Please use a PC Browser to access Register-Tadawul

Earnings Beat And Solana Tokenization Push Could Be A Game Changer For WisdomTree (WT)

WisdomTree Investments Inc WT | 16.38 | -0.79% |

- WisdomTree, Inc. recently reported past fourth-quarter and full-year 2025 results, highlighting revenue of US$147.43 million for the quarter and US$493.75 million for the year, alongside higher net income and earnings per share than the prior year, and also declared a US$0.03 quarterly cash dividend payable on February 25, 2026.

- In parallel, WisdomTree expanded its tokenized funds to the Solana blockchain through its WisdomTree Connect and WisdomTree Prime platforms, underscoring the firm’s push into regulated digital assets across money market, equity, fixed income, alternatives, and asset allocation products.

- We’ll now examine how WisdomTree’s earnings growth and Solana-based tokenized funds expansion may influence the company’s broader investment narrative.

Uncover the next big thing with 24 elite penny stocks that balance risk and reward.

What Is WisdomTree's Investment Narrative?

To own WisdomTree, you have to believe in its dual identity as an established asset manager and an early mover in regulated tokenized funds. The latest results, with higher revenue, net income and EPS than the prior year, reinforce an earnings-driven story at a time when the share price has already moved sharply over the past year. The continued US$0.03 dividend signals a consistent, if modest, capital return that likely does not change the near term thesis on its own. The more interesting development is the expansion of tokenized funds onto Solana, which strengthens WisdomTree’s multi chain push and could become a meaningful differentiator if tokenized products gain traction. At the same time, this increases execution and regulatory risk around digital assets, on top of existing concerns about valuation and debt coverage.

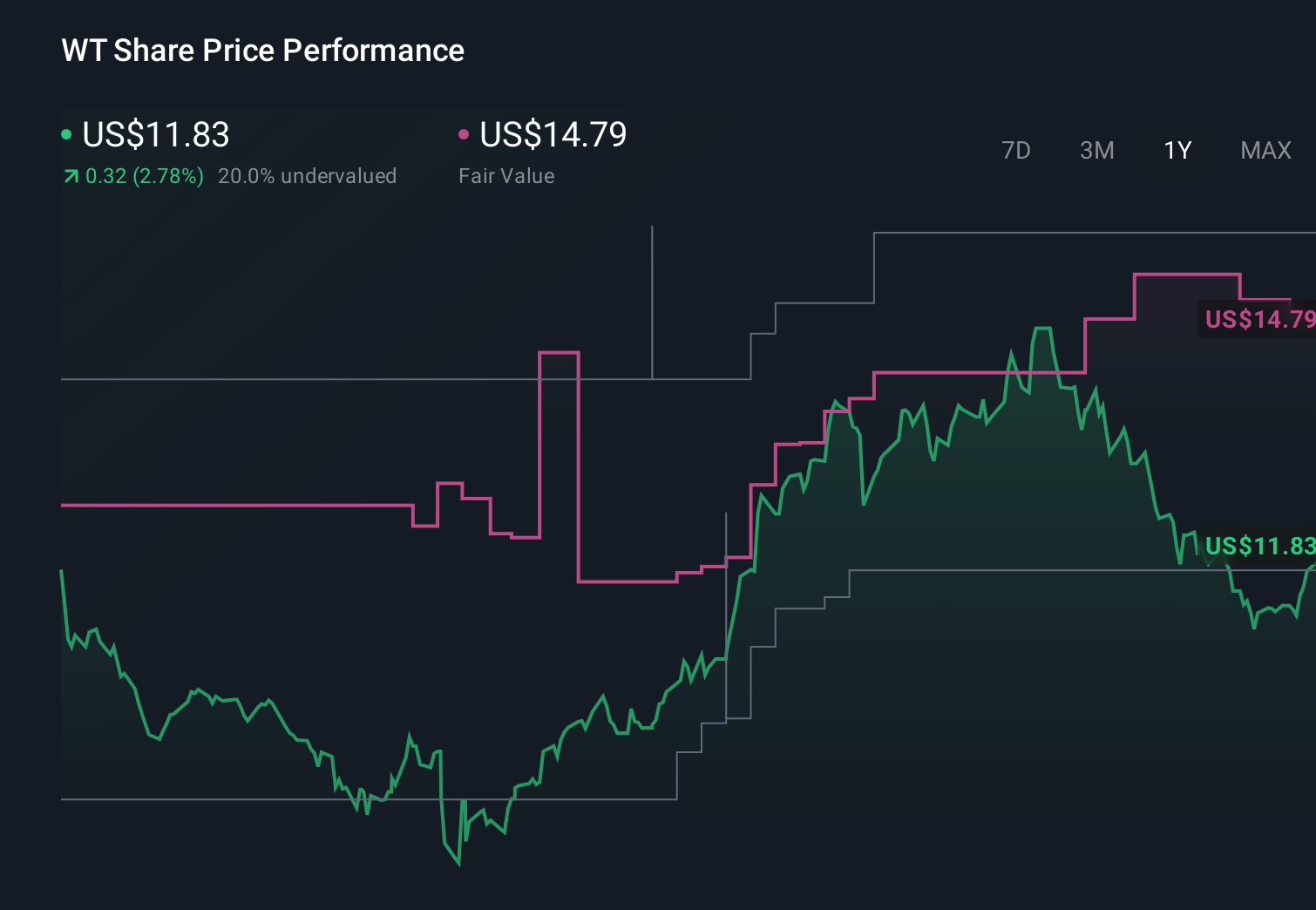

However, one key risk around debt coverage and business mix is easy to miss at first glance. WisdomTree's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth as much as $14.79!

Build Your Own WisdomTree Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've uncovered the 14 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.