Please use a PC Browser to access Register-Tadawul

DoubleVerify (DV): Assessing Valuation After Analyst Downgrades and Revised Growth Outlook

DoubleVerify Holdings, Inc. DV | 10.94 | -0.36% |

Following a wave of analyst updates, DoubleVerify Holdings (NYSE:DV) is on investors’ radar this week. Several major brokerage firms have cited the company’s continued investment in growth initiatives, as well as challenges in the current digital advertising landscape.

Even as DoubleVerify expands its brand suitability tech across new social platforms, its share price has struggled to maintain momentum. The stock is down more than 38% year-to-date with a 1-year total shareholder return of -29%. The tough digital advertising environment and recent analyst downgrades have weighed on investor sentiment despite steady revenue growth, leaving some wondering if today’s prices reflect temporary headwinds or deeper concerns.

If volatility in the digital ad space has you looking for your next opportunity, this could be a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst price targets and ongoing investment in innovative tech, the question facing investors now is whether DoubleVerify is undervalued, or if the market is already pricing in future growth.

Most Popular Narrative: 38.5% Undervalued

With DoubleVerify’s fair value assessment coming in significantly above the latest closing price, there is a clear divergence between narrative expectations and the current market view. The stage is now set for a closer look at what is fueling this bullish stance.

The rapid expansion and adoption of DoubleVerify's solutions in emerging digital ad formats, particularly in Connected TV (CTV), social media, and retail media, are fueling sustained double-digit revenue growth, with CTV measurement impressions up 45% year-over-year and product innovation pipelines (such as new CTV and Meta solutions) expected to unlock further revenue streams in 2026 and beyond.

Want to know which projections are powering this lofty valuation? The narrative banks on aggressive future revenue streams, game-changing profit expansion, and evolving digital ad dominance. The exact numbers might surprise you. Get the full story to find out exactly what is driving this high-conviction price target.

Result: Fair Value of $19.39 (UNDERVALUED)

However, shifts in privacy regulations or tightening controls from major platforms could limit DoubleVerify's data access and put its future growth assumptions at risk.

Another View: The Multiples Perspective

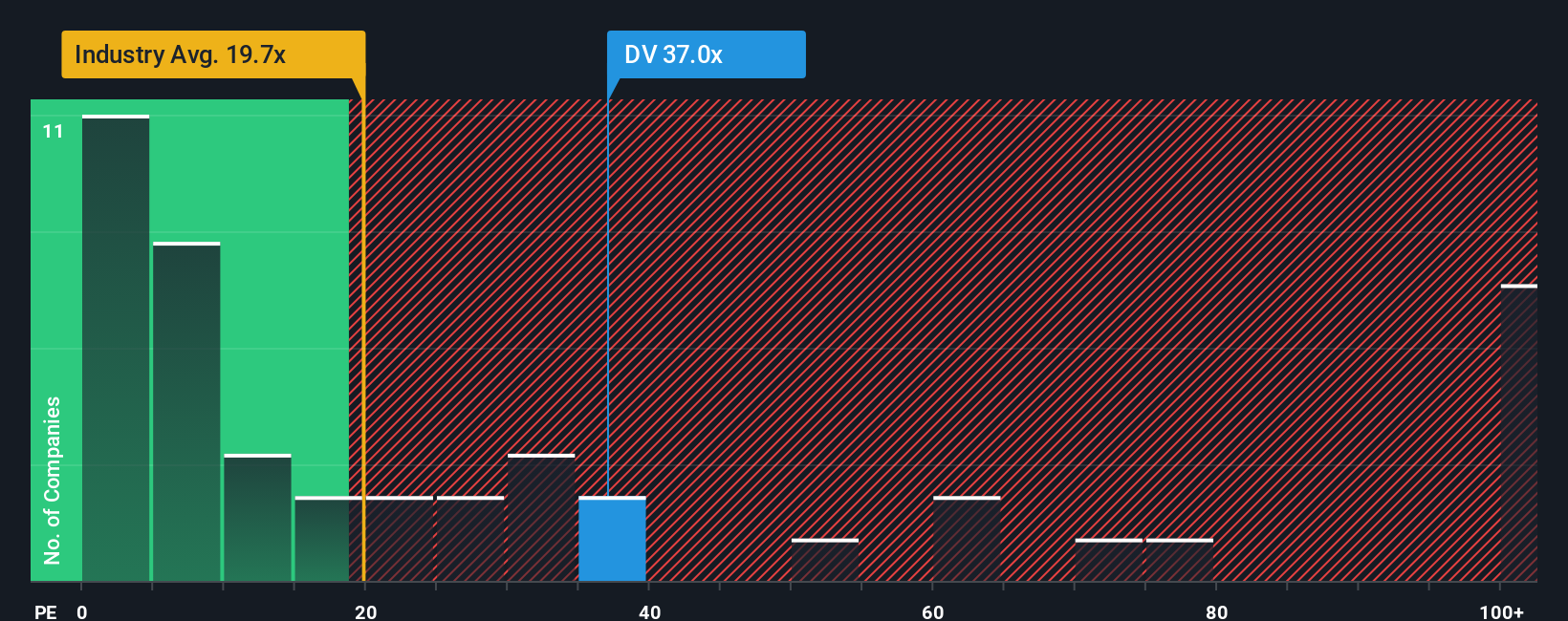

Looking at DoubleVerify through the lens of its price-to-earnings ratio reveals a very different story. Shares are currently trading at 37 times earnings, significantly higher than the industry average of 19.9 times and above a fair ratio of 23.3 times. This premium signals the market is still expecting a lot, which adds valuation risk if growth does not accelerate even further. Does this gap mean investors are ignoring potential downside, or is the optimism justified?

Build Your Own DoubleVerify Holdings Narrative

If you want to dive into the fundamentals yourself or challenge the popular story, you can put together your own take in just minutes with Do it your way.

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to spot tomorrow’s winners before they break out? Broaden your watchlist right now with these powerful tools before your next opportunity slips by.

- Supercharge your search for high-yield potential by scanning these 17 dividend stocks with yields > 3% that consistently deliver attractive income streams above market averages.

- Zero in on innovation by targeting these 27 AI penny stocks at the heart of artificial intelligence transformations and next-wave digital disruption.

- Capitalize on breakthroughs in computing by evaluating these 27 quantum computing stocks pioneering advances that could redefine industries and shape the tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.