Please use a PC Browser to access Register-Tadawul

Eaton’s Expanded Liquidity Signals Preparation For Near Term Growth Moves

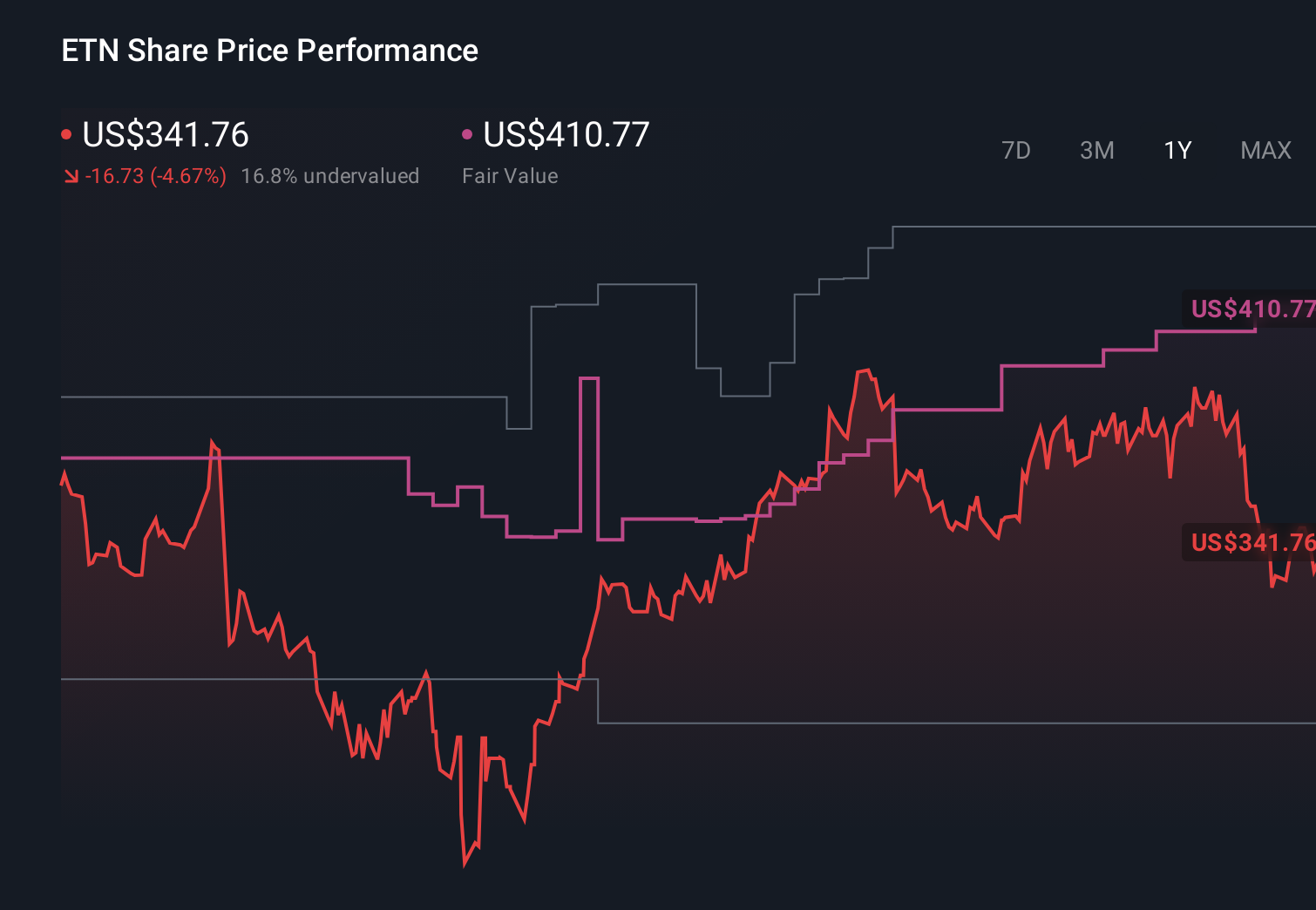

Eaton Corp. Plc ETN | 373.38 | -1.04% |

- Eaton announced an $8 billion senior unsecured term loan to support liquidity and general corporate purposes.

- The company also expanded its revolving credit facility, increasing available borrowing capacity.

- These financing steps are intended to provide additional financial flexibility for upcoming initiatives.

Eaton, traded as NYSE:ETN, is making these funding moves while its shares trade around $396.09. The stock has posted returns of 8.5% over the past week, 20.4% over the past month, 21.0% year to date, and 29.5% over the past year. Over a longer horizon, the stock shows gains of 138.0% over three years and 244.7% over five years.

For investors, this new $8 billion term loan and expanded credit facility indicate that Eaton is actively preparing its balance sheet for future plans and potential opportunities. The scale of the financing may influence how the company funds operations, manages risk, and approaches capital allocation.

Stay updated on the most important news stories for Eaton by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Eaton.

The new US$8.0b senior unsecured delayed draw term loan, together with the expanded revolving credit facility from US$3.0b to US$4.0b, gives Eaton a sizable pool of committed liquidity through December 31, 2026. Because the term loan is unsecured and carries customary covenants on additional debt and liens, it sits alongside Eaton’s existing capital structure without pledging specific assets. This can be important if large acquisitions or capacity projects are being considered. The ticking fee tied to Eaton’s long term debt ratings means there is a cost to keeping this facility undrawn, so investors may want to think about what scale of transaction or capital needs would justify paying for such a large line. Set against recent record earnings, solid Q4 profit metrics and management’s 2026 guidance, the debt package suggests a company preparing for sizable near term funding needs rather than addressing immediate stress, but it still adds to overall borrowing capacity and could influence future debt to equity levels once drawn.

How This Fits Into The Eaton Narrative

- The enlarged liquidity pool can support the capacity expansions, M&A and electrification focused projects highlighted in the community narrative, including data center and aerospace opportunities.

- If Eaton leans heavily on this facility, higher leverage and interest expense could weigh on the margin expansion and free cash flow trajectory that the narrative expects from efficiency gains.

- The short dated, delayed draw structure through 2026 and ticking fee mechanics are not explicitly covered in the narrative, yet they could influence the timing and scale of acquisitions or portfolio actions such as any vehicle unit review.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Eaton to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ The US$8.0b term facility and larger revolver increase Eaton’s potential gross debt load, which links to analyst flagged concerns about the company having a high level of debt.

- ⚠️ Covenants that limit further debt and liens could constrain financial room if end market demand or earnings fall short of the company’s Q1 and 2026 guidance.

- 🎁 The additional committed liquidity can give Eaton flexibility to fund capacity projects, acquisitions or restructuring without relying solely on equity markets.

- 🎁 The financing sits against a backdrop of earnings that have grown over recent years and analyst expectations for further earnings growth, which may help support servicing a larger balance sheet.

What To Watch Going Forward

From here, focus on whether and when Eaton actually draws on the US$8.0b term loan, what the net debt position looks like after any draw, and how interest expense trends versus recent earnings. Investors should also watch for large acquisitions, factory build outs or portfolio moves that might explain the added capacity, and compare those to the company’s organic growth and EPS guidance for 2026. Any change in credit ratings could affect the ticking fee and future borrowing costs. Finally, monitor management commentary in upcoming quarterly calls on how this financing supports data center, electrification and aerospace projects, and whether leverage targets or capital return plans to shareholders are updated as this new debt capacity comes into play.

To stay informed on how the latest news relates to the investment narrative for Eaton, visit the community page for Eaton for updates on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.