Please use a PC Browser to access Register-Tadawul

Earnings Dip and Share Buyback Could Be a Game Changer for Domino's (DPZ)

Domino's Pizza, Inc. DPZ | 394.88 | +0.37% |

- Domino's Pizza reported second quarter results with revenue of US$1.15 billion and net income of US$131.09 million, while also completing a tranche of its share buyback program repurchasing 315,696 shares for US$149.97 million through June 15, 2025.

- Despite higher revenue, net income for the quarter declined year-over-year, highlighting shifting cost pressures even as the company continues to return capital to shareholders through buybacks.

- We'll examine how Domino's earnings growth alongside the recently completed share buyback tranche reshapes the company's investment narrative.

Domino's Pizza Investment Narrative Recap

To own shares in Domino’s Pizza, you typically need to believe that ongoing digital expansion and nationwide delivery partnerships will continue to drive order growth for the brand, despite slowdowns in the broader quick-service pizza market. The latest quarterly results, which showed higher revenue but declining net income, do not materially change the biggest short-term catalyst, adoption of delivery platforms, or the ongoing industry risk of flat category traffic and challenging comparisons as major new product launches cycle through.

The recently completed share buyback tranche, totalling US$149.97 million over the quarter, stands out as the most relevant company action in this news cycle. This capital return could help offset earnings volatility in periods where margin pressure persists, but is not likely to influence near-term growth catalysts tied to digital ordering or delivery partnerships.

However, investors should be aware that flat or negative pizza category traffic could continue to limit Domino's revenue growth if it persists...

Domino's Pizza's narrative projects $5.6 billion in revenue and $719.9 million in earnings by 2028. This requires 5.5% yearly revenue growth and a $122.8 million earnings increase from $597.1 million today.

Exploring Other Perspectives

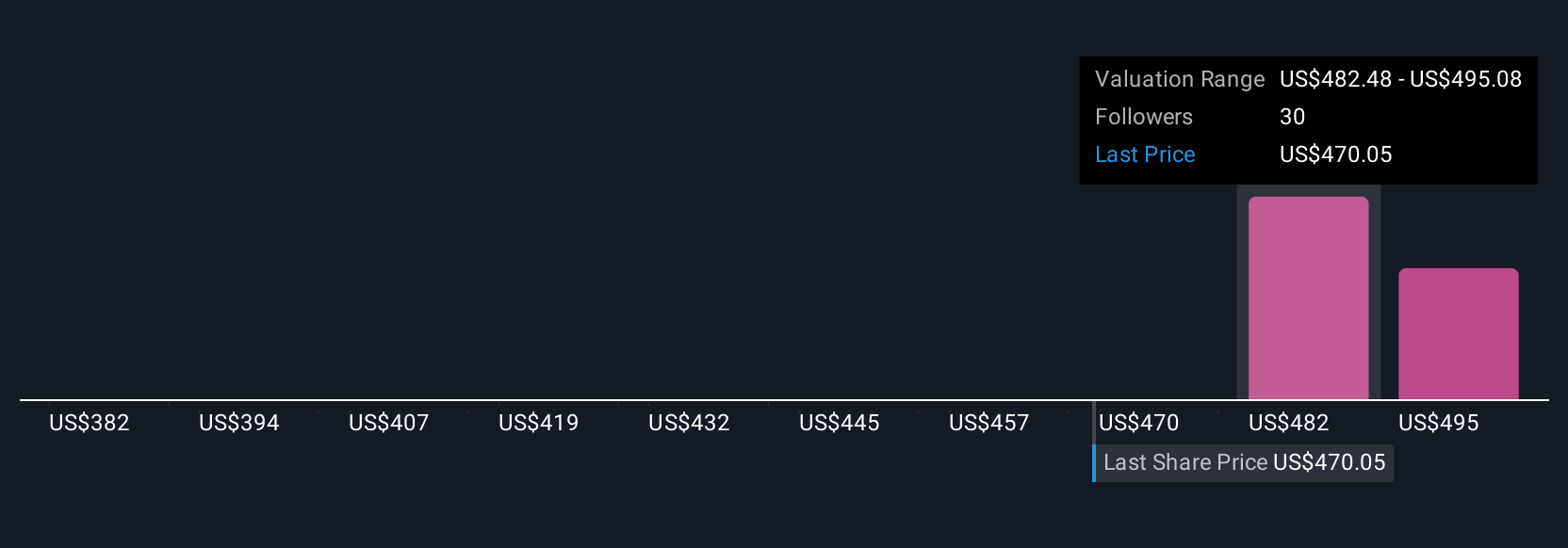

The Simply Wall St Community has published five independent fair value estimates for Domino's Pizza, ranging from US$381.69 to US$507.67 per share. Despite this spread, many contributors remain focused on the possibility that category traffic softness could limit revenue growth, raising important questions for the company's long-term potential.

Build Your Own Domino's Pizza Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Domino's Pizza research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Domino's Pizza's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.