Please use a PC Browser to access Register-Tadawul

Eightco Holdings (ORBS): Exploring Valuation After Major Crypto Treasury Move and Fresh Investor Interest

Eightco Holdings Inc. ORBS | 1.39 | +1.84% |

If you have been watching Eightco Holdings (NasdaqCM:ORBS) lately, it has certainly given investors something to talk about. The company just raised as much as $270 million through a private placement, specifically to build up reserves of Worldcoin and Ethereum. This is not just a surface-level move; it marks a strategic step into the digital asset space and signals the company’s intention to align itself with global trends in cryptocurrency integration. The market took notice, immediately snapping a three-day skid as bargain-seeking investors piled in after the decline.

There has been fresh momentum in Eightco Holdings’ stock, which jumped 15.56% following the fundraising news and new treasury strategy. Looking at a wider lens, the stock is up 7% in the past month and about 10% over the past three months, while its year-to-date gain sits just above 5%. Longer-term performance remains subdued, but for now, the pattern appears to be shifting, fueled both by major business moves and waves of speculative interest tied to its evolving role in crypto-related ventures.

After this recent rebound and pivot into digital assets, is Eightco Holdings undervalued in the wake of new opportunities, or has the market already priced in ambitious growth expectations?

Price-to-Book of 335.3x: Is it justified?

Eightco Holdings currently trades at a price-to-book ratio of 335.3 times, significantly higher than both its peer average and the broader US Packaging industry. This signals the stock is expensive on this metric, which generally suggests that the market is assigning a premium valuation far above typical sector norms.

The price-to-book ratio compares a company’s market value to its book value, helping investors gauge whether shares are valued at a reasonable level given the company’s underlying assets. In asset-focused sectors like packaging, this multiple is a commonly used yardstick for value assessment.

Given Eightco Holdings’ current level is far above the sector average of 2.1 times, this elevated multiple is difficult to justify based on fundamentals alone. The stock appears priced for highly optimistic future developments, with the market potentially overestimating anticipated growth or asset gains as a result of recent strategic pivots.

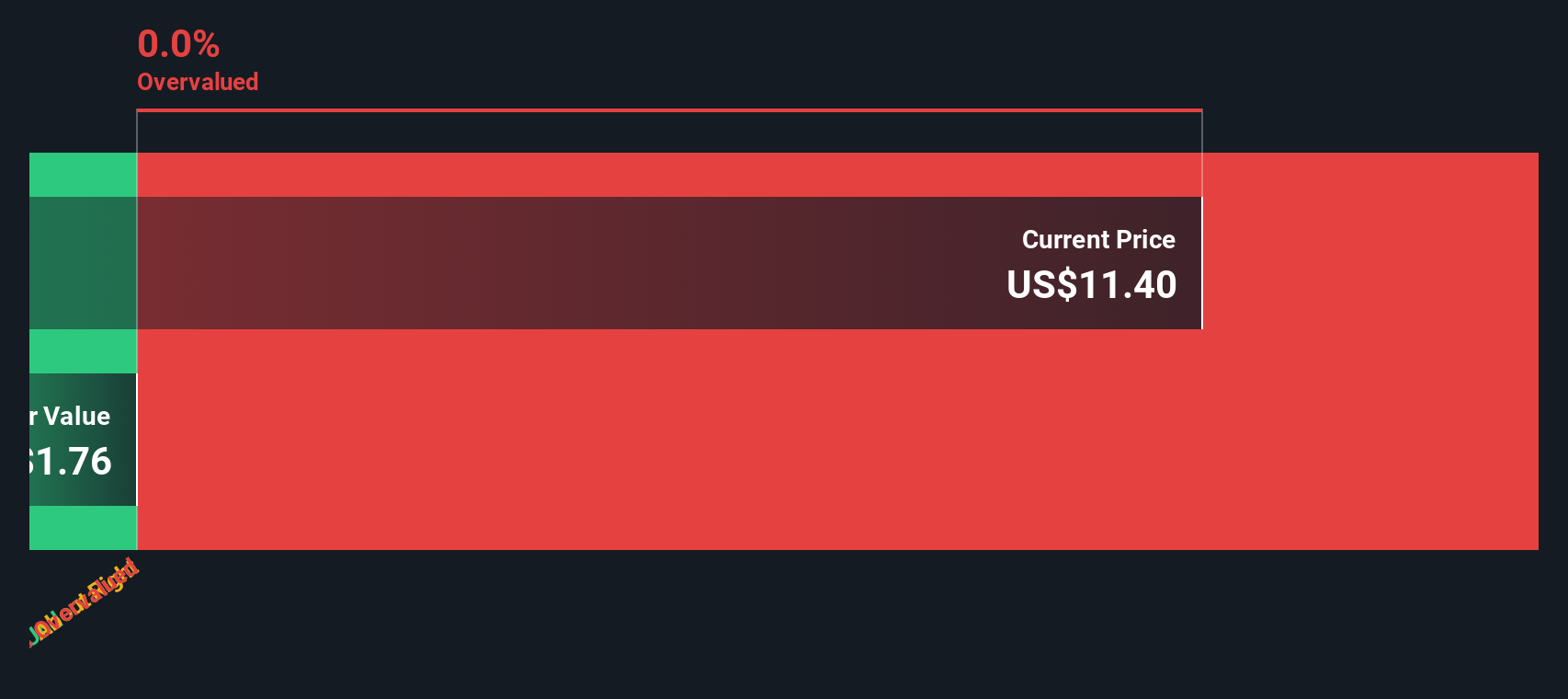

Result: Fair Value of $12.01 (OVERVALUED)

See our latest analysis for Eightco Holdings.However, persistent net losses and a lack of clear revenue growth could challenge bullish expectations. This may make Eightco’s premium valuation vulnerable to quick reversals.

Find out about the key risks to this Eightco Holdings narrative.Another View: What About a Cash Flow Perspective?

Relying solely on asset-based valuations might miss key nuances. It is helpful to look at Eightco Holdings through the lens of our DCF model. The challenge is that there is currently insufficient data to calculate a reliable intrinsic value using this method. Would the cash flows have told a different story, or simply echoed the high price tag?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eightco Holdings Narrative

If you see these numbers differently, or are keen to dig deeper into the details yourself, you have the tools to form your own perspective. Do it your way, Do it your way.

A great starting point for your Eightco Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize new opportunities and grow your portfolio with fresh investing angles that others might overlook. Here are three powerful routes you should check now. Don’t risk missing out on what could be your next big winner!

- Boost your income potential and focus on stability by seeking out established companies offering attractive payouts with our selection of dividend stocks with yields > 3%.

- Unlock the future by targeting the most promising projects in artificial intelligence, where innovation meets potential, using our curated list of AI penny stocks.

- Capitalize on hidden value by tracking stocks currently priced below their true worth; start with our essentials for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.