Please use a PC Browser to access Register-Tadawul

Encompass Health (EHC): A Fresh Look at Valuation After Strong Share Price Gains

Encompass Health Corporation EHC | 107.00 107.00 | +0.14% 0.00% Pre |

Encompass Health (EHC) recently saw its shares move slightly, but there is no major event steering this shift. Investors may be watching the stock’s performance to assess longer-term growth prospects in the healthcare sector.

After a strong run-up so far this year, Encompass Health’s share price has climbed nearly 36% year-to-date, with momentum particularly noticeable in its recent 90-day gain of almost 15%. Over a longer horizon, total shareholder returns have been especially impressive, up 31.6% in the past year and more than doubling over five years. This suggests consistent long-term value creation as investors respond to the company’s growth outlook.

Interested in seeing what other healthcare leaders are up to? You can explore opportunities across the sector with our dedicated screener: See the full list for free.

With Encompass Health shares up sharply and trading at a modest discount to analyst price targets, the question for investors now is whether current prices are factoring in all the potential growth or if there is still room to buy in before further gains.

Most Popular Narrative: 10.2% Undervalued

Compared to the latest close of $124.90, the predominant narrative puts Encompass Health’s fair value at $139.08, a premium that suggests investors are paying less than consensus estimates for further earnings power. This sets up a compelling case for why many see more upside still to come, even after strong recent gains.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

What’s really fueling this optimism? The narrative points to years of expanding specialty care, a bold pipeline of new facilities, and ambitious earnings goals, but the real story is in just how aggressive some of these projections are. Want to see what growth assumptions and market dynamics support this punchy valuation? Only a full read will reveal the wildest details behind this narrative’s price target.

Result: Fair Value of $139.08 (UNDERVALUED)

However, labor shortages and rising industry competition could hamper growth. These factors may challenge the bullish narrative if profitability or patient volumes fall short of projections.

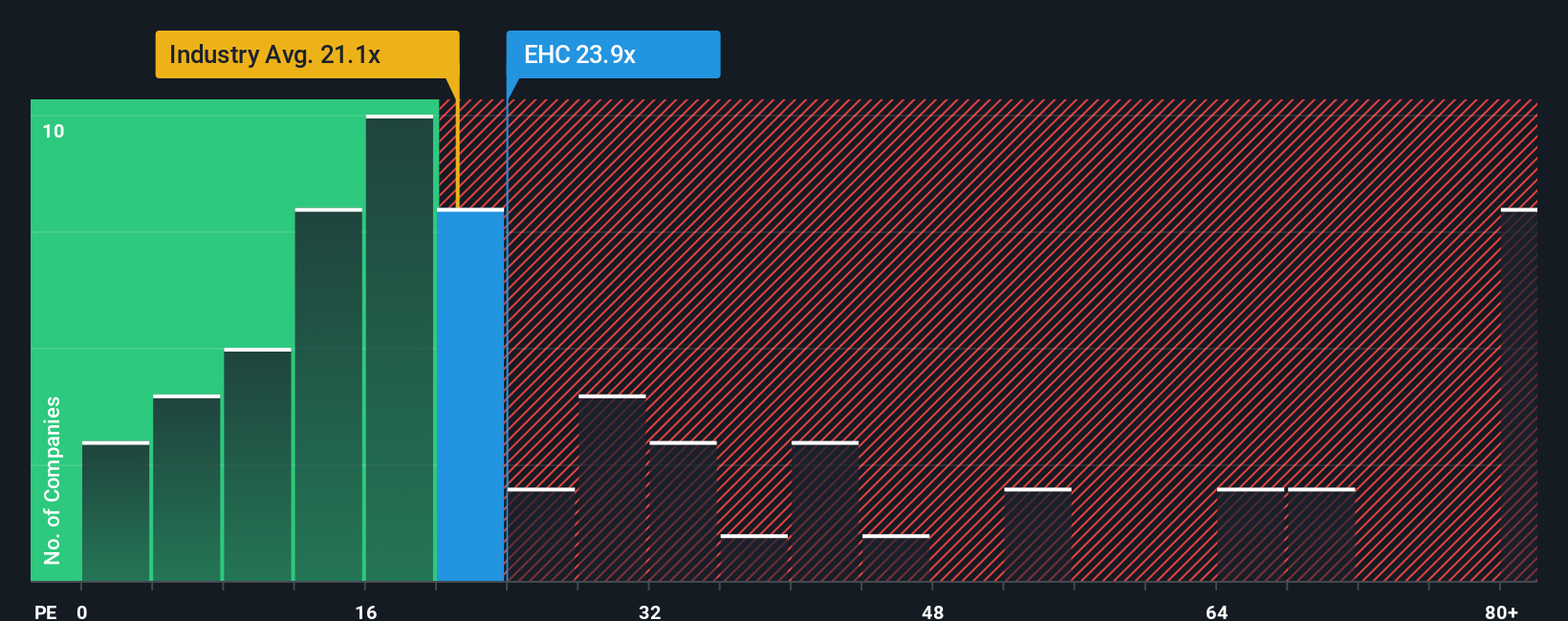

Another View: High Earnings Multiple Raises Questions

Looking from a different angle, Encompass Health’s shares are trading at 24.1 times earnings, which is not only higher than the peer average of 17.6 times but also stands above the industry norm of 21.7 times. This gap signals that investors are paying a premium compared to competitors and the wider sector. The fair ratio suggests a level closer to 21.6 times earnings, so the current valuation may leave less cushion if growth expectations fall short. Is the market’s enthusiasm running ahead of reality, or are these premium multiples justified by future performance?

Build Your Own Encompass Health Narrative

If you want to dig deeper or shape your own outlook, it’s easy to build a personalized take on Encompass Health using the available data. Do it your way Do it your way.

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. See what’s possible with focused stock screens tailored for smart investors. The right ideas could be one click away.

- Accelerate your search for strong income opportunities by checking out these 17 dividend stocks with yields > 3% with yields above 3% and robust payout histories.

- Tap into the next wave of technological disruption by reviewing these 24 AI penny stocks, as these are poised to benefit from breakthroughs in artificial intelligence and automation.

- Spot undervalued potential before the crowd with these 879 undervalued stocks based on cash flows, which highlights quality businesses trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.