Please use a PC Browser to access Register-Tadawul

Edwards Lifesciences (EW): Assessing Valuation as Investors Zero In on Partner 3 Study Results

Edwards Lifesciences Corporation EW | 85.32 | +2.33% |

Edwards Lifesciences (EW) Catches Investor Attention as New Clinical Data Looms

If you’re wondering what’s next for Edwards Lifesciences (EW), you’re certainly not alone. Investors are zeroing in on the approaching release of seven-year results from the Partner 3 study, a pivotal event stirring conversation across the market. The trigger is clear: previously unpublished six-year FDA data hinted at a widening gap in outcomes between TAVR and traditional surgical procedures. This has prompted some analysts to dial back their expectations, while the company’s decision to launch a $500 million accelerated share repurchase program from cash reserves adds another layer for investors to assess right now.

This cluster of headlines has played out against a backdrop of mixed performance for Edwards Lifesciences. Over the past year, shares have delivered a 15% total return. That upswing stands out from the prior three- and five-year periods where returns have been more muted or even negative. While momentum has been building lately, with the stock clawing back some ground year-to-date, that progress contrasts sharply with the hesitancy now resurfacing around upcoming clinical milestones and investor reactions to shifting growth risks.

After a turbulent year packed with both uncertainty and bold financial moves, is the current price a bargain ahead of major data, or has the market already factored in future growth expectations?

Most Popular Narrative: 13% Undervalued

According to the most widely followed narrative, Edwards Lifesciences is trading at a 13% discount to its perceived fair value. This view emerges from expectations around future revenue and earnings growth, as well as the evolving impact of product launches and industry dynamics.

The expected approval of the early TAVR indication in the second quarter, along with policy and guideline changes in the U.S. and globally, represents a multiyear growth opportunity that could significantly enhance revenue streams in the future. The planned launch of the transcatheter tricuspid valve EVOQUE in 2024 is anticipated to uniquely position Edwards to gain market share and increase revenues as it becomes the first company to develop and offer this therapy.

Want to know why this discount could be a fleeting window for investors? The narrative is charged with bold growth assumptions and ambitions for market expansion that are rarely seen in the sector. Curious about which financial forecasts underpin this conviction and drive that notable margin to fair value? This might be your chance to uncover the transformative numbers and daring projections shaping analyst consensus.

Result: Fair Value of $87.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including the impact of tariffs on margins and delays in regulatory approvals. These factors could challenge the bullish view ahead of new data.

Find out about the key risks to this Edwards Lifesciences narrative.Another View: Through the Lens of Market Ratios

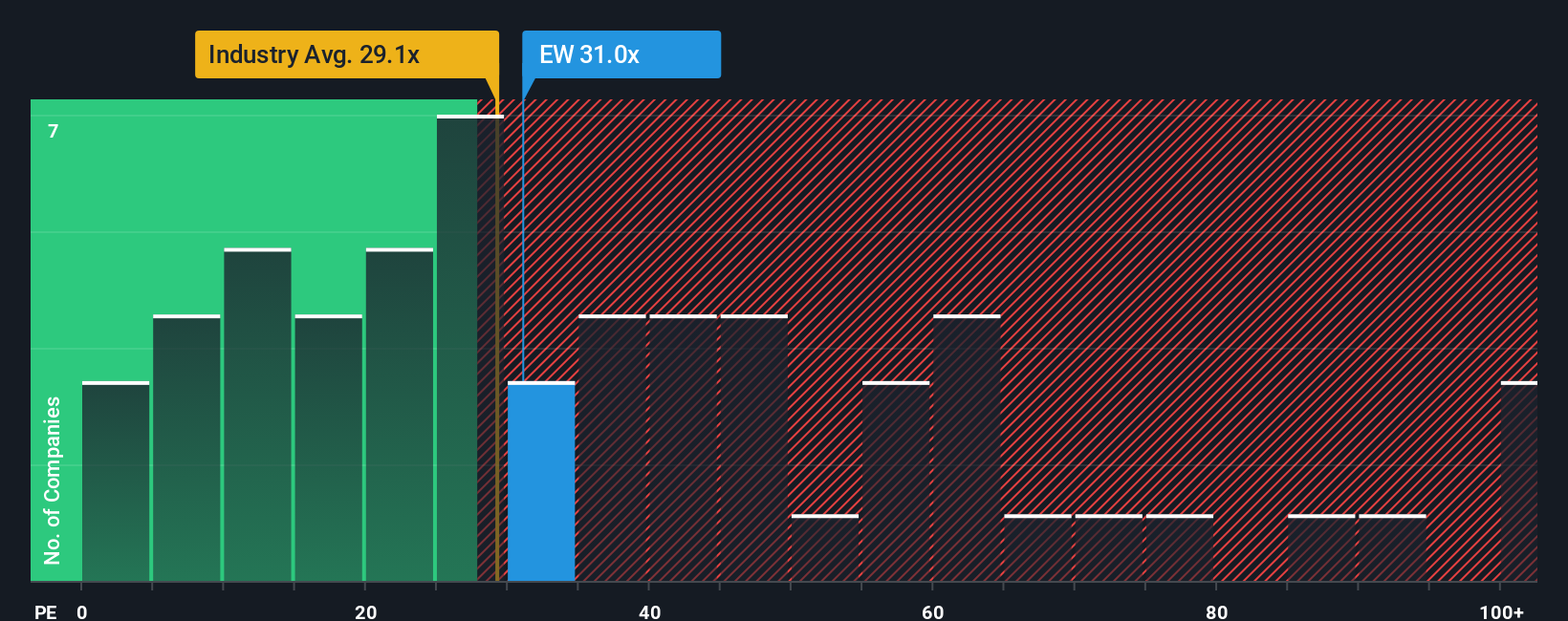

A different approach compares Edwards Lifesciences’ valuation to its industry peers by looking at its price-to-earnings ratio. This suggests the shares may be on the expensive side, which challenges the idea of them being undervalued. Does this market-driven perspective signal a reality check for expectations?

Build Your Own Edwards Lifesciences Narrative

Of course, if you’re not convinced by these perspectives or want to put your own spin on the story, dive into the data yourself. Your personal thesis could come together in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Edwards Lifesciences.

Looking for More Investment Ideas?

If you want to stay ahead of the curve and find stocks that match your investment style, check out the hottest opportunities other investors are watching right now. Smart moves today could put you among the first to benefit from trends others might miss. Don’t let unique prospects slip by while you’re focused on just one stock. Here’s where to start:

- Capitalize on emerging trends in artificial intelligence by scanning the market for promising up-and-comers with our handpicked selection of AI penny stocks.

- Strengthen your portfolio with proven income generators, searching for companies offering generous yields and reliable payouts through our tailored dividend stocks with yields > 3%.

- Jump on undervalued gems before the crowd by scouring a curated list of stocks that, based on cash flow insights, could be the bargains of tomorrow. Start with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.