Please use a PC Browser to access Register-Tadawul

Earnings Outlook For IDEXX Laboratories

IDEXX Laboratories, Inc. IDXX | 698.79 | -0.25% |

IDEXX Laboratories (NASDAQ:IDXX) will release its quarterly earnings report on Monday, 2025-08-04. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate IDEXX Laboratories to report an earnings per share (EPS) of $3.30.

The announcement from IDEXX Laboratories is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

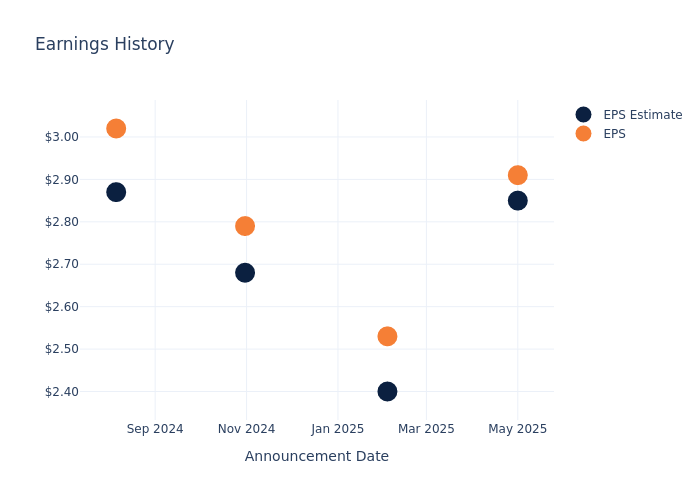

Past Earnings Performance

The company's EPS beat by $0.06 in the last quarter, leading to a 0.11% increase in the share price on the following day.

Here's a look at IDEXX Laboratories's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.85 | 2.40 | 2.68 | 2.87 |

| EPS Actual | 2.91 | 2.53 | 2.79 | 3.02 |

| Price Change % | 0.0% | -1.0% | 3.0% | -0.0% |

Stock Performance

Shares of IDEXX Laboratories were trading at $534.31 as of July 31. Over the last 52-week period, shares are up 17.0%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on IDEXX Laboratories

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on IDEXX Laboratories.

The consensus rating for IDEXX Laboratories is Outperform, based on 5 analyst ratings. With an average one-year price target of $557.6, there's a potential 4.36% upside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of ResMed, Becton Dickinson and GE HealthCare Techs, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for ResMed, with an average 1-year price target of $283.0, suggesting a potential 47.03% downside.

- Analysts currently favor an Outperform trajectory for Becton Dickinson, with an average 1-year price target of $207.33, suggesting a potential 61.2% downside.

- Analysts currently favor an Neutral trajectory for GE HealthCare Techs, with an average 1-year price target of $81.4, suggesting a potential 84.77% downside.

Analysis Summary for Peers

The peer analysis summary presents essential metrics for ResMed, Becton Dickinson and GE HealthCare Techs, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| IDEXX Laboratories | Outperform | 3.56% | $623.38M | 15.95% |

| ResMed | Outperform | 7.92% | $766.41M | 6.76% |

| Becton Dickinson | Outperform | 4.50% | $2.26B | 1.22% |

| GE HealthCare Techs | Neutral | 3.45% | $1.99B | 5.14% |

Key Takeaway:

IDEXX Laboratories ranks at the top for Revenue Growth and Gross Profit among its peers. It also leads in Return on Equity.

Discovering IDEXX Laboratories: A Closer Look

Idexx Laboratories primarily develops, manufactures, and distributes diagnostic products, equipment, and services for pets and livestock. Its key product lines include single-use canine and feline test kits that veterinarians can employ in the office, benchtop chemistry and hematology analyzers for test-panel analysis on-site, reference lab services, and tests to detect and manage disease in livestock. The firm also offers vet practice management software and consulting services to animal hospitals. Idexx gets close to 35% of its revenue from outside the United States.

IDEXX Laboratories's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: IDEXX Laboratories displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 3.56%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 24.31%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): IDEXX Laboratories's ROE stands out, surpassing industry averages. With an impressive ROE of 15.95%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): IDEXX Laboratories's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.46% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: IDEXX Laboratories's debt-to-equity ratio is below the industry average. With a ratio of 0.73, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for IDEXX Laboratories visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.