Please use a PC Browser to access Register-Tadawul

Eli Lilly (NYSE:LLY) Expands US Production With US$50 Billion Investment Creating 3000 Jobs

Eli Lilly and Company LLY | 1041.79 | -1.19% |

In a significant move, Eli Lilly (NYSE:LLY) recently announced plans to expand its domestic medicine production with four new manufacturing sites, reflecting its commitment to a total investment exceeding $50 billion in U.S. capital commitments since 2020. This bold expansion is set against a backdrop of mixed market performance, with major U.S. stock indexes showing varied trends and market conditions fluctuating due to geopolitical factors, including tariff announcements. During the last quarter, Lilly's share price rose 16%, potentially driven by its solid earnings report and strategic alliances, which included milestones in cardiometabolic disease research and cancer treatment developments. While the market saw a 3.6% drop over the past week amidst general concerns, Lilly’s robust financial performance and expansion efforts have seemingly bolstered investor confidence, contributing to its noteworthy price movement.

Eli Lilly's shares have delivered a very large total return over the past five years, emphasizing the company’s robust market positioning and strategic initiatives. Several factors have played a role in this substantial growth. Noteworthy among these is the company's aggressive expansion strategy, including a commitment exceeding $50 billion towards U.S. capital expansions and a $4.5 billion investment in a new manufacturing site in Germany. The company has also expanded its parenteral manufacturing capacity with a US$3 billion investment in Wisconsin. Additionally, its strategic alliances, such as the partnership with Nimbus Therapeutics, have expanded its research capabilities.

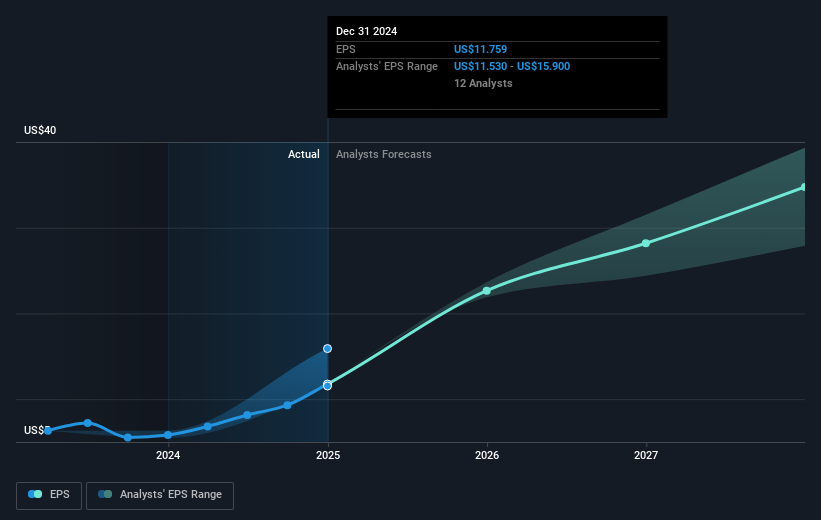

Over the past year, Lilly outperformed both the US Pharmaceuticals industry and the US market. Growth in earnings, which surged to 102.1% over the past year, significantly contributed to sustaining investor confidence. Another key development was the FDA approval of Omvoh and positive R&D outcomes, like Zepbound's expanded approvals, which bolstered market perception. These strategic decisions and regulatory milestones demonstrate Lilly’s commitment to growth and innovation, underlining its strong performance in comparison to industry peers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.