Please use a PC Browser to access Register-Tadawul

Element Solutions Rises Amid Eco-Friendly Growth and Strategic Partnerships in 2025 Valuation Review

Element solutions ESI | 26.36 | -0.11% |

Thinking about what to do with Element Solutions stock? You are not alone. In a market packed with shifting trends and endless options, this company has quietly caught attention again, both for its long-term results and intriguing valuation numbers. Over just the past week, Element Solutions ticked up 2.3%, adding to a modest 3.3% gain for the last 30 days. Year to date, it is up 4.0%. Taking a step back, the picture gets more interesting: while returns dipped slightly over the past year, the three- and five-year numbers, at 53.6% and 139.4%, suggest that patient investors have been rewarded handsomely.

What is behind these shifts? Recent industry developments have given specialty chemicals a higher profile, especially as companies like Element Solutions expand their role in global supply chains for electronics and sustainability-linked products. News about strategic partnerships and efforts to grow their eco-friendly offerings have sparked some optimism among investors, hinting at new channels for growth. At the same time, a subtle change in market sentiment around risk and global manufacturing could be helping support the stock’s prices. This may be setting the stage for future moves.

Of course, numbers only tell part of the story. When you dig into valuation metrics, Element Solutions clocks a value score of 3 out of 6. This means it is judged undervalued by half the key measures analysts typically watch. In the next section, we will explore exactly how that score was calculated and discuss what these standard valuation checks really mean for your investing decisions. Stick around for a look at why traditional valuation misses the full story and a better way to judge what Element Solutions is truly worth.

