Please use a PC Browser to access Register-Tadawul

DoorDash (DASH): Evaluating Valuation as Kroger Expansion and Autonomous Delivery Unveil New Growth Drivers

DoorDash DASH | 227.49 | +1.32% |

DoorDash (DASH) just rolled out a wave of innovations by revealing its first fully in-house autonomous delivery robot, Dot, in addition to a new AI-powered delivery platform. At the same time, all 2,700 Kroger stores joined the DoorDash network for nationwide delivery.

All these moves come as DoorDash wraps up a big year of expansion. Along with the launch of Dot and the Kroger deal, DoorDash also completed its acquisition of Deliveroo and entered a strategic partnership with Yelp to expand delivery access nationwide. While not every headline has sparked a dramatic shift, the 1-year total shareholder return of 87% suggests momentum has remained solid, underlining how investors are reacting to a period of consistent innovation and deeper market reach.

If you're watching how logistics and AI are reshaping delivery, it's a great moment to discover See the full list for free..

The big question now is whether DoorDash shares are still attractively valued given this momentum, or if the recent surge means everything is already reflected in the price. Is there a genuine buying opportunity here, or has the market already taken all future growth into account?

Most Popular Narrative: 9% Undervalued

DoorDash's latest closing price of $271.22 is around 9% below the consensus fair value of $298.19, based on the most widely followed narrative. Investors have taken notice of this gap as analysts update forecasts and weigh new business catalysts.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This trend could diversify and accelerate topline revenue while supporting net margin expansion.

Want to know which bold forecasts underpin this valuation? The narrative hints at accelerated growth across new categories and surging profits, not just from food delivery. There is a pivotal assumption about DoorDash’s earning power that many might find surprising. Dive into the full story to see what could drive shares even higher.

Result: Fair Value of $298.19 (UNDERVALUED)

However, execution missteps in new markets or rising regulatory pressures could quickly challenge this bullish outlook and change DoorDash's growth trajectory.

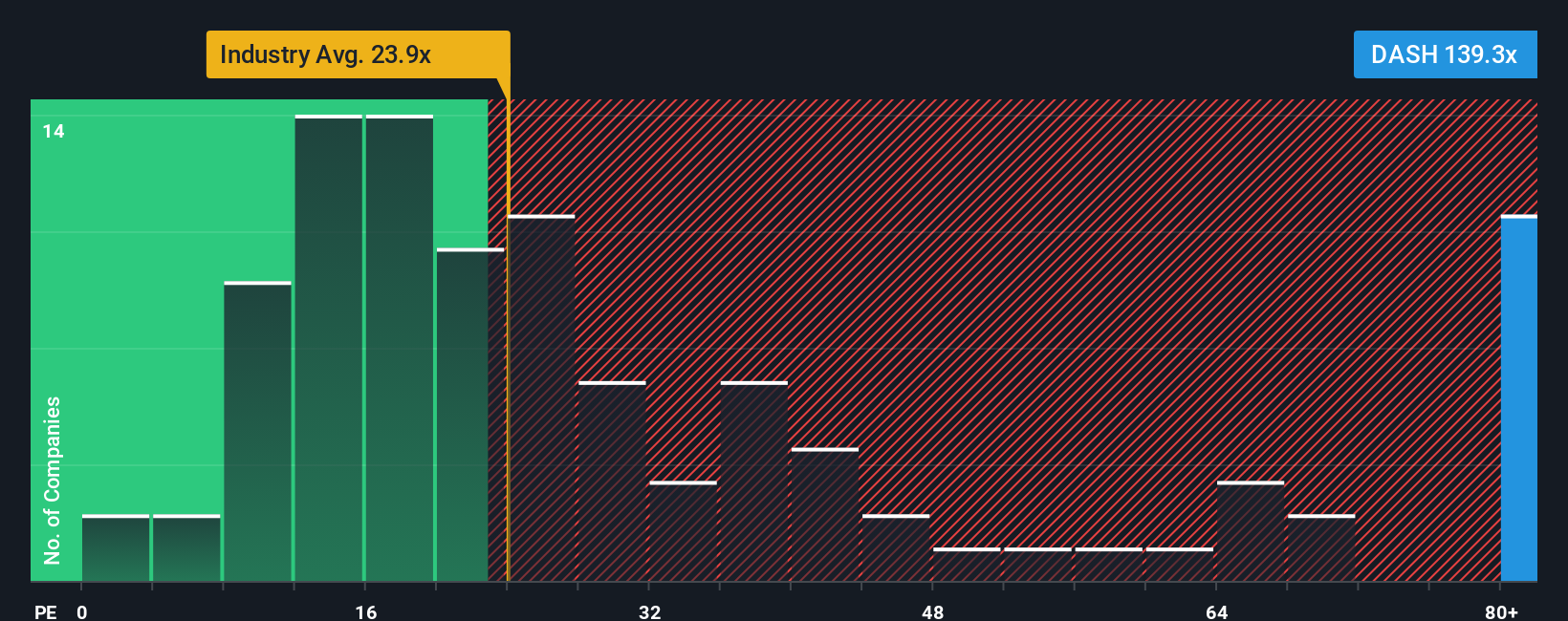

Another View: Multiples Tell a Different Story

While the most popular approach suggests DoorDash is undervalued, a look at its key price-to-earnings ratio points to a much steeper price tag. DoorDash trades at 148.4 times earnings, which is well above the US Hospitality industry average of 24.4 and the peer average of 32.1. Even the fair ratio, calculated at 51.6, is significantly below the current valuation. This raises real questions about valuation risk, especially if future growth falters. Could the market be pricing in too much optimism?

Build Your Own DoorDash Narrative

If you see things differently or want to reach your own conclusions, building your own take on DoorDash is quick and simple. Often, it takes just a few minutes — Do it your way.

A great starting point for your DoorDash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by expanding your watchlist with stocks that fit your goals and help you stay ahead of the crowd. If you skip these, you could miss the next big winner.

- Capitalize on the surge in artificial intelligence by targeting companies at the forefront with these 24 AI penny stocks.

- Start building a portfolio of bargain opportunities through undervalued stocks using these 893 undervalued stocks based on cash flows.

- Lock in reliable income and aim to outperform low-yield savings by browsing these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.