Please use a PC Browser to access Register-Tadawul

Dyne Therapeutics (DYN): Evaluating Valuation After a Year of Volatility and Unclear Catalysts

Dyne Therapeutics Inc DYN | 16.99 | +1.13% |

Dyne Therapeutics (DYN) has caught the eye of investors recently, as its stock price has bounced around with little obvious news to pin the moves on. For some, these unexplained shifts in the share price spark questions, and maybe even new debates, about the company’s prospects. When a biotech stock moves for no clear reason, it often signals changing expectations about the pipeline or hints at shifting market sentiment rather than reflecting any immediate breakthrough or setback.

Against that backdrop, Dyne Therapeutics has had an up-and-down year. After a bumpy start, the stock fell sharply from its highs, losing around 61% over the past year. It hasn’t exactly recovered since then. Momentum was positive in the last month but faded over the past quarter and year-to-date, with double-digit drops adding to long-term losses. Other than routine pipeline updates, there hasn’t been a defining event recently to anchor these price swings.

So after a year of volatility and little headline news, is Dyne Therapeutics a bargain in waiting, or are investors already pricing in all the growth and the risk that lies ahead?

Price-to-Book of 3.3x: Is it justified?

Based on the price-to-book ratio, Dyne Therapeutics trades at 3.3 times its book value. This is notably higher than the US biotech industry average of 2.2x. This indicates the market is pricing in strong expectations for future growth or success in its pipeline.

The price-to-book ratio is a commonly used valuation measure in biotech, where near-term profits are often non-existent and tangible assets help anchor valuation. A higher price-to-book ratio suggests investors are paying a premium for Dyne’s assets due to anticipated breakthroughs or robust revenue growth in the future. Whether this is a fair bet depends on whether Dyne can meet its ambitious growth targets, especially given its recent track record of losses.

Despite being more expensive than its industry peers by this measure, Dyne's share price reflects hopes for significant revenue gains. Investors appear willing to pay a premium, but only time will tell if those expectations are rewarded.

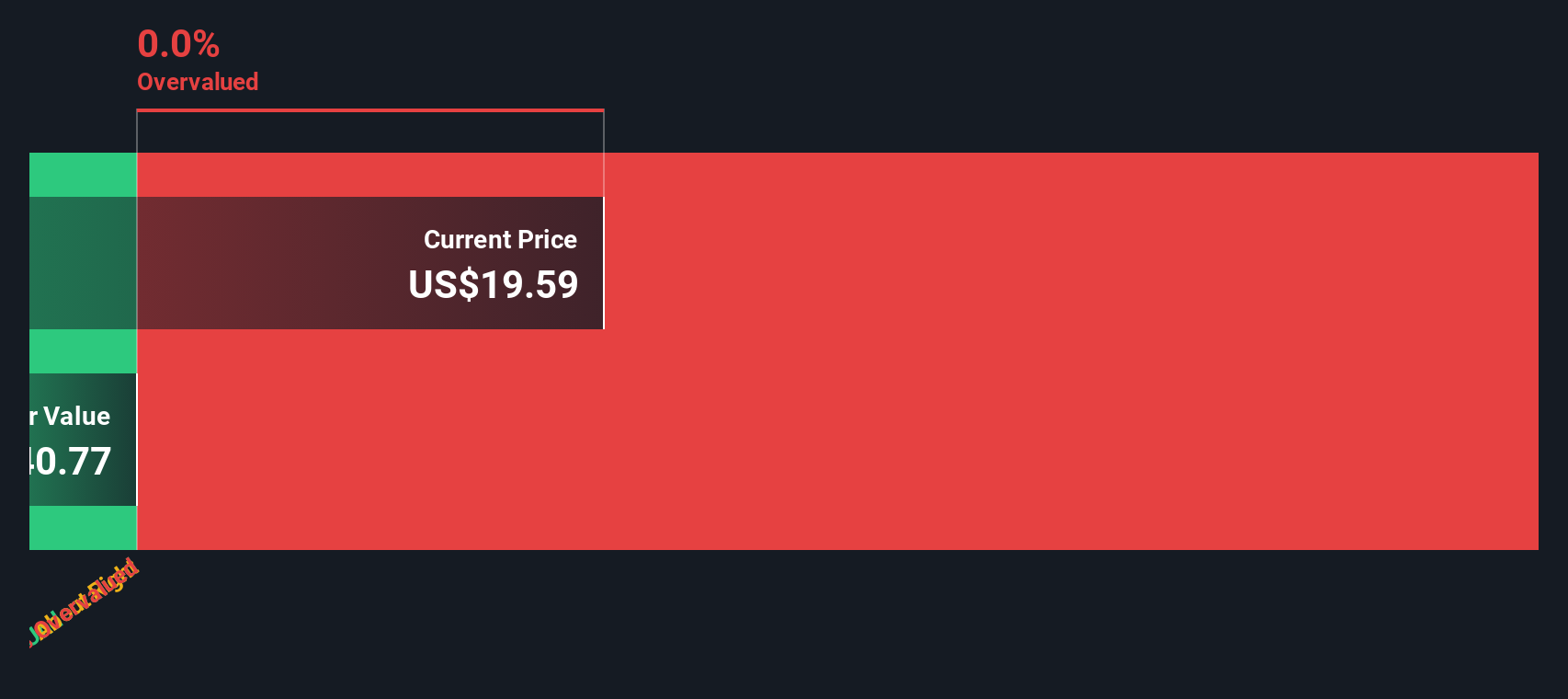

Result: Fair Value of $13.15 (OVERVALUED)

See our latest analysis for Dyne Therapeutics.However, sustained losses or failure to achieve anticipated revenue growth could quickly challenge the current optimism surrounding Dyne Therapeutics' valuation.

Find out about the key risks to this Dyne Therapeutics narrative.Another View: Challenging the Current Price

A look using our DCF model reaches a similar conclusion. This suggests the current share price may be running ahead of Dyne’s financial reality. If both methods point the same way, is the market too eager or simply right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dyne Therapeutics Narrative

If you see things differently or would rather dig into the numbers yourself, you can quickly craft your own view in just a few minutes. Do it your way

A great starting point for your Dyne Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your portfolio to just one opportunity. Shape your financial future with smart strategies by exploring these standout themes and set yourself up for more wins:

- Spot high-yield returns and secure steady income from companies offering dividend stocks with yields > 3%. These companies continue to reward their shareholders.

- Catch the wave of cutting-edge health innovation by seeking out healthcare AI stocks companies driving advancements in patient care and medical technology.

- Capitalize on overlooked gems by searching for undervalued stocks based on cash flows. These options reveal stocks flying under the radar with unrealized potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.