Please use a PC Browser to access Register-Tadawul

EMCOR Group Outlook Raised As Acquisitions Support Growth And Valuation Potential

EMCOR Group, Inc. EME | 812.79 | +1.15% |

- EMCOR Group (NYSE:EME) reported strong operational performance alongside robust demand across healthcare, high tech manufacturing, and institutional markets.

- The company completed six acquisitions in 2025, expanding its services and project capabilities across key end markets.

- Management raised its 2025 outlook for revenue, operating margin, and EPS to reflect the stronger activity and recent portfolio additions.

For investors tracking NYSE:EME, the recent update comes with a share price of $730.4 and a very large 3 year return that is close to 4x. The stock is also up 63.1% over the past year and 18.3% over the past month, with a 3.9% move over the last week, indicating strong recent momentum around the name.

The raised 2025 outlook, combined with ongoing acquisition activity, indicates that EMCOR is responding to what it views as healthy demand in its core end markets. As you look ahead, the key questions are how well the company integrates its new deals and whether current activity levels in healthcare, high tech manufacturing, and institutional projects persist through 2025.

Stay updated on the most important news stories for EMCOR Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on EMCOR Group.

Quick Assessment

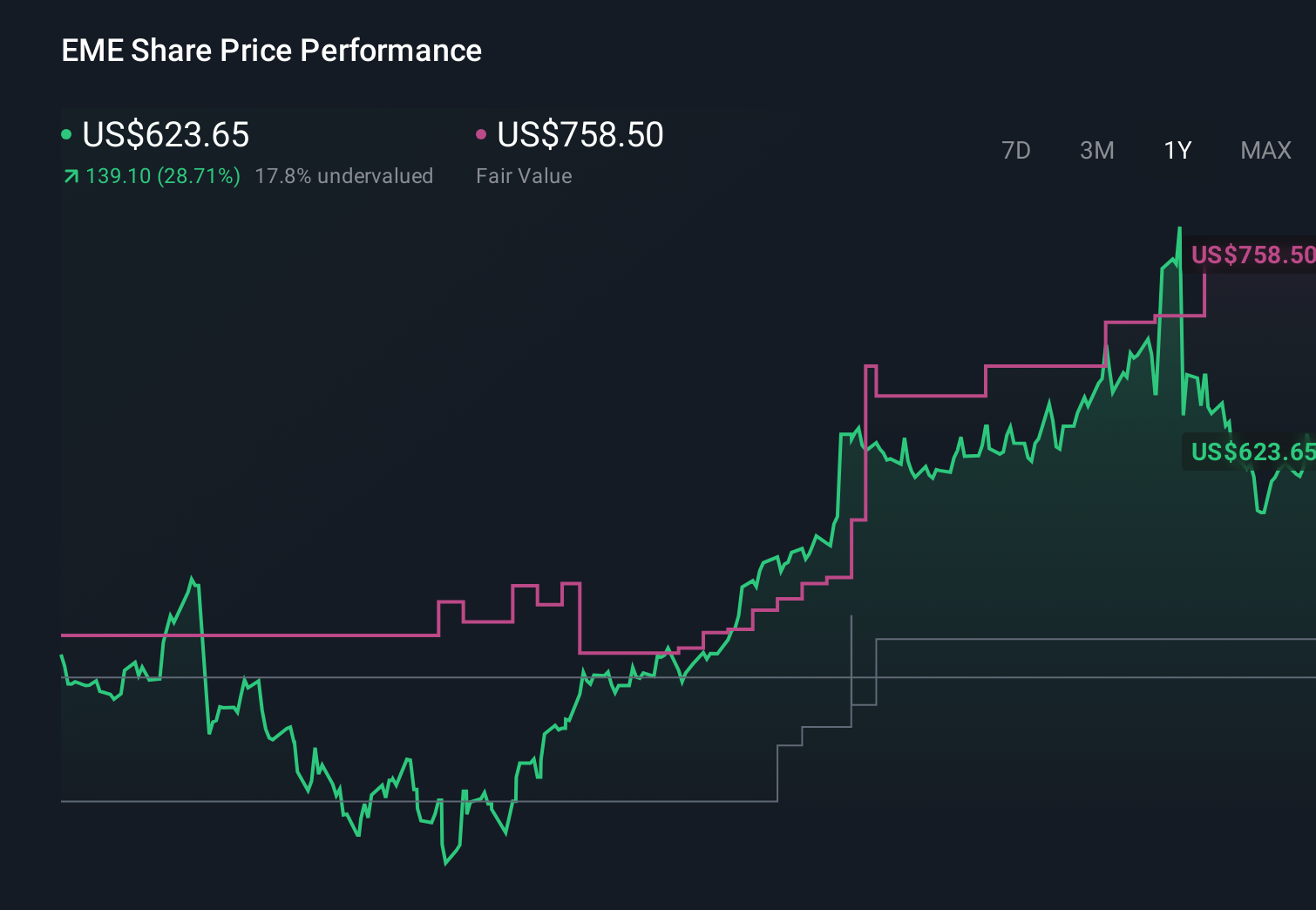

- ⚖️ Price vs Analyst Target: At US$730.4, the share price is about 5% below the US$772 consensus target and inside the analyst range of US$713 to US$900.

- ✅ Simply Wall St Valuation: Shares are described as trading around 19.4% below an estimated fair value, which screens as undervalued.

- ✅ Recent Momentum: The 30 day return of roughly 18.3% shows strong short term price strength around this update.

Check out Simply Wall St's in‑depth valuation analysis for EMCOR Group.

Key Considerations

- 📊 The raised 2025 outlook and six acquisitions support the case that current earnings and revenue expectations are anchored to active end markets.

- 📊 Keep an eye on acquisition integration, project margins and whether earnings track towards the analyst EPS view embedded in the US$772 target.

- ⚠️ After a very large multi‑year run and a 30 day gain of 18.3%, position sizing and entry points matter if sentiment cools.

Dig Deeper

For the full picture including more risks and rewards, check out the complete EMCOR Group analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.