Please use a PC Browser to access Register-Tadawul

Ecolab (ECL): Assessing Valuation Following New Digital Innovation in Food Industry Efficiency

Ecolab Inc. ECL | 263.60 263.60 | +0.87% 0.00% Pre |

Ecolab (NYSE:ECL) has just launched CIP IQ, an advanced clean-in-place technology developed with 4T2 Sensors. The solution offers real-time fluid insight and improved efficiency for food and beverage manufacturers. This innovation supports Ecolab’s ongoing digital strategy.

Ecolab’s launch of CIP IQ adds momentum to what has already been a year of steady returns. While the 1-year total shareholder return stands at just over 10%, the company’s focus on digital transformation and recent double-digit earnings growth has kept positive sentiment bubbling. Investors seem to be noticing the long-term potential rather than short-term share price swings, as broader performance continues to outpace industry averages.

If this push for smarter efficiency caught your attention, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares sitting just below analyst targets and Ecolab steadily outperforming its peers, the big question is whether the current price reflects all of its future upside or if there is still a buying opportunity for investors.

Most Popular Narrative: 4.2% Undervalued

With Ecolab’s most-followed narrative targeting a fair value just above the latest close, attention now shifts to what is driving potential upside in the price outlook.

Investments in digital technologies have led to improved productivity, resulting in a 190-basis-point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to see why analysts think Ecolab could command a premium price? The answer lies in an ambitious plan for digital-led margin gains and a bold outlook on earnings expansion. Discover what crucial assumptions set this valuation apart before you miss the full story.

Result: Fair Value of $286.1 (UNDERVALUED)

However, much depends on sustaining demand and navigating new tariffs, both of which could pressure margins in the coming quarters.

Another View: Market Ratios Signal Caution

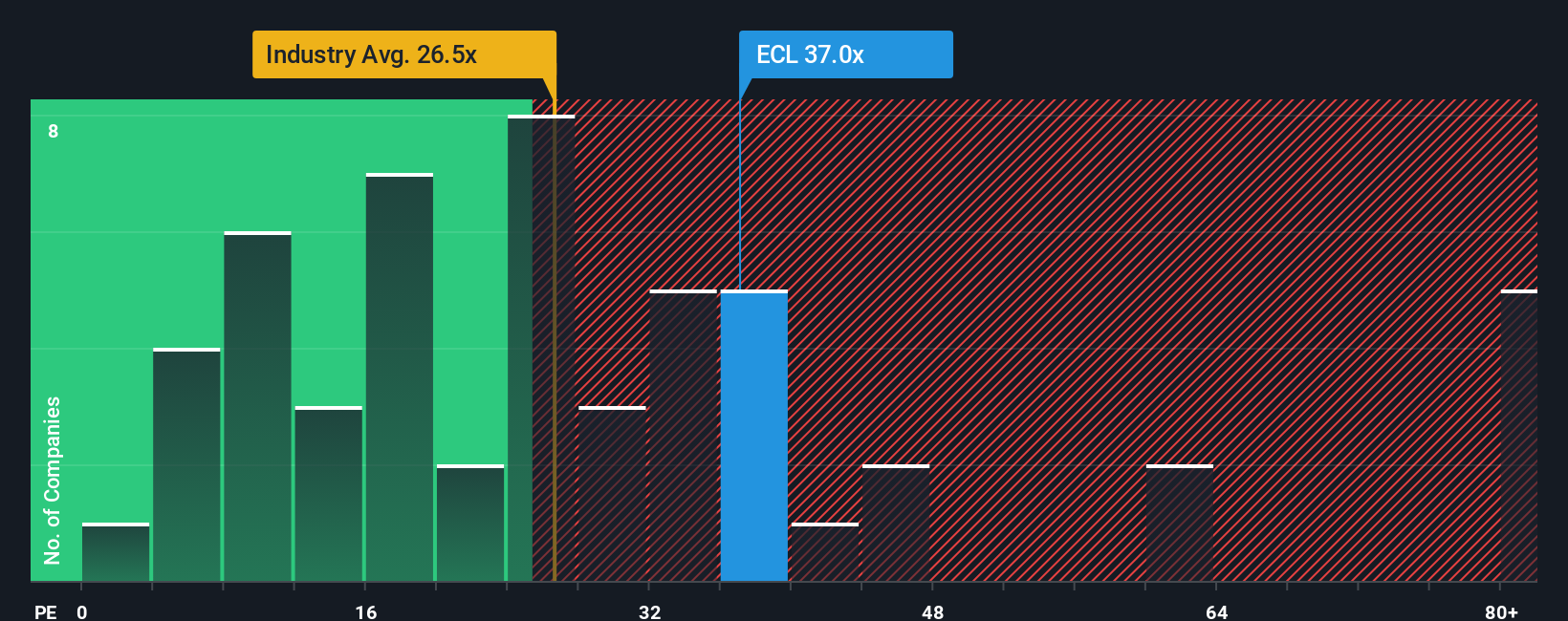

While analysts see Ecolab as fairly valued based on earnings projections, the company's price-to-earnings ratio sits at 36.4x. This is notably higher than both the industry’s 25.9x average and the fair ratio of 23.1x. This gap suggests investors are paying a premium, which could limit future returns if expectations cool off. Is this confidence justified, or are shares at risk of being stretched too far?

Build Your Own Ecolab Narrative

If you want to look below the surface or see things from your own perspective, take the data for a spin and craft your own take in just a few minutes: Do it your way

A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next smart move could be just a click away. Uncover unique, high-potential opportunities that fit your goals and keep your portfolio ahead of the crowd.

- Target reliable income streams by checking the latest these 19 dividend stocks with yields > 3% with strong yields and robust fundamentals in today’s markets.

- Boost your tech exposure instantly with these 24 AI penny stocks that are innovating at the intersection of machine learning and scalable business models.

- Stay ahead of value trends and spot hidden gems using these 909 undervalued stocks based on cash flows based on real cash flow potential, not just market hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.