Approach 1: Element Solutions Discounted Cash Flow (DCF) Analysis

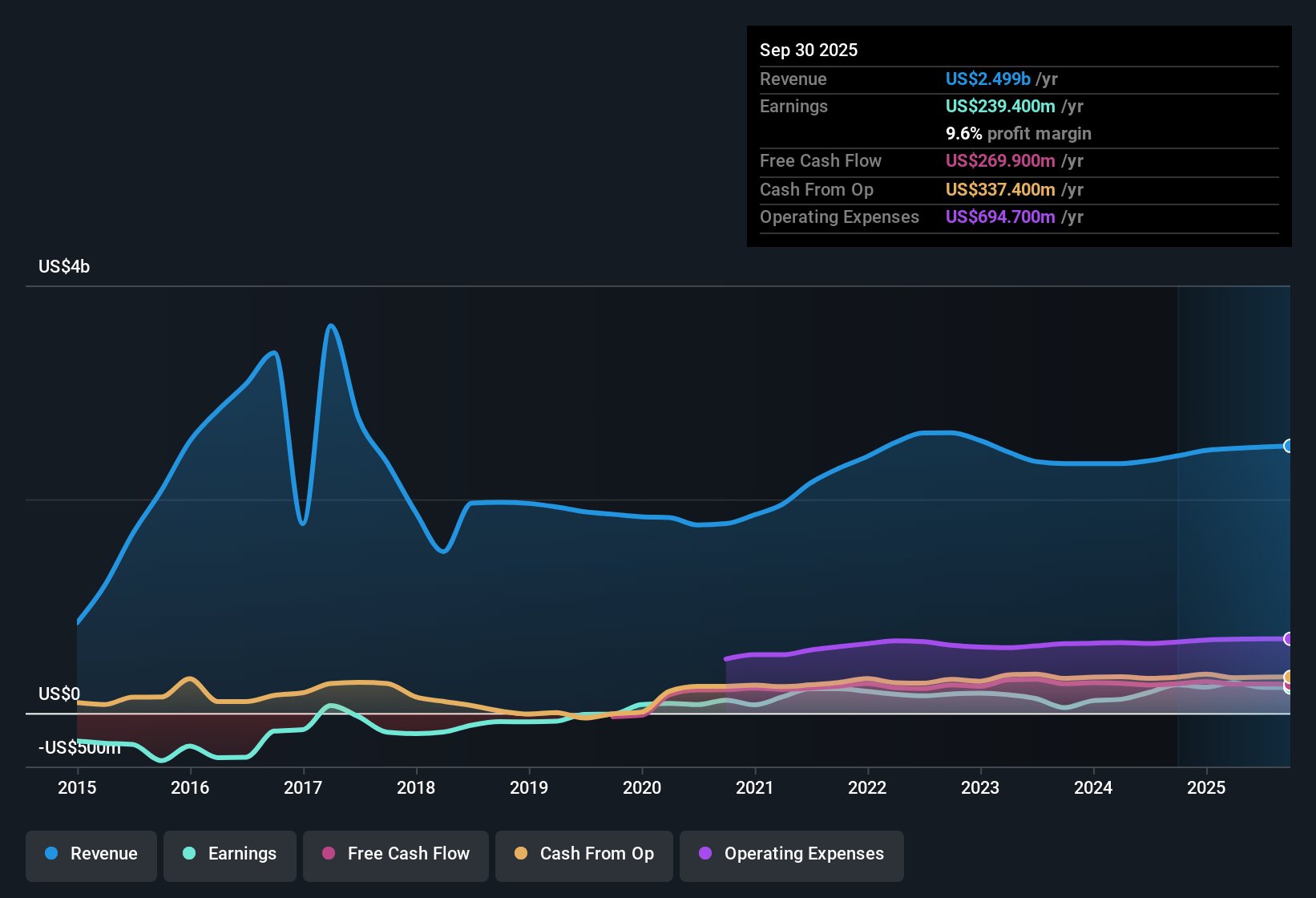

The Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting its future cash flows and discounting them back to today's value, reflecting the time value of money. This approach is common for companies like Element Solutions, where stable cash generation is a key feature.

For Element Solutions, the current Free Cash Flow (FCF) is $275.0 Million. Analysts have projected steady annual increases, with estimates growing to $332.7 Million in 2026 and $407.3 Million in 2027. Beyond that, Simply Wall St extrapolates the next several years, leading to a projected FCF of $692.5 Million by 2035. All cash flows are considered in US dollars.

