Please use a PC Browser to access Register-Tadawul

EMCOR Group (EME) Is Up 6.1% After EPS Outpaces 15.9% Revenue Growth Via Buybacks

EMCOR Group, Inc. EME | 812.79 | +1.15% |

- EMCOR Group, a provider of electrical, mechanical, and building construction services through more than 70 subsidiaries, has recently reported that its market share has increased alongside approximately 15.9% annual revenue growth over the last two years.

- An interesting aspect of this performance is that EMCOR’s earnings per share expanded faster than revenue, helped by an active share buyback program that amplified its profit per share.

- We’ll now examine how EMCOR’s combination of strong revenue expansion and earnings-enhancing buybacks may influence its broader investment narrative.

Uncover the next big thing with 25 elite penny stocks that balance risk and reward.

What Is EMCOR Group's Investment Narrative?

For EMCOR, the core belief is that a diversified, service-focused construction group can keep winning work while converting that into solid profits and disciplined capital returns. The recent confirmation of strong market share gains and revenue growth, alongside earnings per share boosted by buybacks, reinforces the idea that management is effectively turning scale into per-share value. In the near term, catalysts still center on project backlog quality, execution on large contracts, and how aggressively EMCOR continues its repurchase activity alongside its higher dividend. The recent news supports these positives but does not materially change the immediate risk picture: project cyclicality, potential margin pressure, and the need to sustain disciplined capital allocation remain key watchpoints, especially after a very large multi‑year total return.

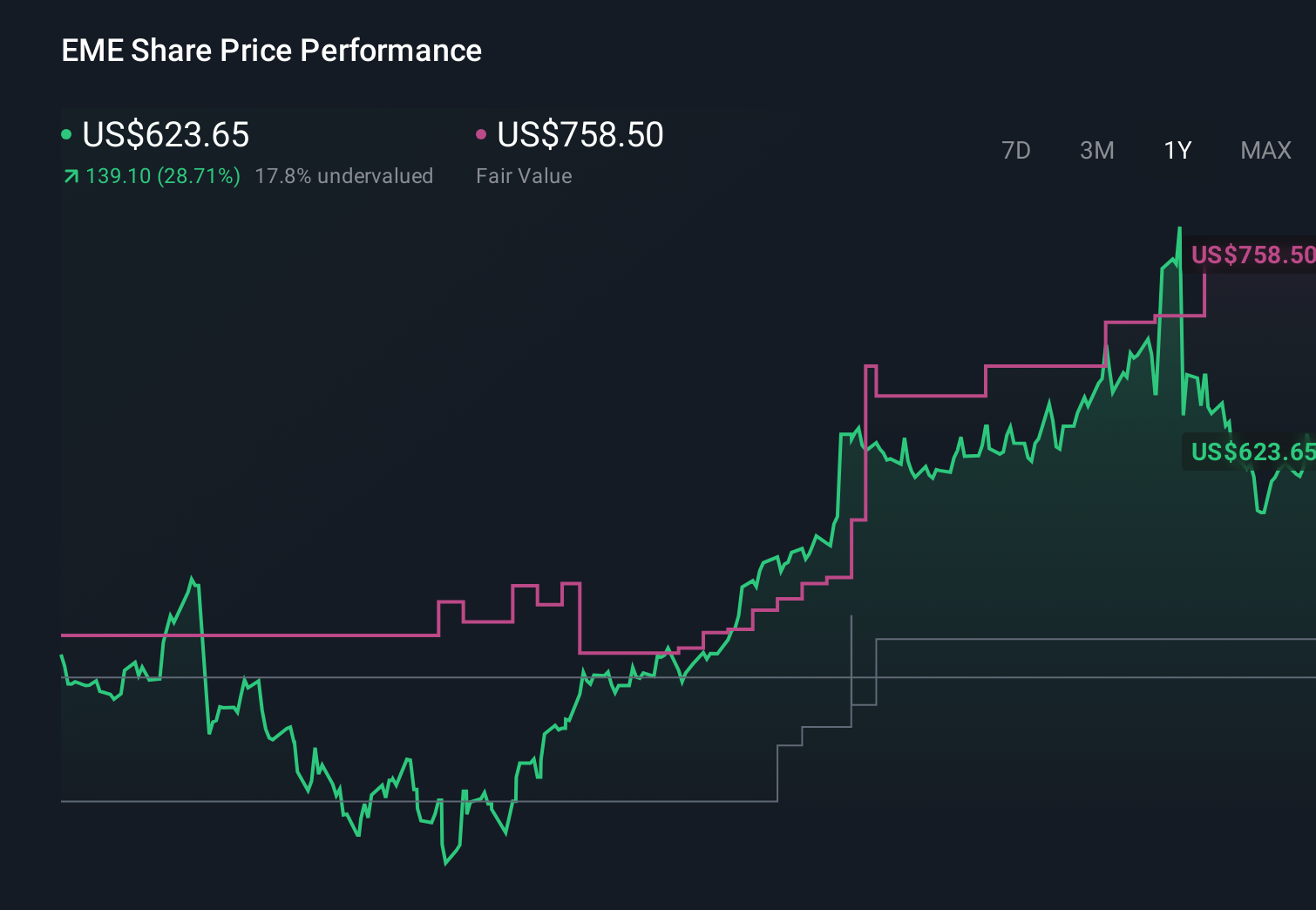

But there is one capital allocation risk here that investors should not overlook. EMCOR Group's shares have been on the rise but are still potentially undervalued by 18%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on EMCOR Group - why the stock might be worth as much as 23% more than the current price!

Build Your Own EMCOR Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've uncovered the 14 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Find 53 companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.