Please use a PC Browser to access Register-Tadawul

Duolingo (DUOL) Reports Q2 2025 Earnings With Sales Rising To US$252 Million

Duolingo, Inc. DUOL | 112.94 | +1.65% |

Duolingo (DUOL) recently announced significant earnings results for Q2 2025, with sales increasing to USD 252 million from USD 178 million and net income growing to USD 45 million from USD 24 million year-over-year. Despite these impressive financial figures, the company saw its share price decline by 9% over the last month. While Duolingo's performance demonstrated operational efficiency and market demand strength, broader market trends featured mixed stock performances and investor attention focusing on Nvidia's earnings, which may have added weight to overall market movements, affecting investor sentiment and, consequently, Duolingo's share performance.

The recent earnings report from Duolingo showcasing increased sales and net income provided a strong operational update, yet the share price declined by 9% over the past month. This disconnect between performance and market sentiment could reflect broader market dynamics, including investors' focus on Nvidia, impacting tech stocks like Duolingo. Evaluating this against the company's efforts toward international expansion and new monetization strategies reveals potential resilience in revenue and earnings expectations, despite short-term market movements.

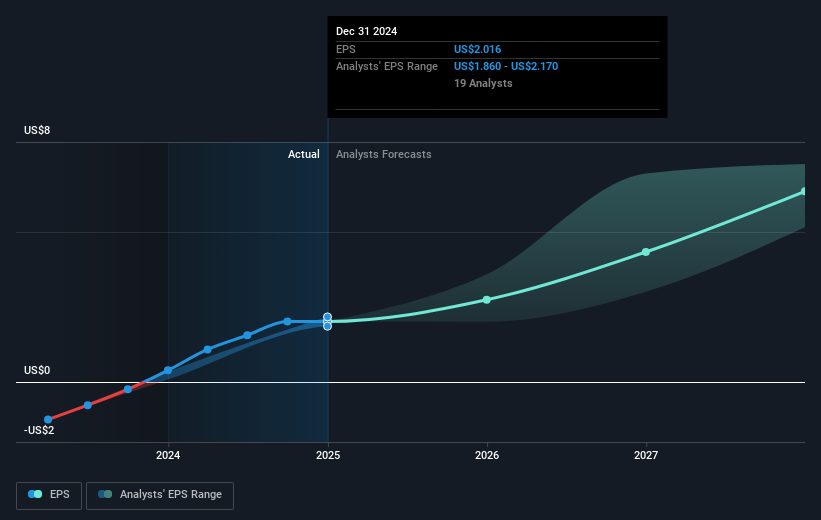

Over a longer three-year period, Duolingo's total returns have been substantial with a noteworthy rise of 258.35%. When compared to the US Consumer Services industry, which returned 19.4% over the last year, Duolingo has outperformed considerably, indicating strong growth momentum relative to its peers. This long-term performance provides context to recent price shifts, where the current share price of US$331.87 sits below the consensus analyst price target of US$489.76, suggesting room for future price appreciation if analysts' forecasts about growth materialize.

Incorporating the latest revenue and earnings forecasts into Duolingo's trajectory indicates continued optimism for expansion, particularly in emerging markets and new educational categories. However, challenges such as slowing growth in core markets and potential regulatory constraints abroad remain pivotal points to monitor. The ongoing disparity between current market valuations and prospective price targets highlights investor caution, inviting analysis on whether future earnings growth justifies such optimism among analysts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.