Please use a PC Browser to access Register-Tadawul

Dynatrace Stock: A Deep Dive Into Analyst Perspectives (9 Ratings)

Dynatrace Holdings DT | 36.18 | +7.33% |

In the preceding three months, 9 analysts have released ratings for Dynatrace (NYSE:DT), presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 4 | 3 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

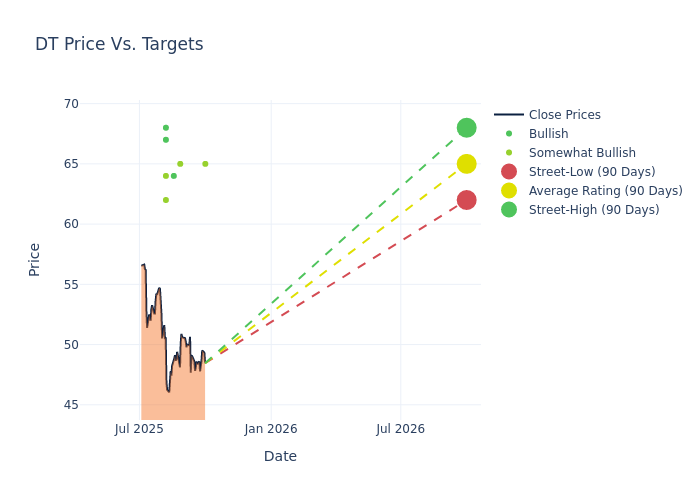

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $65.33, along with a high estimate of $68.00 and a low estimate of $62.00. This upward trend is evident, with the current average reflecting a 0.25% increase from the previous average price target of $65.17.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Dynatrace's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ryan Macwilliams | Wells Fargo | Announces | Overweight | $65.00 | - |

| Ittai Kidron | Oppenheimer | Announces | Outperform | $65.00 | - |

| Fatima Boolani | Citigroup | Lowers | Buy | $64.00 | $68.00 |

| Matthew Hedberg | RBC Capital | Raises | Outperform | $64.00 | $60.00 |

| Howard Ma | Guggenheim | Raises | Buy | $68.00 | $66.00 |

| Keith Bachman | BMO Capital | Lowers | Outperform | $62.00 | $63.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $67.00 | $67.00 |

| Blair Abernethy | Rosenblatt | Maintains | Buy | $67.00 | $67.00 |

| Howard Ma | Guggenheim | Announces | Buy | $66.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Dynatrace. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Dynatrace compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Dynatrace's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Dynatrace's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Dynatrace analyst ratings.

Unveiling the Story Behind Dynatrace

Dynatrace is a software-as-a-service company that enables customers to monitor and analyze their information technology infrastructure, from servers to applications and Python scripts. Dynatrace's unified platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to optimize their business for service-level objectives and ensure uptime.

Dynatrace: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Dynatrace's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 19.57%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 10.05%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Dynatrace's ROE stands out, surpassing industry averages. With an impressive ROE of 1.8%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Dynatrace's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.17%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.03.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.