Please use a PC Browser to access Register-Tadawul

DoorDash (DASH) Turns Profit With Q2 Sales Reaching US$3,284 Million

DoorDash DASH | 226.91 | -0.25% |

DoorDash (DASH) saw its share price surge by 41% over the last quarter, significantly outperforming the broader market, which remained flat over the same period. The company's impressive Q2 earnings, showcasing a shift from a net loss to a net income of $285 million, likely played a major role in boosting investor confidence. Additionally, innovations such as the launch of a drone delivery service and AI-powered ad tools may have reinforced positive sentiment. Despite being dropped from several Russell indices, these strategic advancements positioned DoorDash favorably amid broader market apprehensions around tariffs and economic health.

DoorDash's recent initiatives, highlighted in the introduction, are likely to impact its long-term growth narrative, emphasizing the strategic acquisitions of Deliveroo and SevenRooms. These moves aim to enhance its international presence and expand restaurant services, with potential upside in revenues and profit margins. Over the last three years, DoorDash has achieved a total shareholder return of 231.34%, reflecting a very large increase, which provides context to its current market positioning despite the broader industry's fluctuations. In comparison, the company outperformed both the US hospitality industry and broader market over the past year, showcasing its robust market performance.

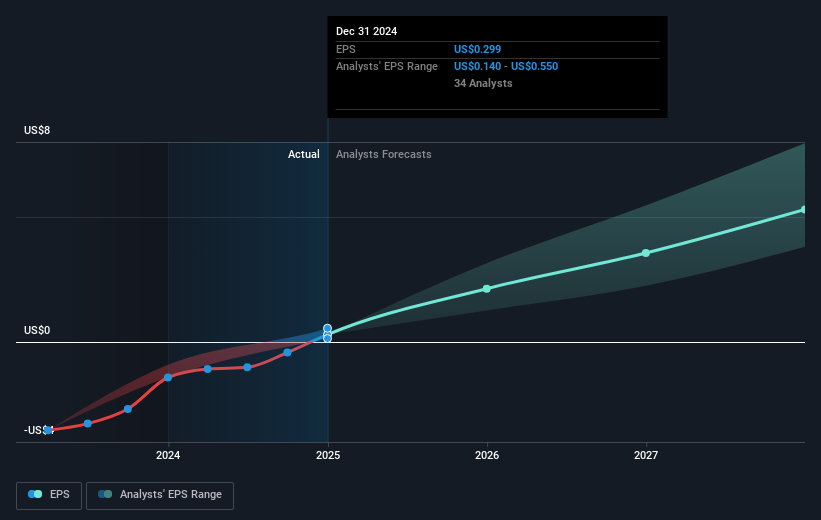

The developments in drone delivery and AI-powered ad tools may further optimize operational efficiency and consumer engagement, feeding into revenue and earnings growth. However, the current share price of US$258.08 is marginally above the consensus analyst price target of US$244.5, suggesting that, despite recent gains, some market participants may consider DoorDash slightly overvalued in the context of anticipated earnings improvements and existing assessments. The transformative news and financial forecasts suggest potential for continued revenue and earnings evolution, aligning with the company's trajectory towards sustained value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.