Please use a PC Browser to access Register-Tadawul

Duolingo (NasdaqGS:DUOL) Sees 13% Price Increase In One Week

Duolingo, Inc. DUOL | 196.28 | -2.33% |

Duolingo (NasdaqGS:DUOL) experienced a 13% increase in its share price over the past week, aligning with the broader market's positive trend of a 2.3% rise. This movement may be reflective of broader market optimism bolstered by recent earnings reports from major companies, which lifted the S&P 500 and tech-heavy Nasdaq Composite. Duolingo's price shift coincides with a rally in technology stocks, particularly chipmakers, suggesting that investor confidence in the tech sector and favorable market trends have contributed to this gain. This alignment with market trends rather than specific company events emphasizes the influence of sector dynamics on Duolingo’s performance.

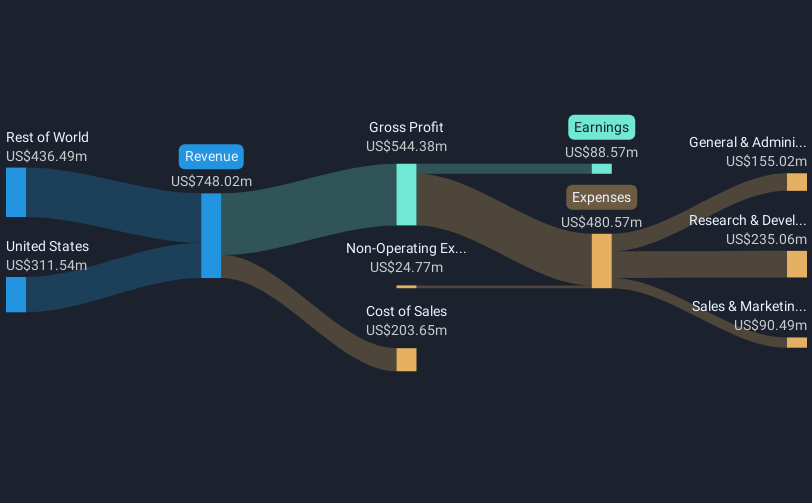

The recent 13% rise in Duolingo’s share price aligns well with sector-wide optimism, influencing its projected revenue growth of 23.2% per year. This suggests that investor sentiment in the tech sector, particularly a focus on AI and content expansion, could bolster Duolingo’s user engagement and monetization potential. Despite short-term margin pressures from AI-related costs, such news might lend confidence to forecasts of Duolingo's annual earnings growth at 37.2%, potentially underpinning its long-term revenue and profitability goals.

Over a longer three-year period, Duolingo delivered a total return of 320.65%, a very large increase which far surpasses the US market's return of 5.9% and the US Consumer Services industry's 10% over the past year. Although Duolingo's shares currently trade at a considerable discount to the analyst consensus price target of US$380.43, which is 11.6% higher than the present US$336.34, this ongoing momentum and industry outperformance offer a context where AI expansion could further cement its market position.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.