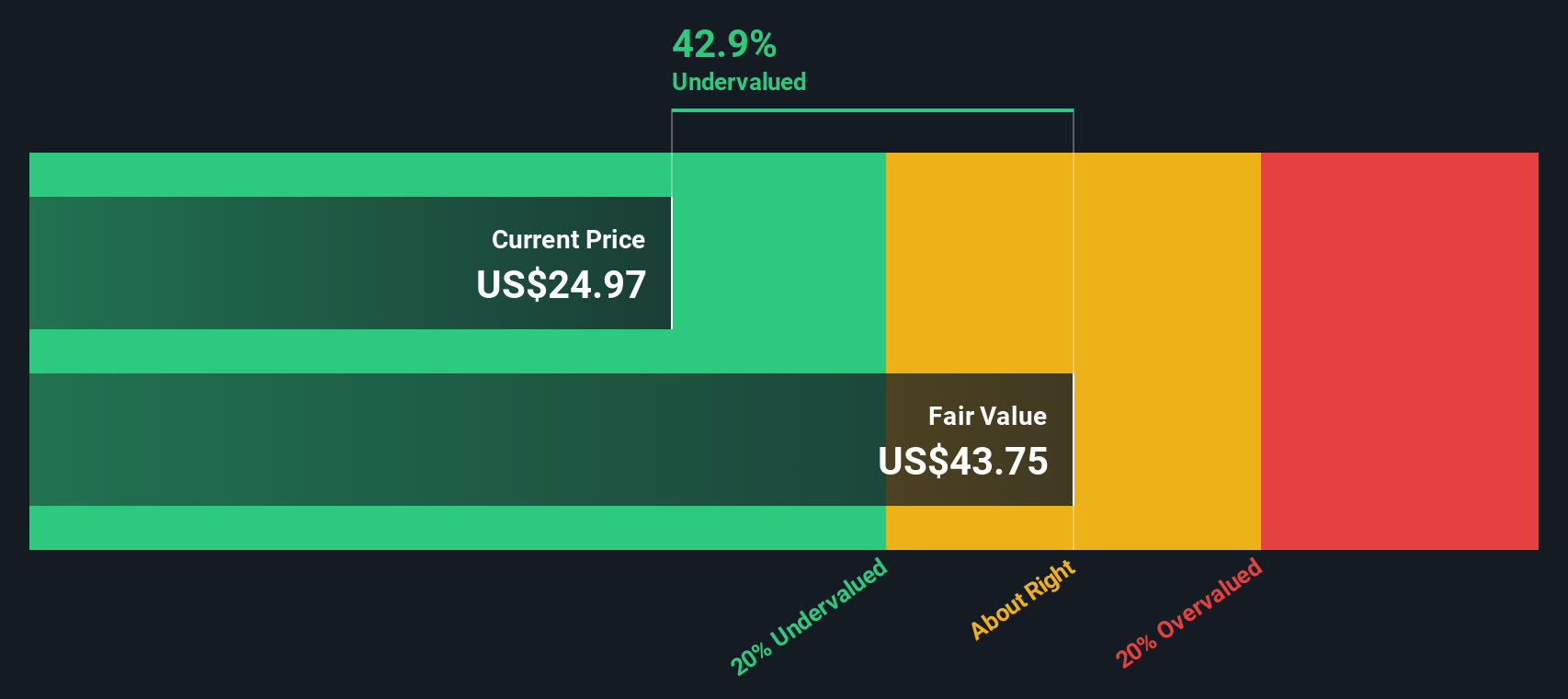

Using these cash flow assumptions and the 2 Stage Free Cash Flow to Equity methodology, the model calculates an estimated intrinsic fair value of $44.02 per share. Compared to Element Solutions’ current share price, this result suggests the stock is trading at a 40.5% discount to its estimated true value, which indicates it is notably undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Element Solutions is undervalued by 40.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Element Solutions Price vs Earnings

