Please use a PC Browser to access Register-Tadawul

Dow (DOW): Evaluating Valuation as New Innovation Boosts Sustainable Materials Strategy

Dow Chemical Company DOW | 23.63 | -1.42% |

If you’re wondering what to do with Dow (DOW) after the recent headlines, you’re not alone. The company has stepped up with the launch of a next-generation silicone gel for high-performance power electronics, strengthening its offerings for electric vehicles and renewable energy systems. At the same time, Dow’s breakthrough partnership with Gruppo Fiori gives it a new way to recycle polyurethane waste from end-of-life vehicles, tackling both sustainability and regulatory pressures. These moves are clear signals that Dow is making significant investments in markets positioned for long-term change.

Despite this spotlight on innovation, Dow’s stock price story over the past year has been less upbeat. Shares have tumbled close to 46% over the past twelve months, and momentum remains negative in both the past month and the past three years, even as the company’s latest efforts are viewed positively by investors focused on growth themes. Still, the buzz around electric vehicles and sustainability regulations has created a new narrative. Dow now appears more willing to reinvent itself and pursue higher-value, future-oriented markets.

With shares under heavy pressure even as Dow increases its focus on innovation, the question remains whether the market is overlooking a potential turnaround or anticipating continued challenges ahead.

Most Popular Narrative: 12.6% Undervalued

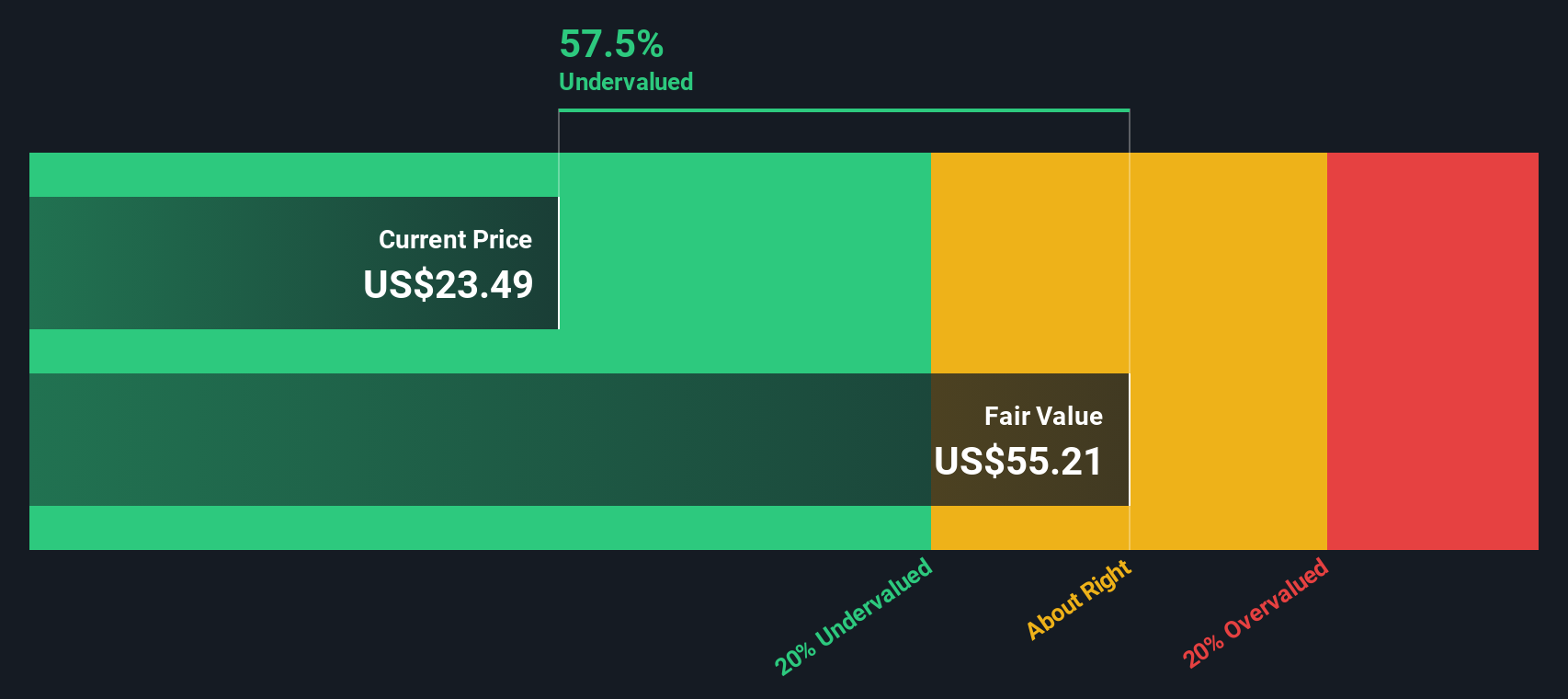

According to the most widely followed narrative, the market is pricing Dow shares at a double-digit discount to what analysts see as fair value. This suggests investors may be underestimating the company’s recovery potential.

Adjusted capital spending and asset optimization strategies aim to enhance cash flow, improve margins, and focus on high-margin operations. Strategic divestitures and cost reductions enhance financial flexibility and improve earnings amidst macroeconomic challenges. Litigation proceeds provide additional support.

Want to unlock the real story behind Dow’s value gap? The secret is an aggressive overhaul of spending, a push for fatter margins, and big expectations for bottom-line turnaround. Curious how much future earnings power this playbook could unlock? The numbers behind this call might surprise you.

Result: Fair Value of $28.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently weak demand and the possibility of a dividend cut could quickly shake confidence in Dow’s turnaround story.

Find out about the key risks to this Dow narrative.Another View: Discounted Cash Flow

Looking through a different lens, the SWS DCF model also sees Dow as undervalued. It arrives at this by estimating the present value of all future cash flows. Can two very different methods agree for the same reasons, or could something be missing in the details?

Build Your Own Dow Narrative

If you have a different perspective or want a hands-on look at the data, it’s easy to craft your own Dow story in just a few minutes. Do it your way.

A great starting point for your Dow research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Broaden your investing horizons and catch the next wave of market winners with a few smart, targeted searches:

- Uncover hidden value by targeting companies with strong fundamentals in overlooked corners of the market using our undervalued stocks based on cash flows.

- Spot the next big leap in healthcare by focusing on stocks driving breakthrough advances with our healthcare AI stocks.

- Stay ahead of tomorrow’s technology curve by tapping into businesses chasing the future of quantum computing through our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.