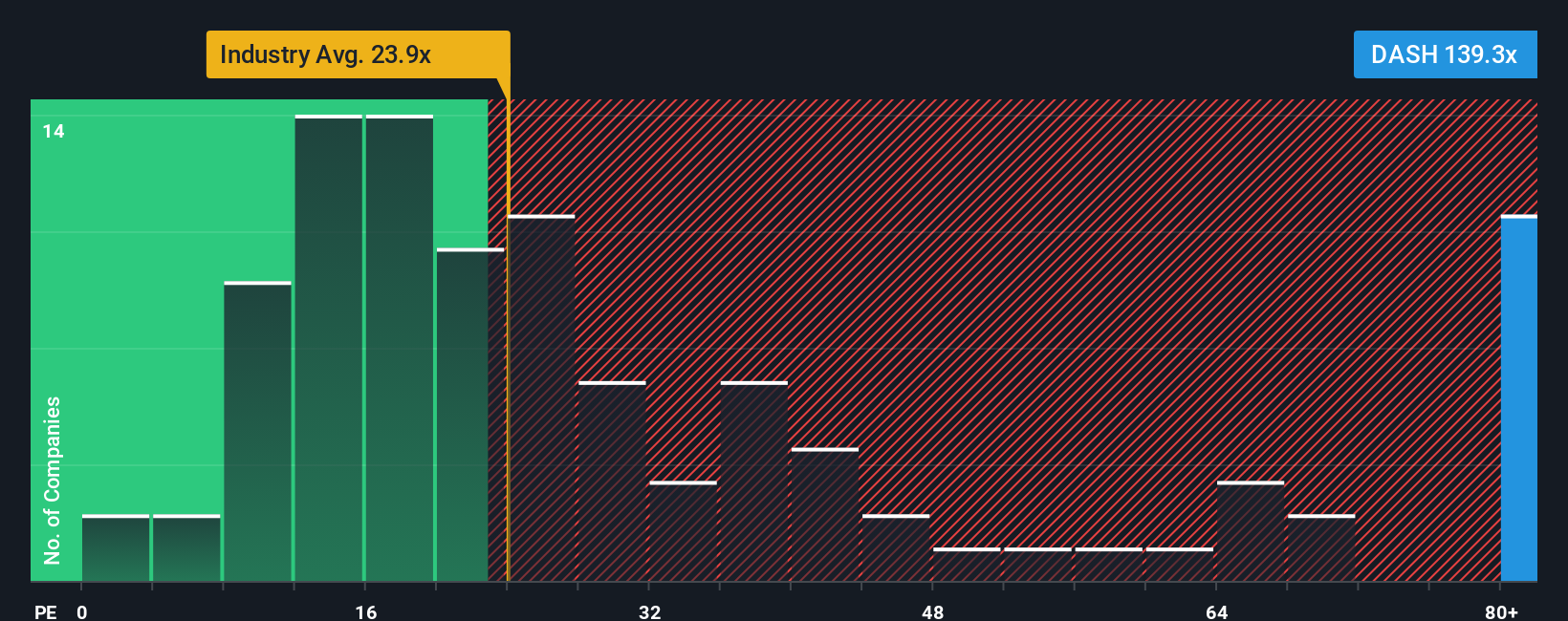

While the analyst consensus points to DoorDash trading below its estimated fair value, a look at the current valuation shows the company is trading at almost six times the earnings multiple of its industry. Is optimism outpacing fundamentals?

Build Your Own DoorDash Narrative

If you see things differently or want to dig into the numbers on your own terms, crafting a personalized narrative is quick and straightforward. Do it your way

A great starting point for your DoorDash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You could be missing some of the market’s biggest opportunities if you stop here. Make your next move and check out these powerful strategies available to you right now:

- Start building income by tapping into CTA_SCREENER_DIVIDEND that consistently reward shareholders with yields above 3%.

- Spot future tech giants early by searching for CTA_SCREENER_AI_STOCKS that are shaping artificial intelligence innovation and driving industry disruption.

- Unlock value opportunities with CTA_SCREENER_UNDERVALUED that analysts believe are trading at attractive discounts based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.