Please use a PC Browser to access Register-Tadawul

DTE Energy: Assessing Valuation Following Major Clean Energy Push and $600 Million Debt Raise

DTE Energy Company DTE | 134.82 134.82 | -0.97% 0.00% Pre |

If you have been eyeing DTE Energy (DTE) lately, the past week just handed you some news worth a closer look. On September 17, DTE Energy completed a $600 million debt sale with the explicit goal of fueling its ambitious clean energy and battery storage projects. This move, combined with accelerating investments in renewables, signals that management is leaning hard into long-term growth themes rather than simply treading water with incremental changes.

It is not surprising, then, that DTE shares have attracted more attention. The stock has climbed 14% over the past year and shows a 5% gain for the past 3 months, even after a minor pullback in the last month. While the company’s annual revenue and net income are growing at sturdy clips, the bigger story is the shift toward renewables, which continues to reshape how investors think about both risk and future returns for utilities like DTE Energy.

So, after this year’s steady gains and the fresh influx of capital, is DTE Energy now undervalued, or are markets fully pricing in the company’s next wave of growth?

Most Popular Narrative: 5.3% Undervalued

According to the most widely followed narrative, DTE Energy is currently viewed as modestly undervalued relative to its estimated fair value. The consensus leans on the belief that strong demand factors and major grid investments will support an upward earnings trajectory, justifying a higher price than the current market level.

“A major upcoming catalyst for DTE is the rapid expansion in electricity demand being driven by hyperscale data centers, with 3 gigawatts of advanced negotiations and an additional 4 gigawatts in the pipeline. These loads, operating at nearly 90% capacity factors, will materially increase revenues and provide significant headroom for rate growth while improving overall system load factor and grid utilization.”

Curious what’s powering this outlook? The secret sauce lies in bold revenue and earnings targets, plus profit margins that step up each year. The most popular narrative uses numbers—locked in for the years ahead—that are anything but random. Eager to discover the real assumptions behind this valuation? Dive deeper for the underlying projections driving DTE Energy’s fair value.

Result: Fair Value of $145.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising project costs or regulatory setbacks could undermine DTE's growth thesis and challenge the optimistic earnings and valuation outlook.

Find out about the key risks to this DTE Energy narrative.Another View: A Different Lens on Value

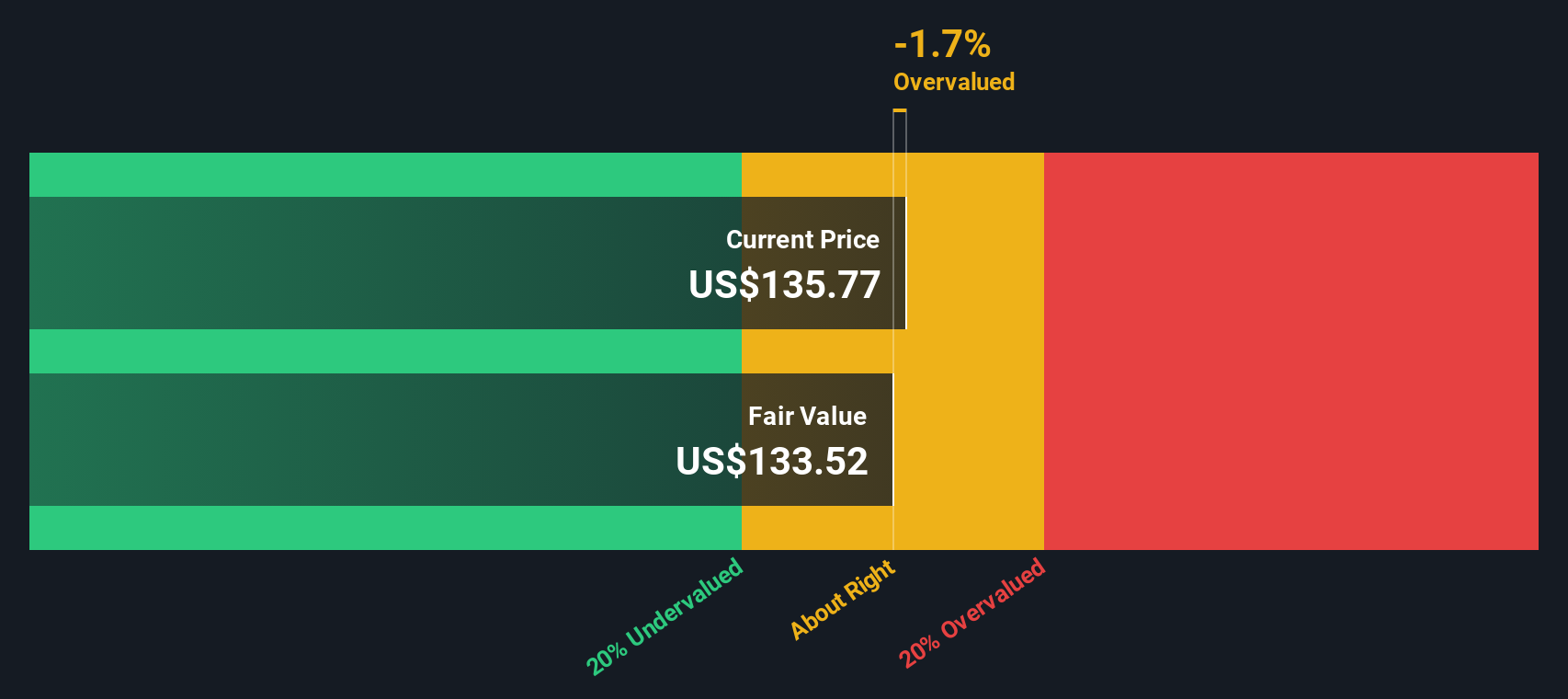

Looking through the lens of our DCF model, the result is less optimistic. This approach suggests DTE Energy is actually trading above its calculated fair value right now. Could this challenge the bullish narrative?

Build Your Own DTE Energy Narrative

If you’re not convinced by the numbers above or prefer drawing your own conclusions, it takes just a few minutes to put together your version of the story: Do it your way.

A great starting point for your DTE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities do not wait around. Give your portfolio an edge by checking out handpicked stock ideas that align with your specific goals and interests. Here are a few standout pathways you will not want to miss:

- Uncover hidden value by spotting undervalued stocks based on cash flows likely flying under most investors' radar, but showing strong potential based on cash flow fundamentals.

- Capitalize on the future of technology when you browse AI penny stocks. These innovators are shaping the next era through artificial intelligence breakthroughs.

- Strengthen your income stream by reviewing dividend stocks with yields > 3% that offer reliable yields greater than 3%, bringing balance to your growth strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.