Please use a PC Browser to access Register-Tadawul

Dorman Products (DORM): Assessing Valuation as Earnings Surprises Drive Renewed Investor Interest

Dorman Products, Inc. DORM | 126.59 | -1.04% |

Most Popular Narrative: 1.7% Undervalued

The prevailing narrative pegs Dorman Products as modestly undervalued, with its perceived fair value just above the current market price. Analysts believe near-term catalysts and longer-term tailwinds still support further upside for patient investors.

"The increasing average age of vehicles in North America (now 12.8 years) is supporting sustained, recurring demand for replacement parts. This is fueling year-over-year volume growth, especially in the light-duty business segment, driving top-line revenue and providing long-term visibility into the company's future revenue streams."

Want to know why analysts are this bullish? The narrative is built on surprising growth in earnings and a valuation multiple not usually seen in this industry. Unlock the full story and see which forecasts, margin trends, and future profit expectations are fueling Dorman Products' nearly justified price target. Curious about the numbers pushing this automotive supplier into the spotlight? Dive in to uncover what just might be the secret to its fair value status.

Result: Fair Value of $164.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff uncertainty and the accelerating shift to electric vehicles could still disrupt Dorman’s current growth momentum and outlook.

Find out about the key risks to this Dorman Products narrative.Another View: Is the Market Overlooking Costs?

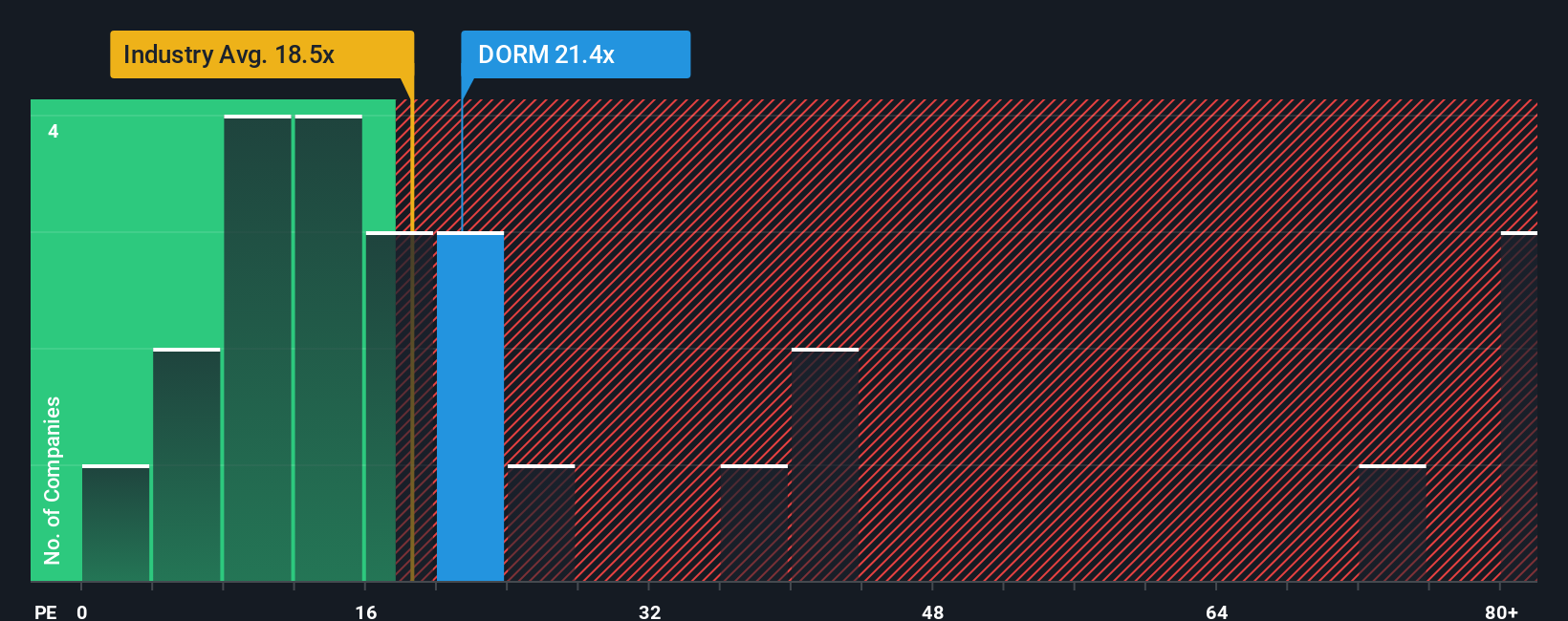

While the analyst consensus suggests Dorman Products is near fair value, a quick look using a typical price-to-earnings approach raises doubts. This method points to the shares being on the expensive side compared to others in the industry. This could indicate that growth expectations are a bit too optimistic.

Build Your Own Dorman Products Narrative

If you see things differently, or want to dig into the numbers yourself, you can easily craft your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dorman Products.

Looking for more investment ideas?

There’s a world of smart opportunities waiting if you know where to look. Don’t let an overlooked winner slip by. Put your strategy into action using these powerful tools below.

- Spot tomorrow’s potential leaders early and tap into penny stocks with strong financials by using penny stocks with strong financials.

- Capitalize on the wave transforming healthcare by finding breakthroughs among healthcare AI stocks through healthcare AI stocks.

- Uncover hidden gems trading below their real value with a closer look at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.