Please use a PC Browser to access Register-Tadawul

Earnings Tell The Story For IQVIA Holdings Inc. (NYSE:IQV) As Its Stock Soars 25%

IQVIA Holdings Inc IQV | 221.68 221.68 | -0.87% 0.00% Pre |

The IQVIA Holdings Inc. (NYSE:IQV) share price has done very well over the last month, posting an excellent gain of 25%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

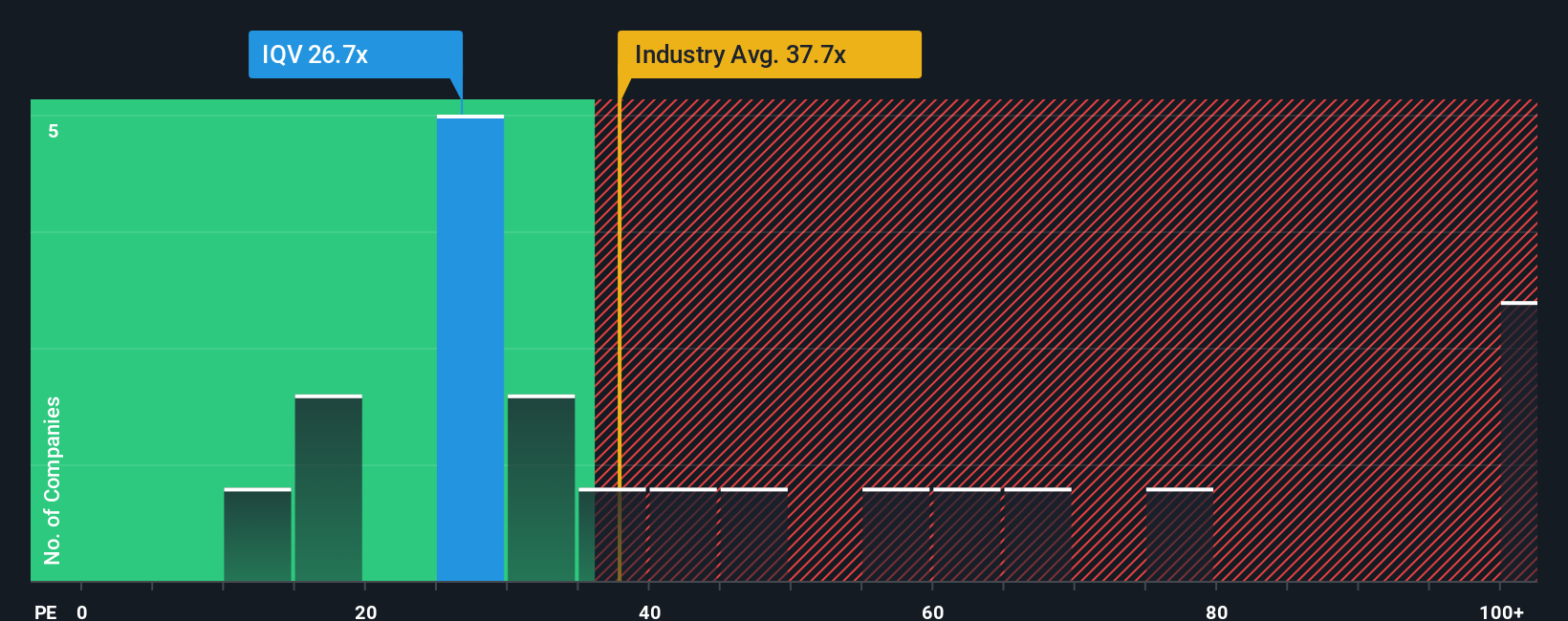

After such a large jump in price, IQVIA Holdings may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.7x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, IQVIA Holdings' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Is There Enough Growth For IQVIA Holdings?

There's an inherent assumption that a company should outperform the market for P/E ratios like IQVIA Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. Regardless, EPS has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 18% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that IQVIA Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The large bounce in IQVIA Holdings' shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that IQVIA Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.