Please use a PC Browser to access Register-Tadawul

Doximity (DOCS): Assessing Valuation as Options Activity and Analyst Upgrades Spark Fresh Interest

Doximity, Inc. DOCS | 43.85 | -0.63% |

Doximity (DOCS) is back in the spotlight after a surge in options market activity caught investors’ attention. The Nov. 21, 2025 $90 Put option has seen some of the highest implied volatility lately, signaling that traders are bracing for a sizable move. At the same time, analyst earnings estimates for Doximity have moved up in recent weeks, hinting at a shift in sentiment or speculation about the company’s upcoming results. The convergence of these factors is creating renewed buzz around what comes next for this telehealth leader.

All this excitement arrives as Doximity’s share price has shown real momentum over the past year, fueled by confidence in its digital platform for healthcare professionals and adoption by major clients. The stock has gained 73% in the past year and nearly 22% in the past three months. This suggests investors are steadily warming to its growth story. Even so, the increased options activity suggests traders see the potential for volatility ahead, whether positive or negative, as Doximity approaches its next catalysts.

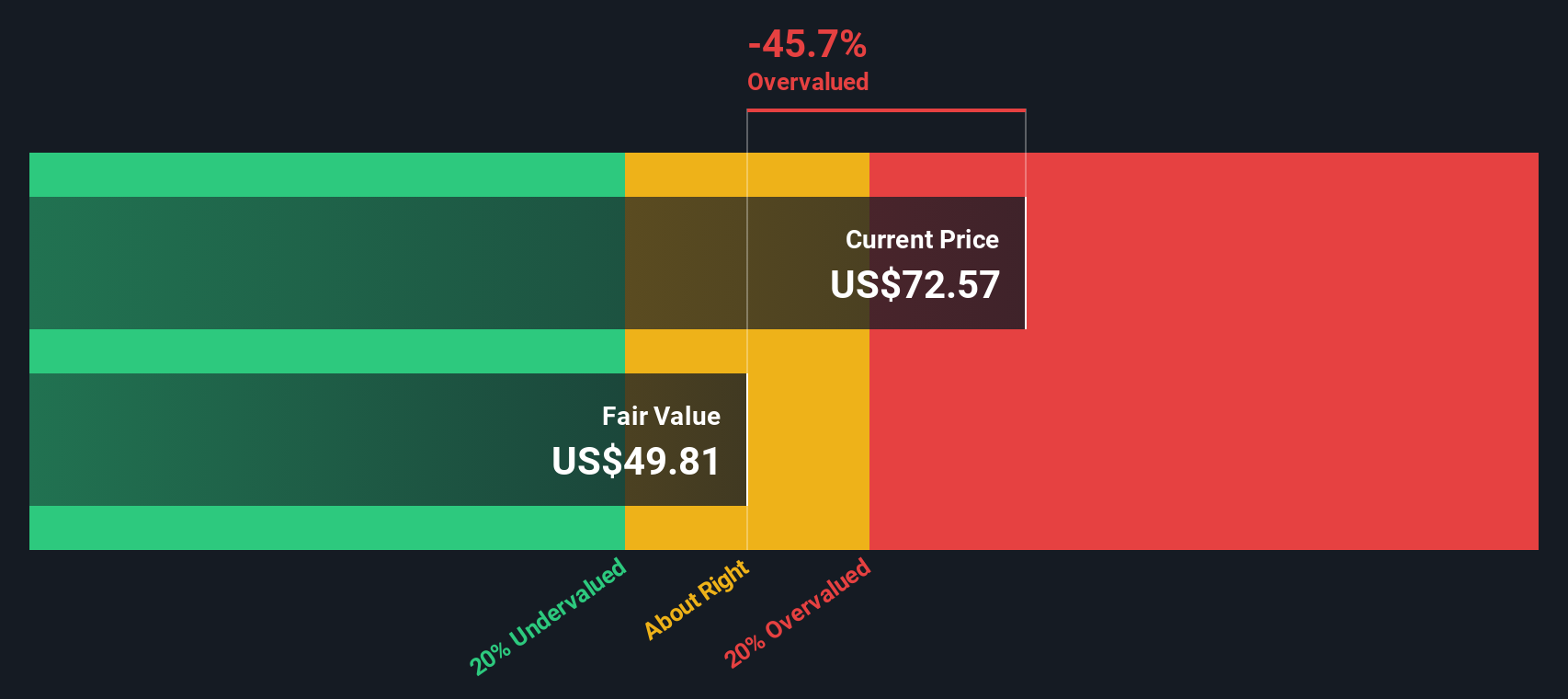

With fresh optimism around earnings and options traders bracing for movement, investors may be considering whether Doximity appears compelling at these levels or if the market has already priced in future growth.

Most Popular Narrative: 8% Overvalued

According to the most widely followed narrative, Doximity is considered moderately overvalued at current prices, based on consensus analyst projections of future growth, margins, and risk.

"Analysts are assuming Doximity's revenue will grow by 11.0% annually over the next 3 years. Analysts assume that profit margins will shrink from 39.9% today to 34.8% in 3 years time."

Curious what drives such a lofty valuation for Doximity? The formula behind this price target relies on a powerful mix of future growth and profit assumptions, along with one remarkably high future earnings multiple. Only by digging into these quantitative expectations will you uncover why sentiment is so bullish right now. Ready to see what is fueling the narrative?

Result: Fair Value of $68.67 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued reliance on pharma marketing revenue and policy uncertainty could quickly challenge the current optimism and spark a change in Doximity's growth outlook.

Find out about the key risks to this Doximity narrative.Another View: SWS DCF Model Raises Overvaluation Questions

Taking a fresh perspective, our DCF model also suggests Doximity's share price is higher than its calculated intrinsic value. This result casts further doubt on whether growth optimism alone justifies today's valuation. Could expectations be too high for the near term?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Doximity Narrative

If you think there is more to this story or have your own insights to explore, it only takes a few minutes to dive into the numbers and build a personal valuation perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Doximity.

Looking for More Investment Ideas?

Don’t let a single stock limit your upside. The smartest investors always look beyond the obvious for tomorrow’s biggest winners. Take charge and hunt for fresh opportunities others might miss with your next investment move.

- Unearth stocks positioned for strong rebounds by scanning for hidden value through undervalued stocks based on cash flows.

- Ride the AI wave and pinpoint breakout trends before they go mainstream with the help of AI penny stocks.

- Tap into future tech breakthroughs by searching for companies pioneering quantum innovation with quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.