Please use a PC Browser to access Register-Tadawul

Eli Lilly (NYSE:LLY) Reports Strong Q1 Growth Despite Lowered 2025 EPS Guidance

Eli Lilly and Company LLY | 1040.44 | -2.05% |

Eli Lilly (NYSE:LLY) harnessed significant operational performance during the latest quarter, reporting robust sales and net income that showcased strong year-over-year growth. Despite affirming its revenue guidance, the company's decision to lower EPS forecasts amidst IPR&D charges and investment losses saw shares decline. Albeit negatively impacted, the company's 9.20% price move aligns closely with overall market trends, evidenced by strong movements in major indices like the Dow Jones and S&P 500, which continued their extended streak amid tech earnings. Notably, Eli Lilly's sustained commitment to product innovation and pipeline advancements reflect resilient long-term strategies amidst market volatility.

The recent developments at Eli Lilly, such as the solid operational performance despite the lowered EPS forecast, highlight a complex picture that could influence future revenue and earnings projections. The immediate share price decline is notable, but it aligns with a broader market trend witnessed across major indices like the Dow Jones and S&P 500. This trend emphasizes the resilience required amidst fluctuations influenced by tech earnings and investment losses.

Over the past five years, Eli Lilly's total shareholder return, encompassing share price appreciation and dividends, has been very large, marking 510.05% growth. This impressive performance eclipses the US Pharmaceuticals industry's mere 1-year return of 0.4%, showcasing the company's strong alignment with shareholder interests and commitment to consistent returns.

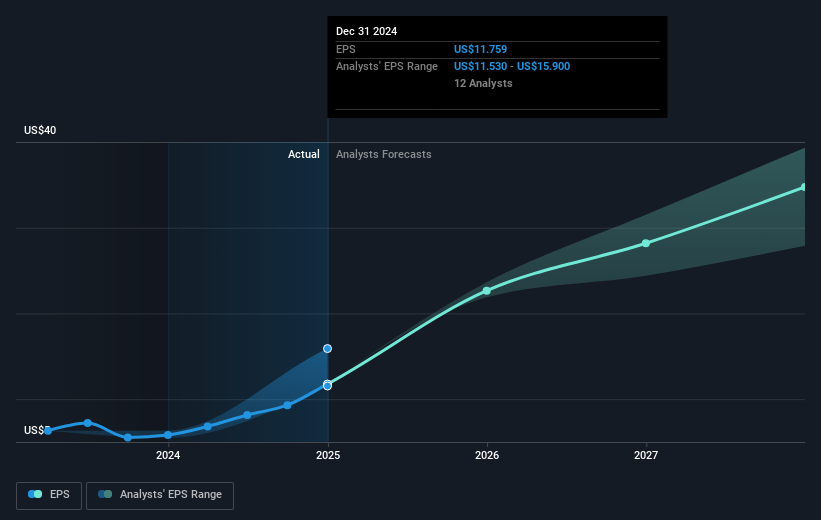

In future revenue and earnings forecasts, the IPR&D charges and investment losses are positioned to have specific impact areas. However, Eli Lilly's robust revenue guidance and associated manufacturing expansion efforts signal growth potential, potentially aligning with analyst expectations of US$31.1 billion in earnings by 2028. Nevertheless, the share price currently trading around US$885.2 remains at a discount to the consensus analyst price target of approximately US$991.97, reflecting a 10.8% gap. This gap suggests room for appreciation if projected revenue growth and efficiency improvements materialize as anticipated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.