Please use a PC Browser to access Register-Tadawul

Element Solutions Micromax Deal Reshapes Growth Drivers And Valuation Case

Element Solutions Inc ESI | 35.44 | -0.17% |

- Element Solutions (NYSE:ESI) has completed its acquisition of Micromax, expanding its specialty chemicals portfolio for advanced electronics applications.

- The company has amended its credit facilities, adding new term loans and increasing revolving credit capacity to support the transaction and future initiatives.

Element Solutions, a specialty chemicals supplier to the electronics and industrial markets, is taking a bigger role in the tech hardware supply chain with the Micromax deal. The acquisition broadens its exposure to areas such as advanced electronics, 5G infrastructure, and electric vehicles, where material performance is closely tied to long product cycles. For investors, this represents a shift in the mix of technologies and end markets that sit behind NYSE:ESI's revenue base.

On the financing side, the amended credit facilities give Element Solutions additional flexibility to fund this transaction and other potential projects. As the Micromax business is integrated, investors may focus on how the new assets, customer relationships, and added leverage shape the company’s risk profile and capital allocation choices over time.

Stay updated on the most important news stories for Element Solutions by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Element Solutions.

Quick Assessment

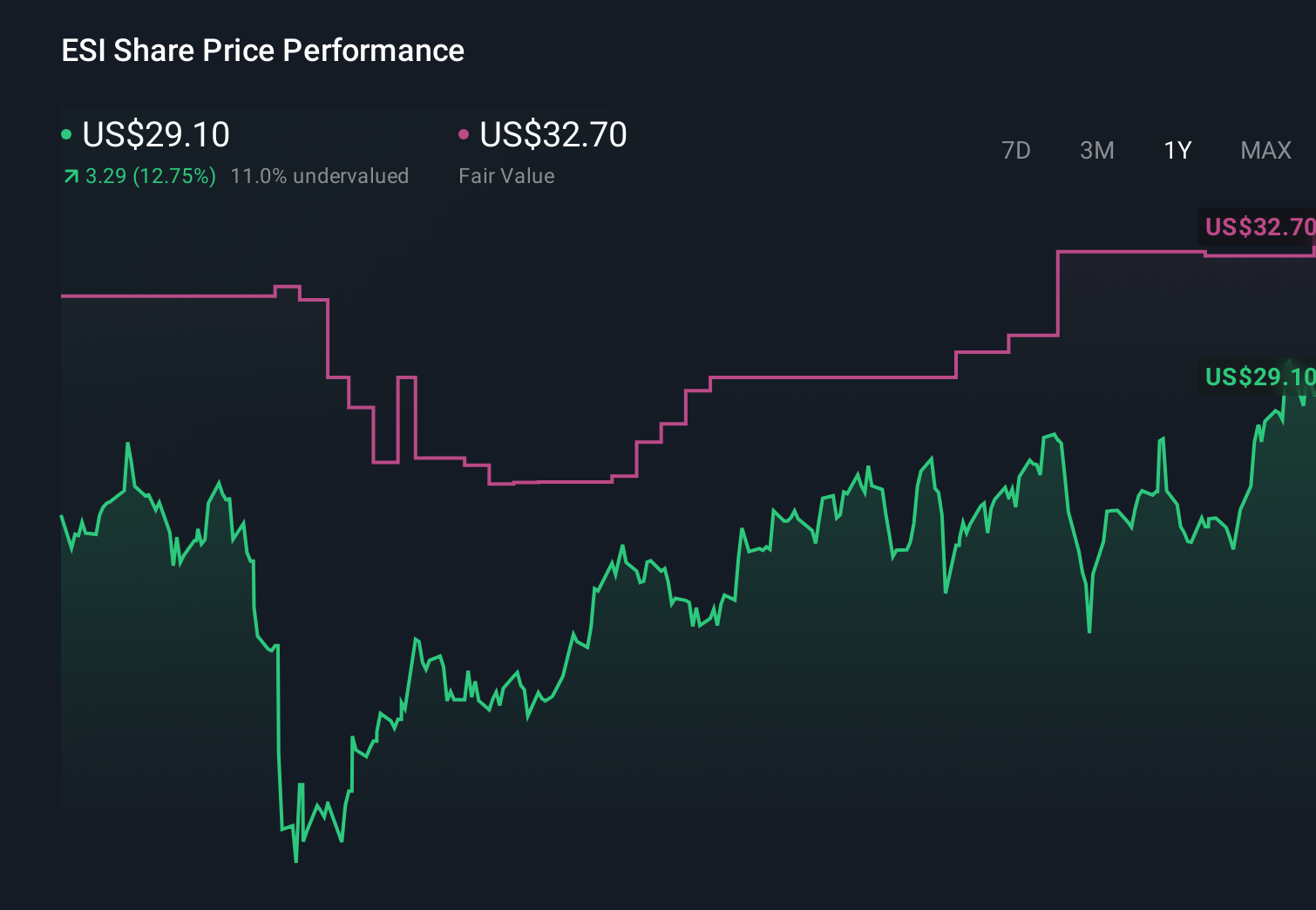

- ⚖️ Price vs Analyst Target: The current price of US$28.93 sits about 13% below the US$33.10 analyst target, so there is a modest gap to consensus.

- ✅ Simply Wall St Valuation: Shares are described as trading 27.7% below estimated fair value, which screens as undervalued in that model.

- ✅ Recent Momentum: The 30 day return of roughly 11.5% points to positive short term price momentum.

Check out Simply Wall St's in depth valuation analysis for Element Solutions.

Key Considerations

- 📊 The Micromax acquisition increases Element Solutions' exposure to advanced electronics and EV supply chains, which now play a more significant role in the underlying drivers if you hold NYSE:ESI.

- 📊 Monitor how integration costs, new customer wins and any changes in leverage appear in margins and earnings per share over the next few reporting periods.

- ⚠️ The company highlights minor risks related to insider selling and large one off items, which could influence how clean reported results appear as the transaction is integrated.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Element Solutions analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.