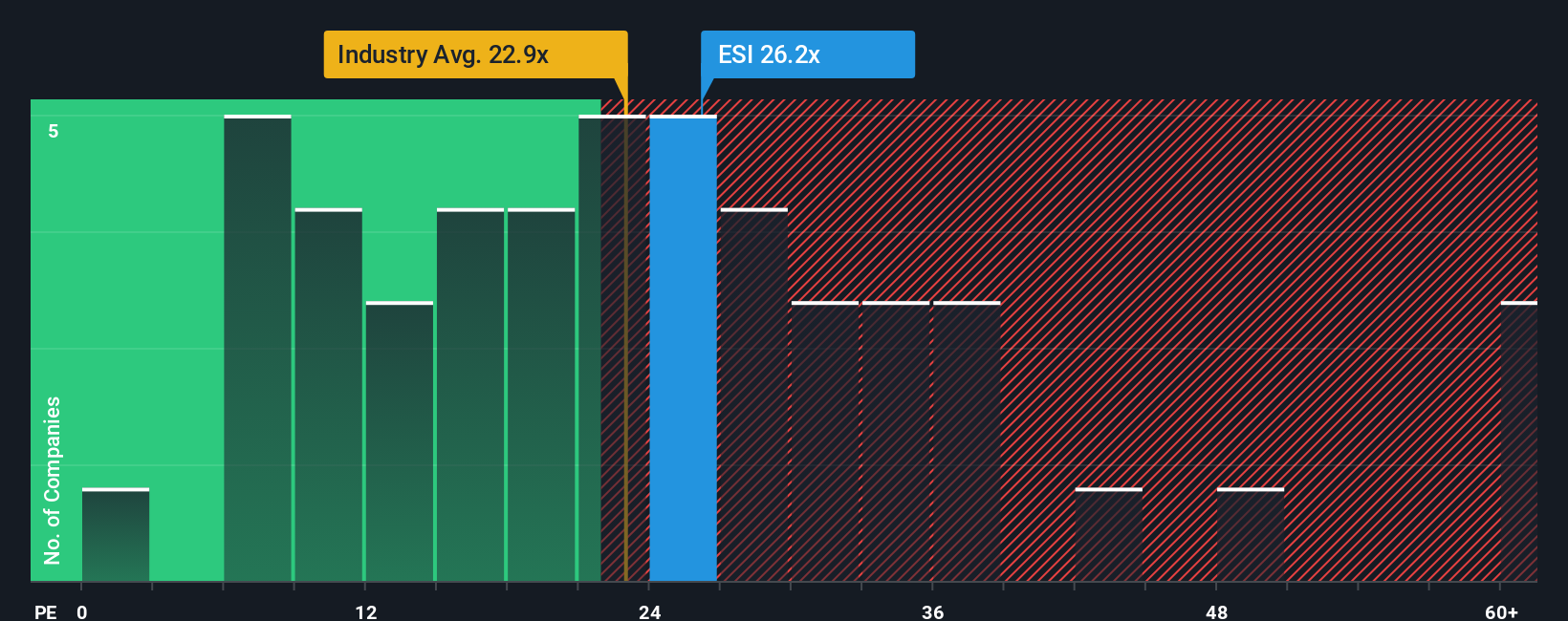

For established, consistently profitable companies like Element Solutions, the Price-to-Earnings (PE) ratio is a tried-and-true valuation tool. This metric gives investors a snapshot of how much they are paying for each dollar of current earnings, making it a popular yardstick for assessing whether a stock is expensive or cheap relative to its profit generation.

What makes a “fair” PE ratio can vary, as market participants tend to reward higher growth prospects or penalize increased risk by pushing the ratio up or down. Companies with robust earnings growth or lower perceived risks often command higher PE multiples. In contrast, slower growth or sector uncertainty tends to keep PE ratios more subdued.

Element Solutions currently trades at a PE ratio of 26.3x. This sits just above the industry average of 25.7x and notably above direct peers, who average 17.9x. To get a more tailored valuation gauge, Simply Wall St’s proprietary “Fair Ratio” factors in not only industry standing but also the company’s unique growth outlook, profit margins, market cap, and specific business risks. For Element Solutions, the Fair Ratio is 23.2x, reflecting these nuances more fully than simple peer or sector comparisons can.

Since the actual PE ratio of 26.3x is moderately higher than the Fair Ratio of 23.2x, the shares appear to be trading at a premium to what underlying fundamentals would justify according to this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Element Solutions Narrative

Earlier we mentioned there is a better way to think about valuation, so let us introduce Narratives. This innovative approach goes beyond the numbers to connect the company’s evolving story with a quantitative fair value estimate. A Narrative is your perspective about the future of Element Solutions, brought to life through simple, adjustable forecasts for revenue, earnings, and profit margins, alongside your view of risks and opportunities. Narratives combine what the company actually does, what is changing in its industry, and your judgment about its prospects, all into a financial forecast that translates directly into a fair value for the shares.

This method makes it easy for anyone, not just experts, to build and share their investment thesis within the Simply Wall St Community page, which is used by millions of investors globally. Narratives instantly show you whether the stock might be overpriced or present an opportunity by comparing your calculated Fair Value to today’s share price, helping you know when to consider buying or selling. Moreover, these forecasts update dynamically whenever new events, news, or earnings results arrive, so your Narrative always remains relevant and actionable. For example, some investors see Element Solutions as poised for expansion in data centers and electric vehicles, resulting in a higher fair value, while others emphasize ongoing risks in legacy markets and competition, leading to a more conservative estimate. This demonstrates how tailored and impactful your Narrative can be.

Do you think there's more to the story for Element Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.