Dorian LPG Ltd. (NYSE:LPG) Stock Goes Ex-Dividend In Just Three Days

Dorian LPG Ltd. LPG | 0.00 |

It looks like Dorian LPG Ltd. (NYSE:LPG) is about to go ex-dividend in the next 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, DorianG investors that purchase the stock on or after the 7th of May will not receive the dividend, which will be paid on the 30th of May.

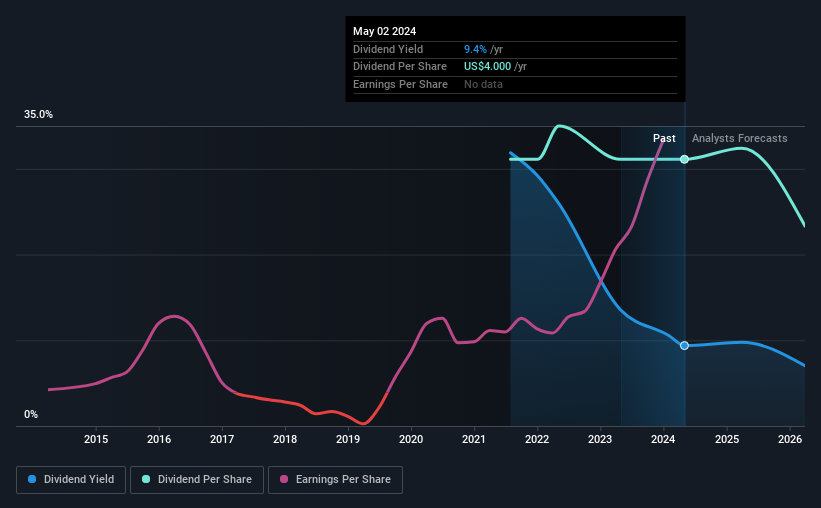

The company's next dividend payment will be US$1.00 per share, and in the last 12 months, the company paid a total of US$4.00 per share. Calculating the last year's worth of payments shows that DorianG has a trailing yield of 9.4% on the current share price of US$42.64. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for DorianG

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. DorianG is paying out an acceptable 53% of its profit, a common payout level among most companies. A useful secondary check can be to evaluate whether DorianG generated enough free cash flow to afford its dividend. Dividends consumed 61% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's positive to see that DorianG's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see DorianG's earnings have been skyrocketing, up 49% per annum for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. DorianG's dividend payments are broadly unchanged compared to where they were three years ago.

To Sum It Up

Is DorianG worth buying for its dividend? It's good to see earnings are growing, since all of the best dividend stocks grow their earnings meaningfully over the long run. However, we'd also note that DorianG is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. Overall, it's hard to get excited about DorianG from a dividend perspective.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. We've identified 3 warning signs with DorianG (at least 1 which is significant), and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 02/12 13:26

Texas Capital Bancshares Board Authorizes New Share Repurchase Program Up To $200M

Benzinga News 02/12 13:36Michael and Susan Dell pledge $6.25 billion for investment accounts for US children

Reuters 02/12 13:50UPDATE 3-US investor Saba Capital blocks merger of Baillie Gifford-managed trusts in London

Reuters 02/12 07:39Amplitude to Present at UBS Technology & AI Conference

Reuters 02/12 14:00From $10,000 to $42 Million: Rejecting Complex Indicators, Short-Term Trading Legend Dan Zanger Creates Miracles With "Chart Patterns"!

Sahm Platform 02/12 15:03Day's Trending USA Stocks | Capricor Therapeutics, Inc.: Overnight gain 371.1%, Breakthrough in Duchenne muscular dystrophy trial boosts investor confidence, driving stock surge.

Sahm Platform 03/12 22:25Day's Trending USA Stocks | CAPR: Overnight gain 371.1%, Breakthrough in Duchenne muscular dystrophy trial boosts investor confidence, driving stock surge.

Sahm Platform Today 02:48