Please use a PC Browser to access Register-Tadawul

Encompass Health (EHC): Valuation in Focus Following Patient Safety Concerns and Legal Scrutiny

Encompass Health Corporation EHC | 107.00 107.00 | +0.14% 0.00% Pre |

Encompass Health (NYSE:EHC) is under the microscope after a recent New York Times article brought critical patient safety issues and poor safety records at its facilities into the spotlight. This has sparked renewed concerns from investors.

Following the headline-making safety concerns and ensuing legal attention, Encompass Health’s share price saw a steep single-day decline but remains up almost 34% for the year. This signals robust momentum despite short-term shocks. Over the long haul, shareholders have enjoyed a total return of 154% over three years, reflecting impressive compounding even as ongoing risks start to weigh more heavily on sentiment.

If this sector turbulence has you curious about your next move, now’s a good time to consider discovery opportunities like See the full list for free.

With strong long-term gains, but heightened legal risks and sector headwinds, investors are left asking whether Encompass Health is trading below fair value or if the market is already factoring in its growth prospects.

Most Popular Narrative: 10.5% Undervalued

Encompass Health’s current share price is slightly above $122, while the most popular market narrative supports a fair value in the high $130s. This difference hinges on bold assumptions about demand, margin expansion, and execution.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

Ever wondered what kind of profit margins and future multiples could support such an optimistic valuation? The key catalysts here are not just expansion; they rely on aggressive growth forecasts and a payout profile not seen since pre-pandemic healthcare booms. Dig into the narrative to see what is fueling this bold call.

Result: Fair Value of $137.42 (UNDERVALUED)

However, persistent labor shortages and the continued shift toward home-based rehabilitation could put pressure on Encompass Health’s growth story in the coming years.

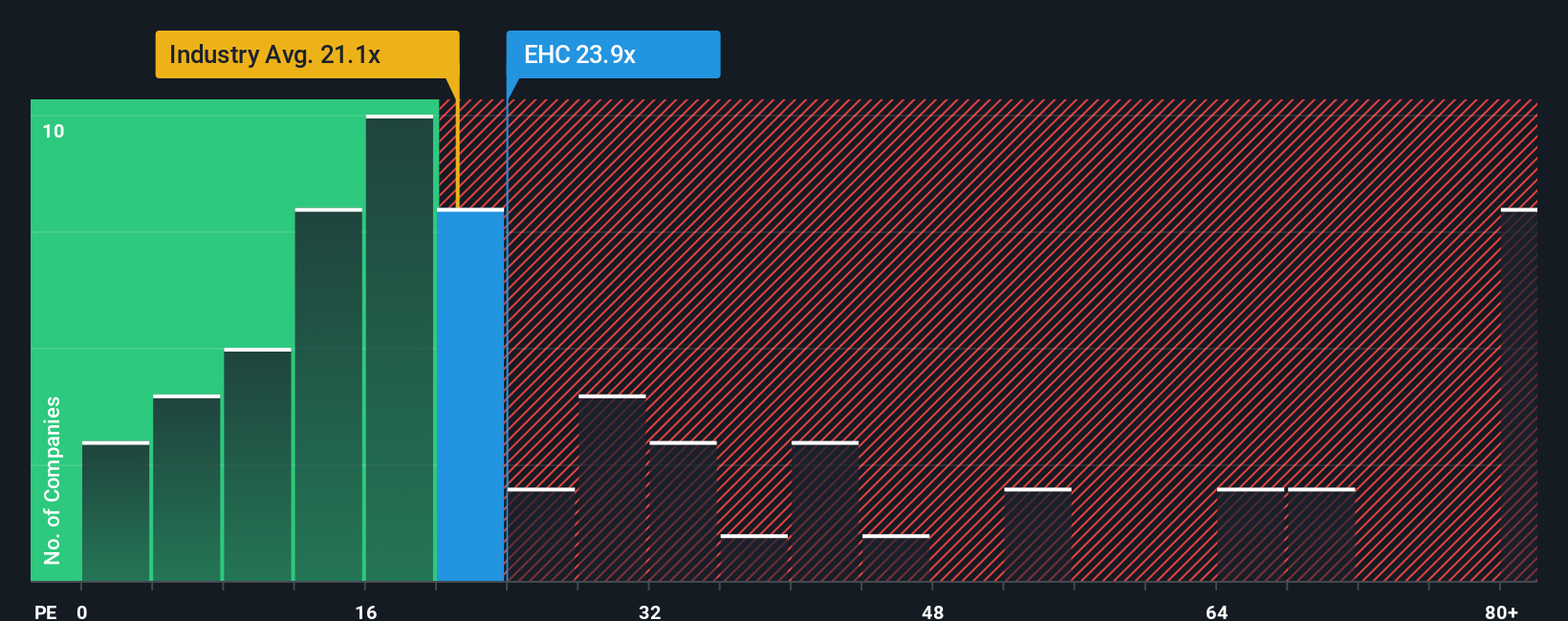

Another View: Market Ratios Raise Questions

Looking through the lens of market multiples, Encompass Health trades at a price-to-earnings ratio of 23.7x. This is noticeably higher than both the US Healthcare industry average of 20.7x and the peer group average of 17.5x. It is also above its fair ratio of 21.5x. Such a premium could signal investor optimism or possible overvaluation, especially if the company’s growth does not keep pace with these expectations. Should investors be concerned about paying too much, or does this premium reflect real opportunity?

Build Your Own Encompass Health Narrative

If you see the story differently or want to rely on your own analysis, you can craft your own informed narrative in just a few minutes. Do it your way

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Opportunity is waiting beyond a single stock. Unlock a world of investing choices using the Simply Wall Street screener and supercharge your portfolio with these handpicked ideas.

- Boost your income strategy by tapping into these 18 dividend stocks with yields > 3% that consistently deliver yields above 3 percent. This can strengthen your potential returns over time.

- Jumpstart your growth portfolio with these 25 AI penny stocks that are pushing the boundaries in artificial intelligence and reshaping entire industries at rapid speed.

- Find tomorrow’s market leaders today by targeting these 878 undervalued stocks based on cash flows where smart cash flow analysis reveals hidden value many investors overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.