Please use a PC Browser to access Register-Tadawul

Eli Lilly (LLY) Partners With Senderra For Innovative Digital Patient Care Solution

Eli Lilly and Company LLY | 1027.51 | +1.80% |

Eli Lilly (LLY) recently introduced EBGLYSS through Senderra Specialty Pharmacy, targeting patients with atopic dermatitis, while enhancing patient and provider experiences via SenderraCare+. Despite these positive moves, Eli Lilly's stock faced a 15% decline over the last quarter. This can be viewed against the backdrop of record high trends in major indexes like Nasdaq during the same period. While Eli Lilly reported strong earnings growth and raised its guidance, the broader market dynamics didn't fully support its stock, as other sectors experienced significant gains, particularly in technology and consumer markets.

The introduction of EBGLYSS by Eli Lilly is noteworthy, potentially paving new paths in the treatment of atopic dermatitis and enhancing user experiences through SenderraCare+. While these moves align with the company's narrative of growth through strategic product approvals and investments, specifically in areas like oncology and immunology, they may not immediately offset the recent 15% share price decline. Over the past five years, Eli Lilly's shares saw an impressive 339.9% total return, showcasing strong long-term growth. However, this recent decline is in contrast with the performance of major indexes like Nasdaq.

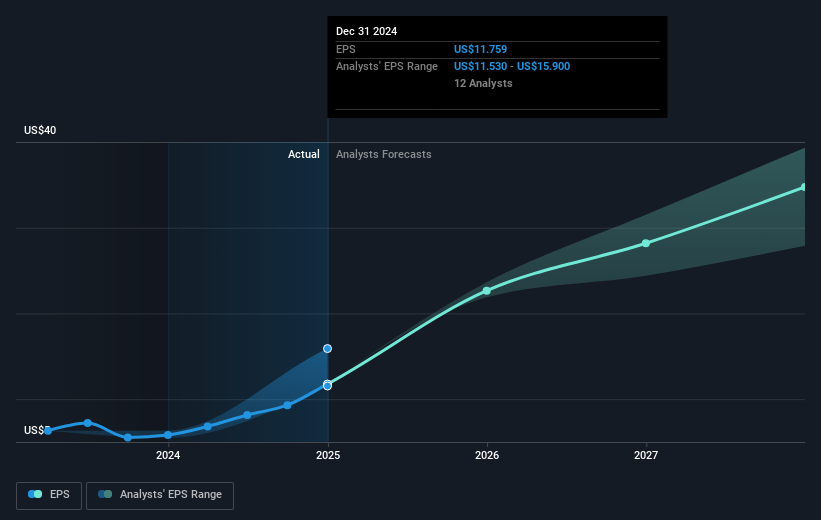

The recent share price movements, compared to the consensus analyst price target of US$915.74, highlight a significant discount of approximately 46%, suggesting potential underestimation of Eli Lilly's long-term earning projections. The current development in Eli Lilly’s portfolio could positively impact revenue estimates, given the advancements from Phase III trials and potential new approvals. Analysts forecast revenue and earnings growth rates higher than the industry, adding optimism towards meeting future expectations. That said, achieving these forecasts will depend heavily on overcoming risks associated with pricing pressures and regulatory challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.